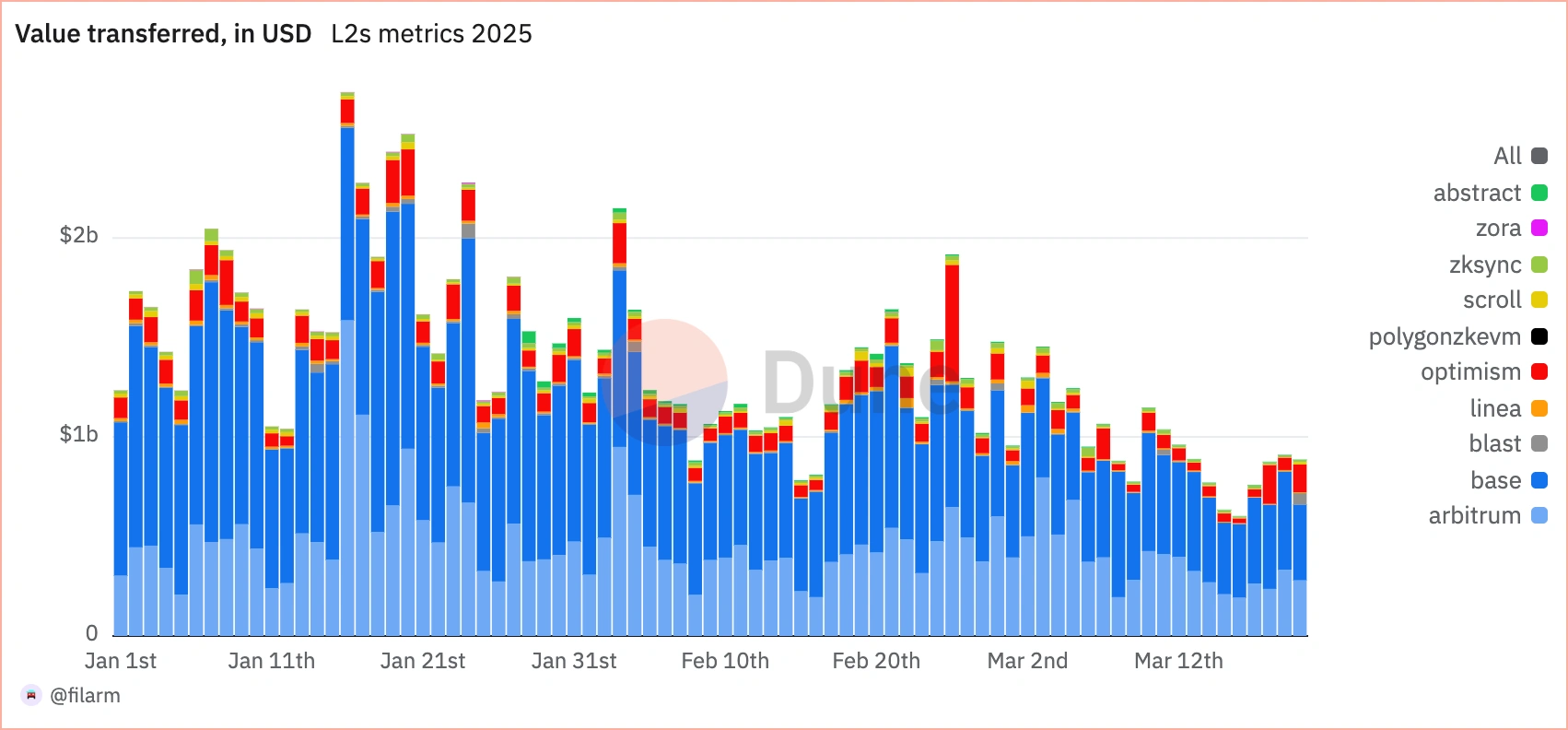

A new metric data report from Dune, a platform specializing in on-chain data analytics, shows that Base and arbitrum are the leading Layer 2 (L2) blockchain with on-chain activity and revenue generation.

Regarding transferred values, the base and the gold association dominate the space with market shares of 55% and 35% respectively, with optimism becoming a distant third.

Base and arbitrum lead L2 from the perspective of value transferred in 2025. Source: Dune Analytics

However, the new data provided information on the activities of the base and non-arbitrum L2 blockchains leading certain metrics, such as values transferred by transactions and gas units.

According to Dune, high values per transaction often indicate meaningful uses such as Defi Trades or large-scale transfers, such as spam or low-value interactions. It can reflect the ability of blockchains to support real-world use cases that require significant value movements, but the value transferred per gas unit reflects the economic density and efficiency of blockchains in handling valuable activities compared to resources.

In this area, data shows that blockchains like Skoll, Zksync, and Arbitrum take leads from an efficiency standpoint.

