This is part of the 0xResearch newsletter. Please subscribe to read the full version.

Beyond short-term sector rotation, one group continues to stand out on a year-to-date basis. It’s a Bitcoin miner, up 150.32% year-to-date. This outpaces crypto stocks’ 16.13%, with BTC itself far behind with an increase of just 1.05%.

This miner’s outperformance reflects a structural shift in valuations for sectors of the market. Whereas previously miners were primarily seen as leveraged proxies for BTC, they are now increasingly seen as infrastructure providers managing scarce, pre-licensed power capacity and high-density data center real estate that can be monetized either through hashing or AI/HPC hosting. This yields approximately 70% more revenue per megawatt than BTC mining, with the contract earning approximately $149,000/MW per month compared to $87,000 per month from mining at current hash price levels.

Several miners are benefiting from this trend, including Core Scientific (CORZ), Cipher Mining (CIFR), Iris Energy (IREN), CleanSpark (CLSK), and TeraWulf (WULF). They secured a multi-year hosting contract that provides contracted dollar-linked cash flow in addition to mining income.

Leadership remains highly focused. Heavyweights CLSK, IREN and WULF have achieved exceptional triple-digit performance year-to-date, supported by three key competitive advantages:

- Efficient exahashing and rapid scale-up of rack capacity.

- Cheap and reliable power with secure grid interconnections and clear expansion paths.

- Transform your power-rich campus into a diverse contract revenue stream with reliable AI/HPC options.

Conversely, laggards in this space typically have smaller footprints, higher energy costs, weaker balance sheets, or limited progress in pivoting their infrastructure toward AI/HPC workloads.

— shonda

Plasma has fluidity, but now it needs life

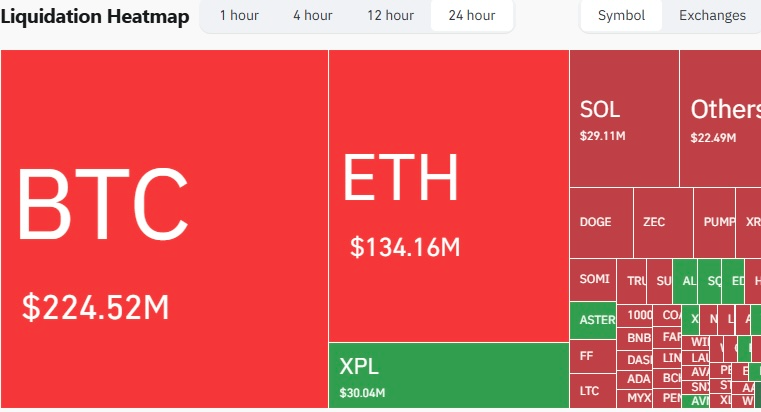

As the plasma mainnet approaches its demise, On its one-month anniversary, it’s a good time to evaluate whether it lives up to its reputation as a stablecoin chain. After an explosive start, XPL’s price movements have been brutal. It is down -43% over the past week and -70% from its all-time high.

Despite ranking as the 4th largest chain on DeFi TVL with $8.42 billion, Plasma’s hallmark should be utility, not deposits. Stablecoin chains are characterized by active circulation. Weekly P2P transfer data shows Tron and Solana leading by a wide margin, with each stablecoin dollar flipping roughly twice a week. Plasma and Ethereum delays suggest that most stablecoins are parked in farms or remain abandoned.

Approximately 65% of Plasma’s stablecoins are deposited in lending protocols such as Aave, reflecting its agriculture-focused ecosystem. Incentives explain behavior. You will be rewarded approximately $230,000 daily for lending with Aave and $55,000 for borrowing USDT0. TVL bootstrapping has its place, but stablecoin incentives should ideally drive usage, not just inflate metrics.

This TVL turns out to be far from sticky. As the price of XPL fell, the rewards also decreased, prompting large withdrawals and loan repayments. Due to its limited practical utility, XPL has effectively become a reward token and faces continued selling pressure from inflation at an annual rate of approximately 25%.

The next stage for plasma must move beyond incentives. Unless users start using USDT0 for payments or a stable unique use case emerges, we risk losing the next yield farm. Still, there are bright spots. Neutrl today launches pre-deposits with $50 million in capital to offer hedged OTC and delta neutral yield strategies. This gives retailers access to institutional-grade products that have traditionally been locked away behind OTC desks. Even as projects like Neutrl gain traction on Plasma and seller consolidation continues, Plasma could evolve from a yield farm to a functional stablecoin economy.