Bitcoin mining activity across the U.S. is in sharp decline as an Arctic storm front batters multiple U.S. states, with U.S.-based operators scaling back operations to ease pressure on the power grid during the difficult period. As a result, Bitcoin’s network hash rate has dropped significantly, with current data showing a total hash power of 800 to 875 exahashes per second (EH/s) over the past day.

6-day slide: Arctic explosion drops Bitcoin hashrate by nearly 250 EH/s

The Arctic storm front in late January 2026 will hit the South and lower Ohio Valley the hardest, with the most severe conditions centered on Tennessee, Texas, Louisiana, Mississippi, Kentucky, Georgia, Alabama, and West Virginia. Several of these states have large clusters of Bitcoin mining facilities, with Texas being the most prominent.

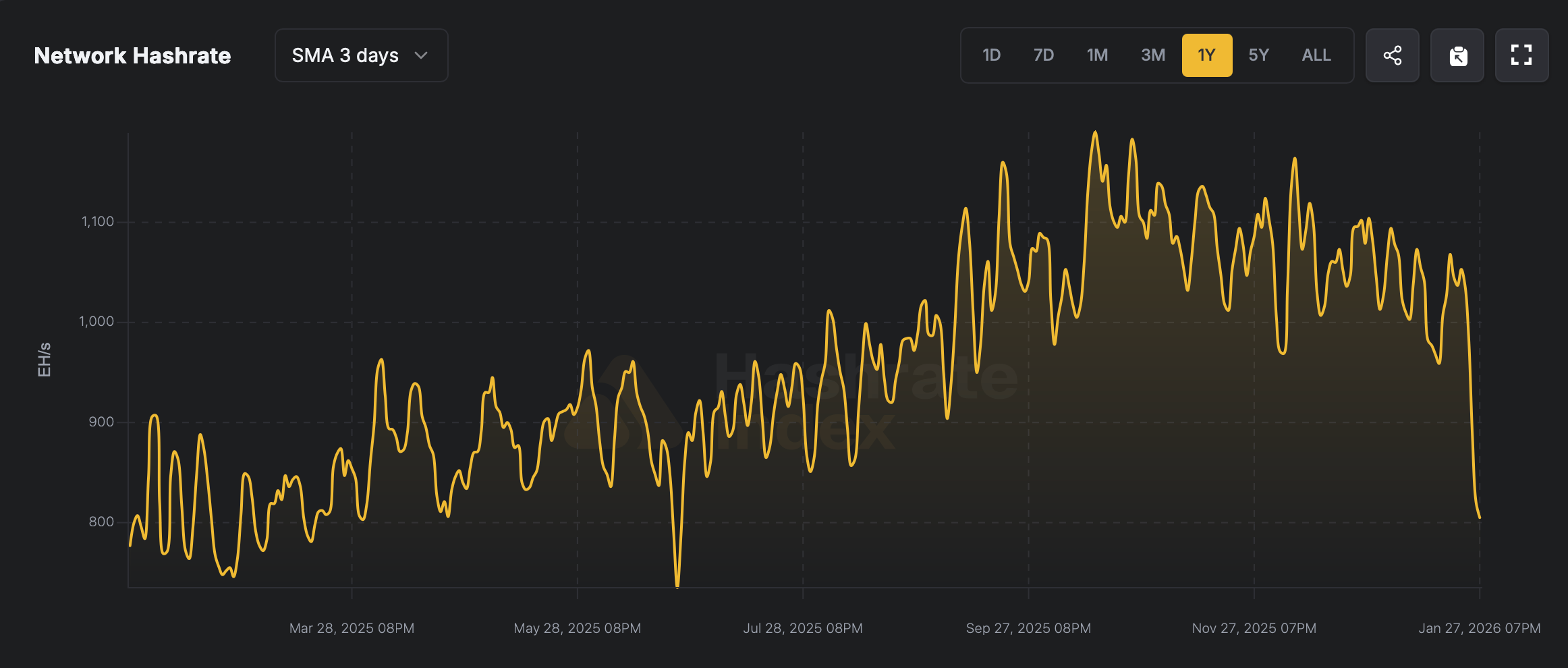

Three days ago, Bitcoin.com News reported that the world’s largest mining pool, Foundry USA, had cut a significant portion of its hashrate in preparation for the storm, after theminermag.com shared an update last week. Since then, the hashrate has continued to trend downward. Bitcoin has fallen by 385 EH/s since October 15, 2025, as measured using a 3-day simple moving average (SMA) over a 1-year period.

Bitcoin overall hashrate with 3-day SMA for 1 year by hashrateindex.com.

However, network data compiled by hashrateindex.com shows that the steepest decline actually occurred after January 22, 2026. On that day, the total hashrate was measured at 1,053 EH/s and currently sits at 805 EH/s with a 3-day SMA. In fact, of the 385 EH/s decrease from the all-time high of 1,190 EH/s on October 15, 2025, approximately 248 EH/s disappeared between January 22 and January 28.

