Bitcoin announced a rise in retail activity as more than 344,00 new wallets were added yesterday, May 8th, bringing prices to a nine-month peak.

Bitcoin recorded a surge in prices between May 6th and May 9th, 2025, touching $104,000, rising from under $94,000. The move continued in a short consolidation phase seen between May 3rd and May 5th.

However, recent price increases have not been quarantined. Data from Santiment, Coingecko and Sosovalue reveal that wallet growth, user participation and the dynamics of the derivatives market have contributed significantly to the acceleration.

Record-breaking wallet growth

The price of Bitcoin surged at $103,000, but a total of 344,620 new Bitcoin wallets have been created, marking one of the best daily growth of wallet activity in 2025. This latest notable surge was directly aligned with the start of the upward price movement.

In Bitcoin’s network, 344,620 new wallets have been created on the network to allow FOMO to be poured into it. Crypto’s top mark cap asset silenced the bear, reaching its first high of 103.8K since January. pic.twitter.com/hai245lqjz

– santiment (@santimentfeed) May 9, 2025

Historically, rapid wallet creation often indicates a new influx of retail. This is a trend generally related to increasing investor interest while market momentum is growing. The latest wallet growth is based on a trend that has been ongoing since May 4, when new daily wallets fell below 272,000 due to the struggles of BTC prices.

