Bitcoin miners just caused one of the biggest exits in years, but few people are talking about it. Hashrate has fallen more than 40% from its all-time high, with some experts calling it the biggest failure for miners since China’s ban in 2021.

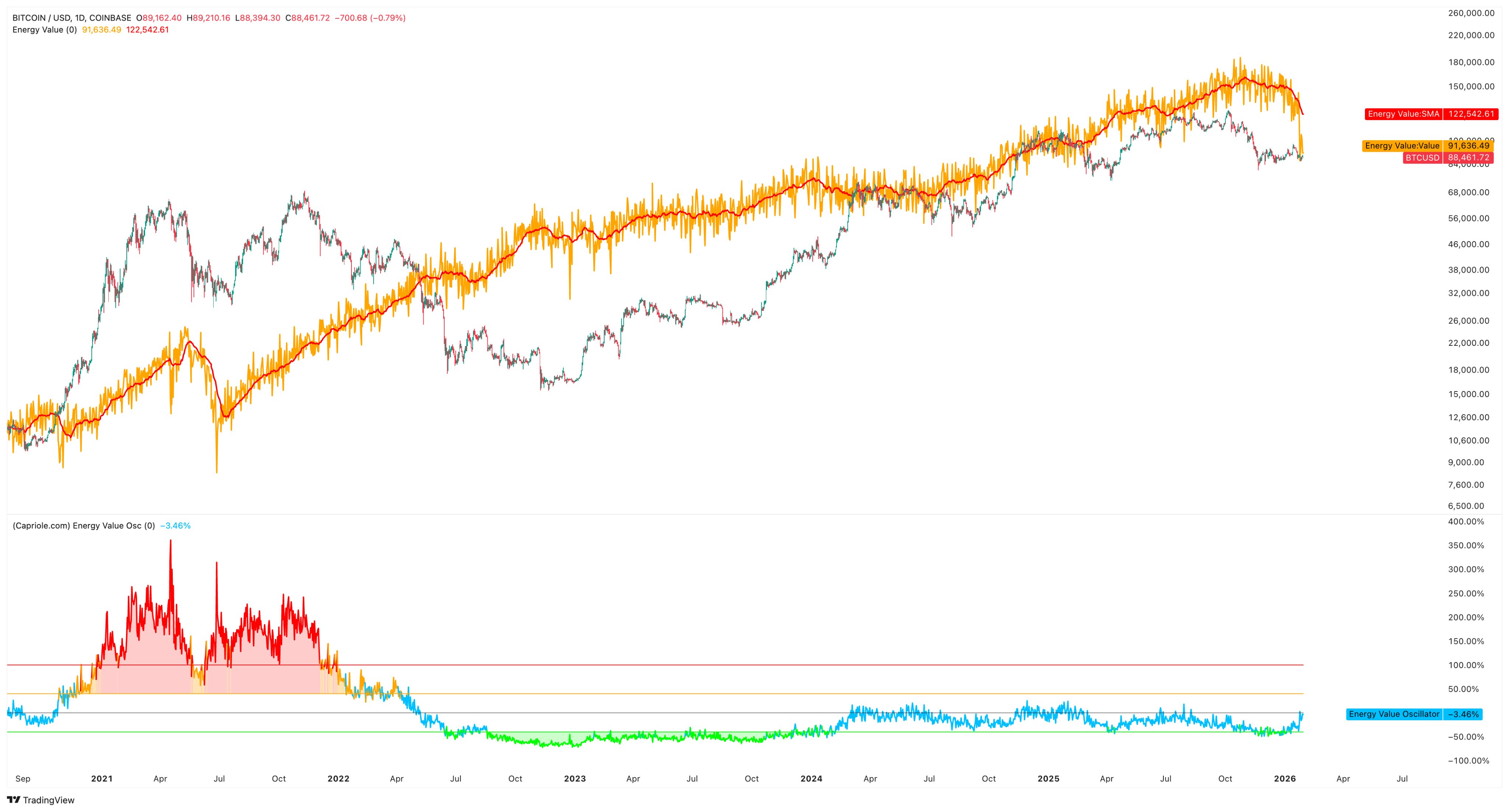

Red flag? Bitcoin’s energy value doesn’t get much attention, but it’s actually a pretty predictable metric. I researched this indicator very hard.

Charles Edwards, creator of the Energy Value Model, was the first to sound the alarm. His view is that major BTC miners are being shut down. Again, don’t scale back, retreat all together.

The metric, which links hashrate and energy costs to fair value, shows Bitcoin’s price is almost 4% below its energy-based benchmark. And the moving average line has reversed for the first time in over a year.

But not everyone accepts the doom.

“Crypto Winter” is still winter

Opponents argue that the drop in hashrate is not a capitulation, but simply a winter. Power prices across the major U.S. power grids soared to more than $100 per MWh as winter storm Fern disrupted supply and led to load shedding. In this version, the miner does not exit, it just pauses.

So most of that hashrate could recover within two weeks, and Edward’s chart has just captured a weather phenomenon.

Some see rising energy costs as an opportunity rather than a threat. As smaller players withdrew from the competition, large industrial-scale miners were able to capture more market share and better profit margins. This changed Edwards’ bearish view of the mining company consolidation theory.

Still, the magnitude of the decline cannot be ignored. The last time energy values fell this sharply, cryptocurrencies spent six months in a death spiral before finding bottom. But that doesn’t mean we’re headed for a repeat of the past. Today’s environment includes ETFs, nation-state buyers, and structurally higher demand.

But the warning signs are flashing again.