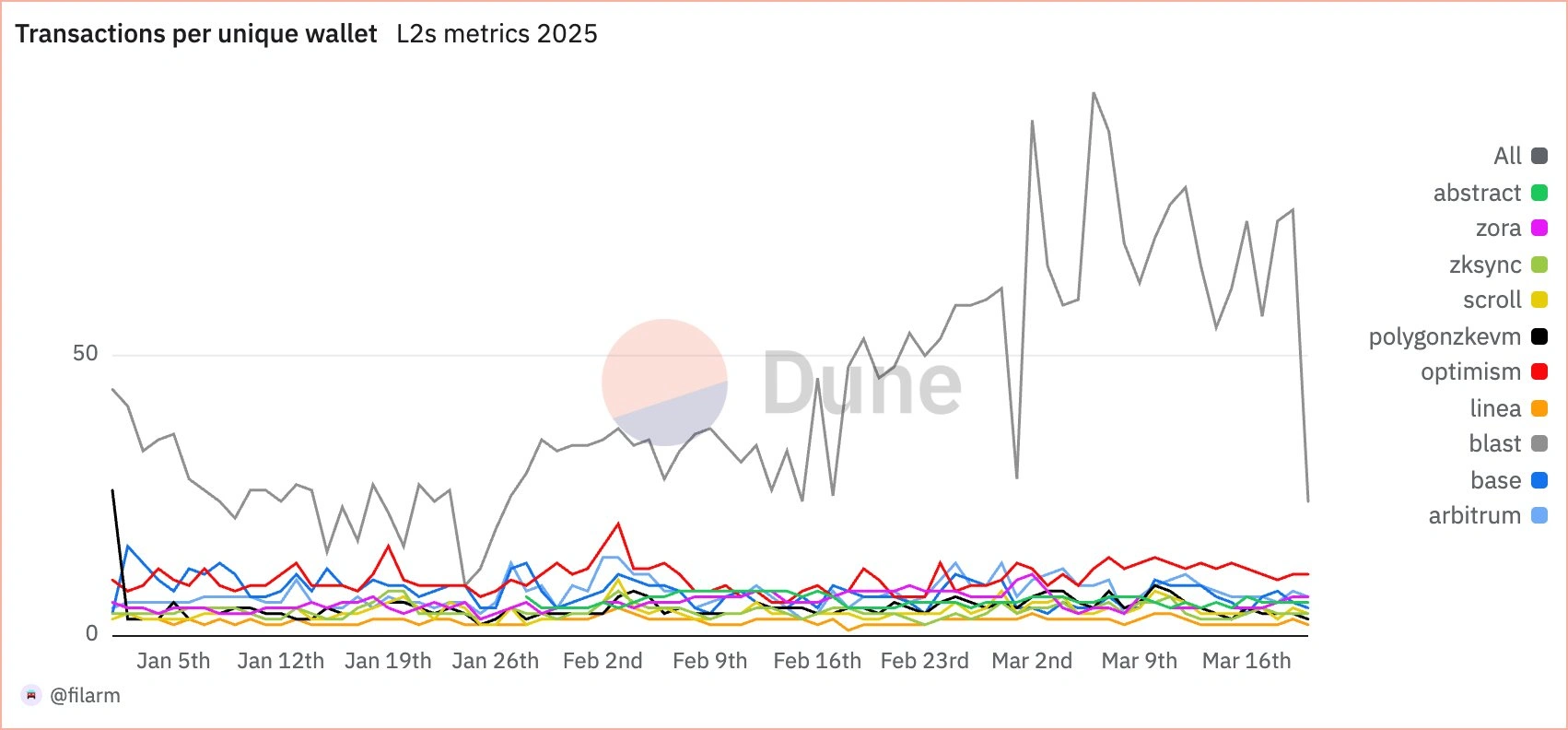

In a post on X (formerly Twitter), Filippo (@Filippoarman) reports that the biggest winners on the value of unique wallet-by-wallet transactions are explosion and optimism. However, Dune also pointed out that the indicator can be misleading because it is prone to distortions primarily due to Civil attacks.

Blast and Optimism are the biggest L2S winners in terms of transaction value per unique wallet. Source: Dune Analytics

The inter-blockchain bay becomes increasingly clear in the revenue (transaction fee) section. This is a big indicator, according to Dune, as it represents revenue (transaction fees), costs (L1 fees), and profit (L2 fees).

The base has a large share in terms of transaction fees, accounting for more than 80% of the market share. Arbitrum moves between 5-10%, followed by abstract and optimism at around 5-3% of the market share.

In analyzing this data, Filippo said that in terms of revenue per transaction, Linear leads in a metric that sheds light on the profits that Layer 2 blockchain generates on average from each transaction processed on a given day, followed by Base, Zksync, and Polygon Zkevm.

However, in terms of overall profit (profit = revenue – L1 cost), the base will once again top the chart, followed by Arbitrum. Both blockchains lead in terms of profit and profit per transaction.

Ethereum still dominates with over 50% sharing in regards to Dex volume. As for L2S, base and arbitrum lead the fees, with base taking around 25-30% share, arbitrum charging 15%, while others are far behind.

Ethereum still controls NFT trading volume, with a share of over 80%. Zksync is second in the L2 front, with a share of 10% to 15%, followed by base (3.5%) and Blast (2.5%).

While Base has proven to perform well in revenue and profits, Arbitrum maintains positive and consistent metrics across almost all metrics. As the report shows, the base and arbitrum are not alone at the top. Several L2 blockchains, such as Zksync, Scroll, Linea, Blast, Optimism, are excellent at certain metrics.

The future of Ethereum’s L2 blockchain

The report also reflects the increased performance and use of the L2 blockchain, reflecting the sentiment of Josefulvin, the co-founder of Ethereum, and said the future of the Ethereum blockchain is related to L2 scaling solutions.

Lubin said this at the Digital Asset Summit, and Ethereum’s security and developed infrastructure provide the best foundation for improving networks, allowing developers to build new Layer-1 networks without the need for them.

However, there is no absolute agreement with Rubin’s position as the L2 blockchain considers it a parasitic to the Ethereum blockchain, and investors see it as a parasitic to the Ethereum blockchain. The L2 blockchain adds little value to the L1 blockchain compared to values derived from Ethereum.

Given the availability of available data and metrics, there is no doubt that Ethereum’s L2 blockchain will remain here. And the only way forward is for both layers to build mutually beneficial agreements.