Avax Price reached $30 on Binance. This is the highest level since February. This performance has transformed investors’ sentiment into a more optimistic outlook for the rest of the year.

Currently, Avax sees it as a strong candidate for portfolio allocation. What fueled this gathering? The following details explain the driver:

Avalanche (Avax) will expand institutional exposure in September

The Financial Times reported that the Avalanche Foundation is negotiating the creation of two US-based Crypto financial vehicles, targeting $1 billion.

The initial contract, led by Hivemind Capital, aims to raise up to $500 million through a company registered with NASDAQ, and is expected to be completed by late September.

The second deal includes SPACs backed by Dragonfly Capital.

Funds from both transactions have been used to purchase millions of avax from the foundation’s reserves, leveraging the maximum total supply of 720 million tokens, of which 420 million are already in circulation.

Performance at avax prices. Source: Beincrypto

According to Beincrypto data, the news likely pushed Avax to $30 on September 11th.

Today’s exchanges have Avax trading volumes above $1.8 billion, which is also the highest volume of the day since February. This shows that this Altcoin has once again attracted traders’ attention.

Real World Assets (RWA) Growth Strengthen Avax’s Outlook

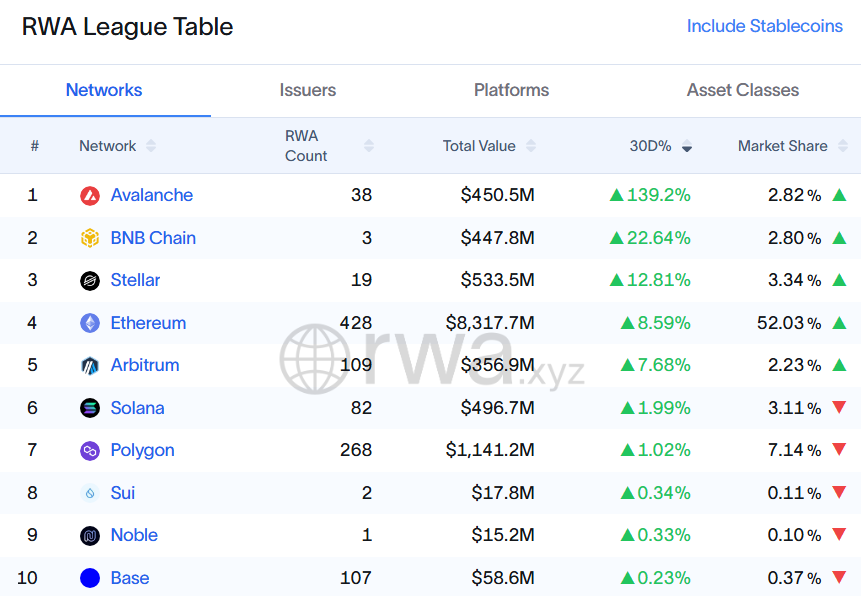

Another major highlight of Avax is its major position in real-world assets growth over the past 30 days. According to data from RWA.xyz, Avalanche has recorded growth of over 139% of total RWA, exceeding $450 million.

The avalanche has surpassed the RWA sector in 30 days of growth. Source: rwa.xyz

Much of this growth comes from the tokenization of assets by Janus Henderson, a global investment company with over $379 billion. Specifically, the Janus Henderson Anemoy AAA CLO Fund (JAAA) was published entirely in chains via an avalanche centrifugation protocol.

Since early September, the total amount of avalanche JAAA has exceeded $250 million. However, the data shows that Avax’s RWA market share is still very low at just 2.82%, reflecting today’s fierce competition in the RWA sector.

Increased institutional involvement during September eased emotions and supported Avax’s gatherings. Based on this momentum, technical analysts see the potential for higher goals, with some expecting returns of over $40 by the end of the year.

The Avax Post broke $30 as it first appeared on Beincrypto as RWA recruitment and Treasury plans were promoted.