Binance has listed Aster with a seed tag and is preparing to open trading starting October 6th. The token will no longer be displayed as a Binance Alpha token and transactions will not be directed towards Alpha points.

Aster will begin trading on Binance with Seed Tag starting October 6th, with deposits open for the first two trading pairs. Withdrawals will start from October 7th. The asset will begin trading in three pairs: Aster/USDT, Aster/USDC, and Aster/Try. Initially, only simple orders will be accepted as bots and copy trading are enabled after 24 hours.

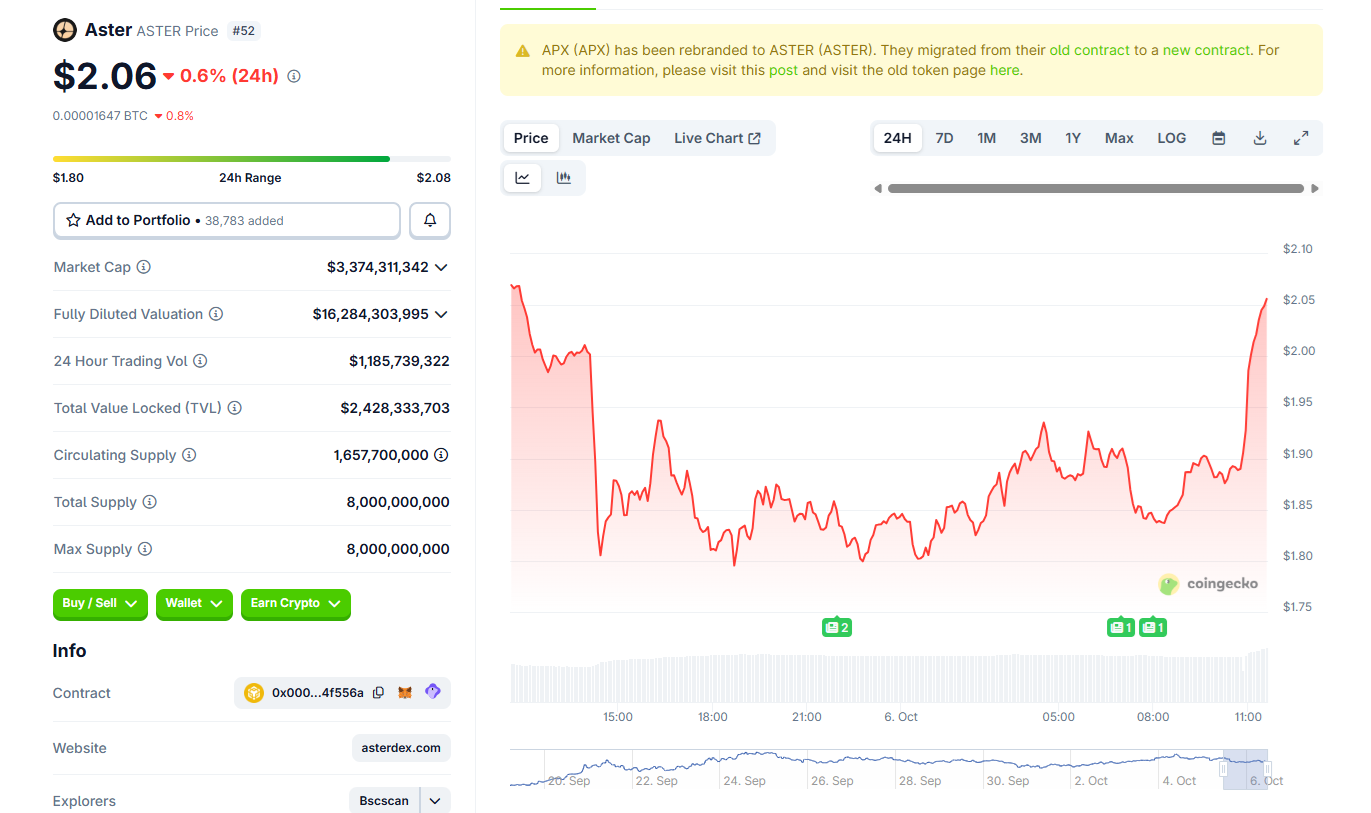

Aster has rallied above $2 on the Binance Spot Listing news and is now below its price peak at $2.31. Aster expects a rally to $4 with increased spot trading. |Source: Coingecko.

Aster quickly became part of Binance Alpha and allocated Alpha Points for trading. However, once spot trading begins, Aster will exit the Alpha program and the trading volume will no longer generate Alpha points. Users can transfer Aster from their Alpha account to their account before the assets are delisted from the Alpha program.

Binance will transfer all Asters from your Alpha account to your Spot account within 24 hours of initiating spot trading. Binance Alpha has already played its part in pre-screening Astor for potential listings. This listing was expected as part of Binance’s support for the Aster Dex project.

Aster is under pressure

Shortly before the listing, Aster was trading at $1.89, stalling a quick rally following the token’s rebranding.

Following the Spot Binance Market news, Aster recovered to $2.02, near the peak of its range. Aster broke out to $2.31 in hopes of going to $4.

Aster was pressured by recent discoveries that DEX volumes may not be completely organic. As a cryptopolitan has been reported Previously, Defillama excluded Aster Dex from its volume data dashboard. Aster Dex reported over $96 billion in 24-hour volume. The numbers raised questions about the possibility of laundering deals or fake volumes.

Aster Dex’s intent was to provide a dark pool for large orders and institutional purchases. However, non-transparent transactions called into question the reality of trading volumes. Aster turned out to be the leading Dex in terms of charges generated in September, but its liquidity still lags behind High Lipid.

Aster Dex offers VIP tier trading

Aster Dex is changing its trading conditions and will soon offer VIP trading. This program affects large traders and will drop due to higher activity. Pricing is based on a 14-day rolling calculation of volume. Aster Dex also introduces special rates for market makers.

VIP price tier updates

Starting October 6th at 10:00 UTC+0, Aster will implement updates to the VIP pricing tier.

1️⃣New spot trading fee structure

2️⃣ Adjusted permanent futures ratesFor more information: https://t.co/y3b2zr9dxa pic.twitter.com/kkmhxuclsy

— Aster (@aster_dex) October 6, 2025

Aster Dex introduces Aster’s monthly reward pool worth $300,000 for distribution to eligible market makers based on the volume achieved.

Just as Dex finishes the second season of Point Farming, new offers arrive. Season 3 has already started and will run until November 9th. On October 10th, all Stage 2 participants will be able to receive their tokens.