BlackRock continues to double its Bitcoin strategy and actively purchases DIP despite wider market turbulence.

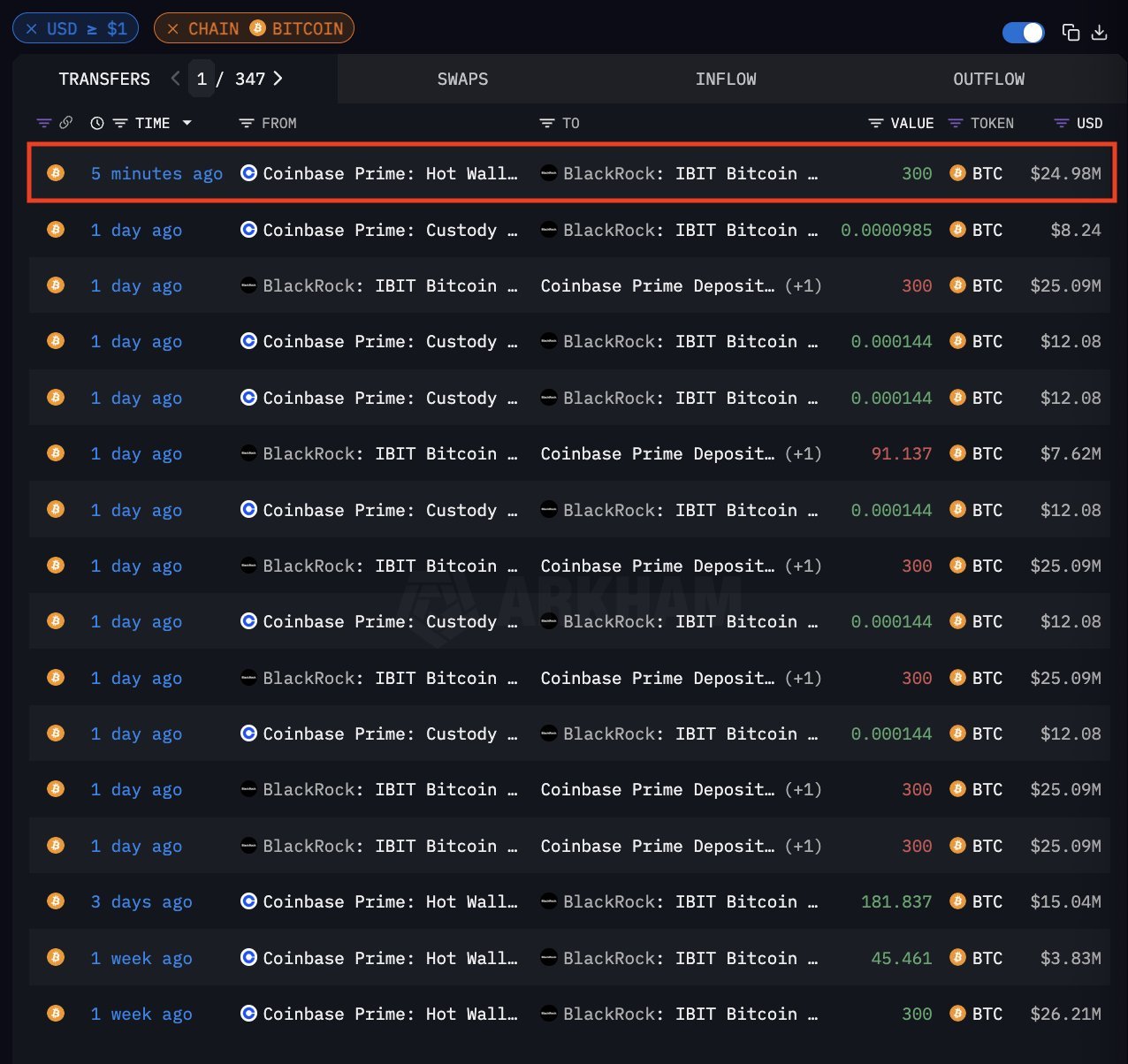

BlackRock’s Spot ETF, IBIT, added an additional $25 million worth of Bitcoin to its holdings, according to Arkham data.

This is because Bitcoin is trading at around $83,300 and it rose by about 1% on Friday despite the Nasdaq 100 experiencing a sharp decline on the second day following the newly announced trade tariffs.

NASDAQ has now fallen by more than 16% since the start of the year, while Bitcoin has soaked nearly 12% in the same period, but has significantly outperformed the high-tech index over time.

The continued accumulation by BlackRock highlights the long-term conviction in Bitcoin. This stance was reflected earlier this year by CEO Larry Fink in his annual shareholder letter, where he expressed concern about the US dollar’s global domination.

Citing Balloon’s national debt, Fink warned that if geopolitical risks increase, Bitcoin could ultimately become a more attractive and valuable repository than the US dollar. He also warned that decentralized finances could erode the US economic advantage.

Is Bitcoin a risk-off asset?

Despite Bitcoin’s recent outperformance of traditional stocks, the question of whether it will serve as a risk-off asset remains contested. Historically, Bitcoin has been traded alongside other risky assets, showing a strong correlation with stocks.

Bloomberg ETF analyst Eric Baltunas has gained weight and suggests that Bitcoin should not be sold as a hedge other than inflation and financial decline. “It’s 100% hot sauce,” Bulkunas points out, and although it’s not a safe haven, IBit has grown 78% since it was launched over a year ago.

Yes, publishers should not sell it as a hedge other than a global money printer. It’s 100% hot sauce and that’s not a bad thing, but you don’t have a chance to be surprised if you know it. By the way, since it was released over a year ago, it has only grown by 78%. https://t.co/rk3p9ys5lo

– Eric Balchunas (@ericbalchunas) April 4, 2025

As institutions like BlackRock continue to support Bitcoin, investors’ perceptions of assets may evolve. Not necessarily as digital gold, but as a powerful and volatile tool for an increasingly unstable macroeconomic landscape.