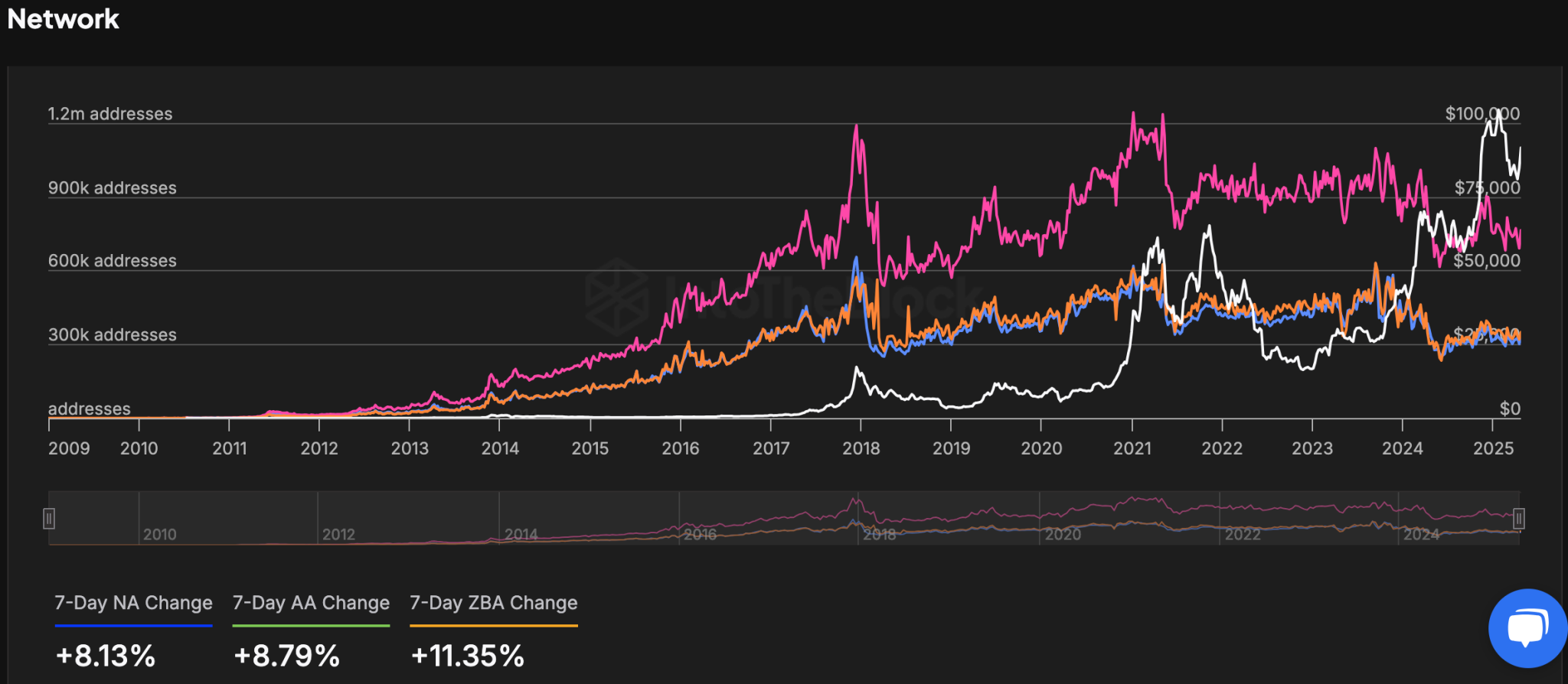

Since then, metrics have continued to increase, reaching their latest peak. Furthermore, related on-chain metrics revealed similar growth trends. New addresses rose 8.13%, active addresses increased 8.79%, and zero-balanced addresses reached 11.35% active spikes over seven days.

Bitcoin Daily Active Address | Intotheblock

These figures indicate an increase in retail engagement as previously inactive or new users began funding their wallets during price increases.

A short squeeze drives further acceleration

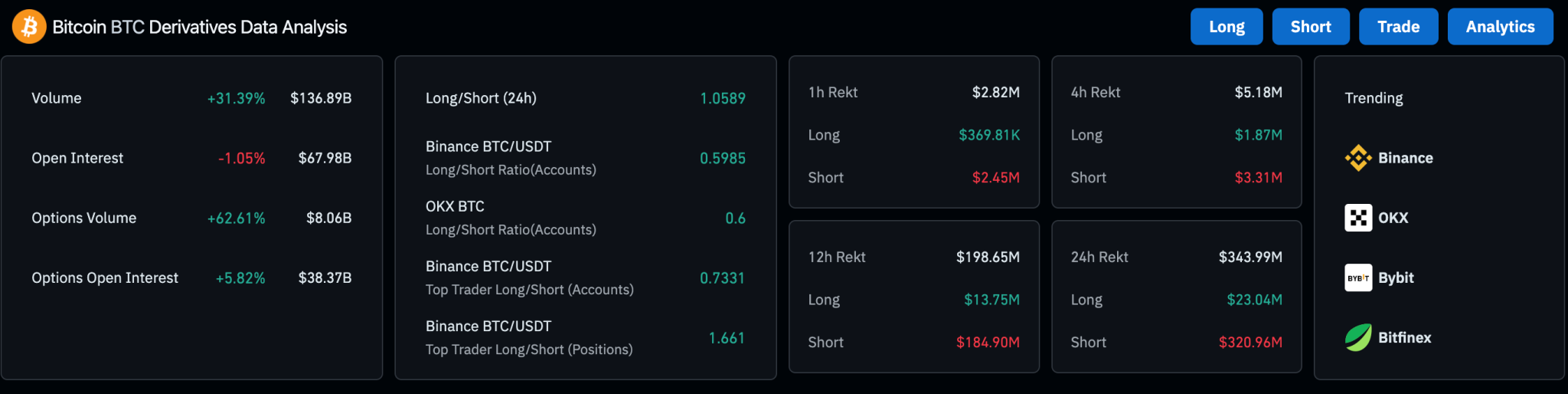

in parallel, Liquidation data It provided insight into the structure of the rally from the Bitcoin derivatives market. Over the course of 24 hours, $343.99 million was liquidated in total positions.

Bitcoin Derivative Data | Coinglass

Of this figure, $320 million comes from a short position, significantly outpacing the long liquidation of $2,304 million. Within the last 12 hours, $184.9 million has been closed in short positions, confirming intense market pressure on bearish positions.

These liquidations reflect the classic short aperture. Price increases are when traders force their assets to leave by often returning to the market and buying back.

Bitcoin surpasses Amazon in terms of market capitalization

Furthermore, in the rally, Bitcoin’s market capitalization rose above the Amazon era. According to For so-so value. With BTC reaching a market capitalization of $2.040 trillion, it placed Bitcoin as the fifth largest asset in the world, slightly surpassing Amazon’s $2.039 trillion.

This development came during an intensifying retail activity and a period of derivative-driven price transfers. Bitcoin currently follows Nvidia, Apple, Microsoft and Gold in total market value.

At the time of writing, BTC was just above $102,000, up 4.1% over the last 24 hours, 6.4% over the week and 10.4% over the 14 days.