Binance, the largest cryptocurrency exchange by trading volume, has announced the delisting of three altcoins. These include Flamingo (FLM), Kadena (KDA), and Perpetual Protocol (PERP).

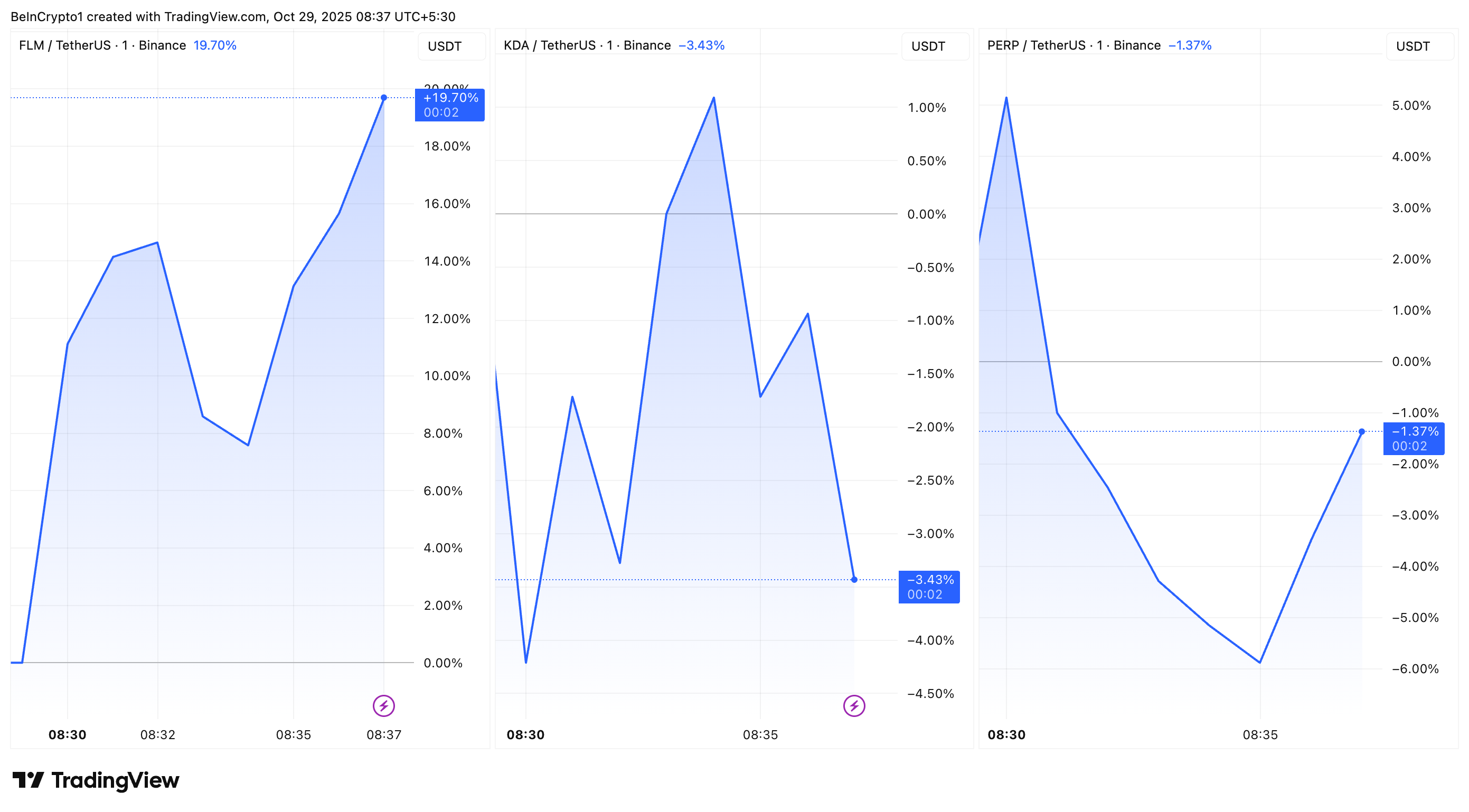

The decision caused price fluctuations for all three tokens, but FLM soared by double digits on the news, ignoring the typical delisting decline.

Binance delisting details and schedule

According to Binance’s official announcement, spot trading on FLM, KDA, and PERP will end on November 12, 2025 at 03:00 UTC. Deposits made after November 13, 2025 03:00 UTC will not be credited. Finally, withdrawals will no longer be possible after January 12, 2026.

“Spot trading pairs of the aforementioned tokens will be removed. All trading orders will be automatically removed after trading on the respective trading pairs is completed,” Binance said.

Additionally, several Binance services will also be affected by the delisting. Spot copy trading for these altcoins will end on November 5th.

Meanwhile, margin transactions will end on November 4th, and borrowing will be suspended from October 30th. Mining pool services will be suspended on November 4th. Additionally, the converter service will no longer be available after November 6th.

Futures contracts linked to FLM, KDA, and PERP remain available. However, Binance said these may be subject to additional risk management measures.

The decision follows the exchange’s regular review process, which evaluates listed assets against multiple criteria. This includes team commitment, development activity, trading volumes, liquidity, network security, transparency, and regulatory trends. This approach allows Binance to adhere to listing standards while responding to changing market conditions.

“At Binance, we regularly review each digital asset we list to ensure that it meets high-level standards and industry requirements. If a coin or token no longer meets these standards or industry conditions change, we will conduct a more detailed review and, in some cases, delist it. Our priority is to ensure the best service and protection for our users while continuing to adapt to evolving market dynamics,” the exchange added.

Altcoins react to Binance’s latest delisting

Market reaction to the delisting announcement was mixed. KDA, which was already facing market headwinds due to Kadena Organization’s exit, plunged 3.43%, deepening its ongoing decline.

PERP fell 1.37% on the news. The token operates on Ethereum’s Layer 2 Optimism network and supports a decentralized perpetual futures exchange.

Price performance of FLM, KDA and PERP after Binance delisting. Source: TradingView

Meanwhile, FLM surprised the market by jumping 19.7% after announcing its delisting. The jump in prices is notable because delisting announcements typically trigger a sharp decline along with reduced liquidity.

However, this reaction mirrors the Alpaca Finance (ALPACA) incident, which soared 71% after Binance delisted the company earlier this year. At the time, the coin’s soaring price raised concerns of market manipulation among analysts and community members.

“Binance plans to delist FLM on November 12, 2025, but the token is surging…Big pumps often mean big risks,” the market watcher posted.

The contrast between FLM, KDA, and PERP highlights the unpredictable nature of delisting events. While KDA’s collapse deepens the ongoing economic downturn, FLM’s surprise rally reflects how market sentiment and speculative trading can defy expectations despite looming liquidity risks.

The article Binance delisting causes market volatility for 3 altcoins appeared first on BeInCrypto.