As noted in our report, the drop in hashrate has pushed block intervals well beyond the typical goal of 10 minutes. At the time this report was published, the average block time was over 12 minutes and continues to hover at 12 minutes and 12 seconds. If this pace continues, the difficult period that arrives around February 8, 2026 will rank as one of the biggest corrections in years.

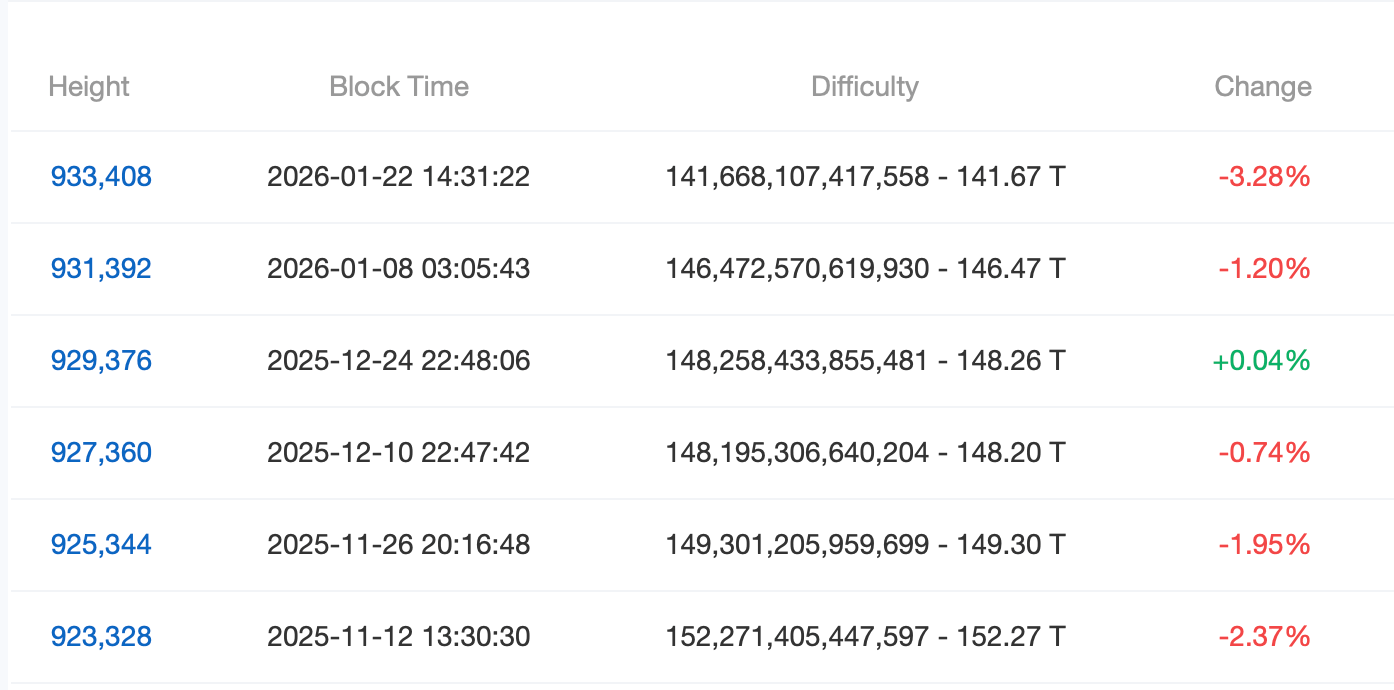

Out of the last 6 epochs, the difficulty has decreased 5 times and increased by only 0.04% on December 24, 2025.

At this time, hashrateindex.com and other tracking platforms predict a reduction in difficulty of more than 18%. This outcome remains very plausible, as the arctic storm front across the United States is expected to continue into early next week, bringing us uncomfortably close to the coming difficult period. The magnitude of the predicted decline will likely diminish once hashrate recovers and block times normalize prior to the adjustment, but for now, the data points to record difficulty declines.

Also read: Cryptocurrency ETFs slump due to Bitcoin and Ether, resulting in a combined exit of $211 million

The timing couldn’t be better for Bitcoin miners, who are suffering from falling BTC exchange rates and thin hash price-based returns. Such a significant difficulty adjustment would provide immediate relief by easing competitive pressures and improving the odds of earning block rewards with the same infrastructure. In an environment where margins are tight, even a temporary improvement in network conditions can lead to significant increases in operational efficiency and short-term profitability.

Frequently asked questions ⛏️

- Why is Bitcoin mining difficulty expected to decrease in early February 2026?

The network is headed for a significant downward correction due to a sharp drop in hashrate and longer block times due to mining reductions related to the US storm. - How big can Bitcoin’s difficulty change be in the future?

Current estimates from hashrateindex.com suggest that difficulty could drop by more than 18% if network conditions remain the same. - What caused Bitcoin’s hashrate to drop so quickly in late January?

An arctic storm front moving across major U.S. mining states forced operators, particularly in Texas, to scale back operations to reduce stress on the power grid. - Why is lower difficulty important for Bitcoin miners?

Lower difficulty reduces competition per block, increasing mining efficiency and profit potential during periods of low hash prices.