Bitcoin is pulled back within rising channels and shows a potential retest of the $80k mark as leverage increases. Will the inflow into Bitcoin ETFs maintain bullish momentum?

Bitcoin’s lower than $85,000 indicates a gradual decline in bullish momentum. This continuous pullback has led to BTC dropping by 2% over the past 24 hours.

Meanwhile, crypto market liquidation has approached $200 million in the last 24 hours, with a long liquidation accounting for $131 million. Will the resurrection of bearish sentiment push Bitcoin back below the $80,000 mark?

The potential breakdown of Bitcoin is $80k

On the 4-hour price chart, BTC price trends show an increase in channel patterns. After a short-term recovery, BTC is testing a long-standing line of resistance.

However, Bitcoin is currently experiencing short-term pullbacks within the upward channel, falling below $85,000. Additionally, the pullback failed to maintain control at $84,841 at a Fibonacci level of 23.60%.

Currently, Bitcoin is trading at $84,135, forming the second highest price-rejection candle, showing an expanded pullback on the 4-hour chart. As bearish momentum increases, the MACD and signal lines cross negatively, potentially signaling the sale.

Bitcoin Futures Market Shows a Change in Whale Sensation

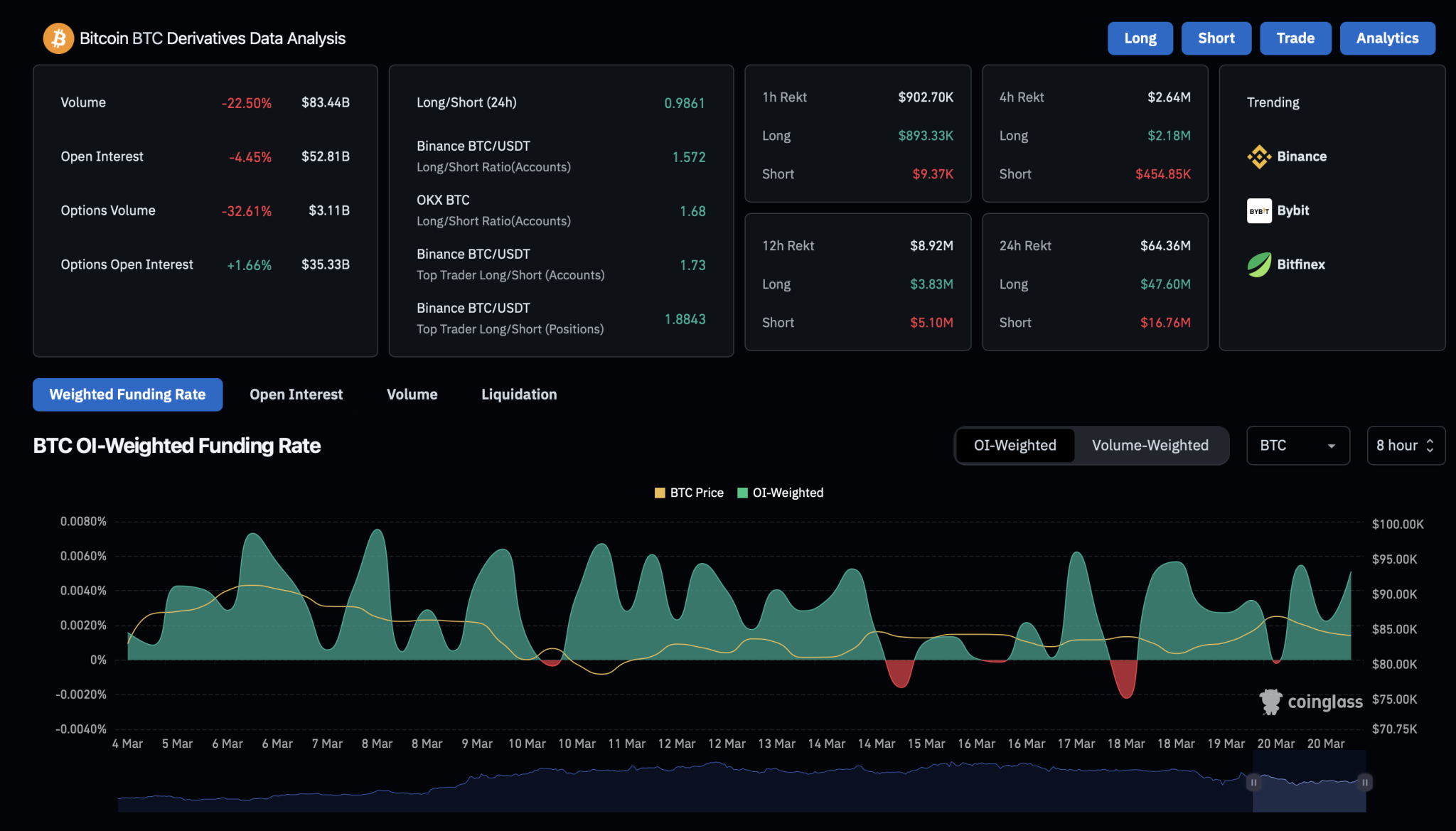

Bitcoin’s public interest fell 4.45%, reaching a low of $528.1 billion. At the longest ratio, it is currently at 0.9861, with the bearish position being slightly increased.

Bitcoin Derivative Market

Nevertheless, funding rates have continued to fluctuate over the past few weeks, and sometimes immerse themselves in negative territory. Currently, the open interest rate is 0.0051%, reflecting a bullish sentiment towards the strengths despite paying extra premiums.

Alphractal, an advanced cryptographic platform, points to an increasing bearish position within the Bitcoin market. According to a recent tweet, Whale has moved from a locked position to a new open short contract as Bitcoin went over $87,000 in the short term.

Furthermore, the open interest rate to the market has risen again, indicating an increase in market leverage. High leverage could lead the market to face a new wave of volatility, potentially causing massive liquidation.

As leverage increases, whales will enter a short position with Bitcoin!

The Whale decided to close its long positions and open shorts as BTC went over $87,000 in the short term. Additionally, the open interest/market capital ratio has risen again, indicating an increase in market leverage. This is…pic.twitter.com/vmffdcwuph

– March 20, 2025, Alphractal (@alphractal)

Bitcoin ETF inflows skyrocket, BlackRock drives packs

Despite the increased volatility in the derivatives market, institutional support for Bitcoin is returning. On March 20th, the US daily net inflow reached $16,575 million.

BlackRock led the way and acquired more Bitcoin with an influx of $172.14 million. Following BlackRock, Vaneck, Fidelity and the Grayscale Bitcoin Mini Trust, it recorded inflows of $11.9 million, $9.19 million and $5.22 million, respectively.

However, Bitcoin ETFs from Bitise, Grayscale Bitcoin Trust and Franklin Templeton had $17.4 million, $7.98 million and $7.31 million respectively. The remaining ETFs had net zero flow.

Institutional support could trigger new Bitcoin price rally as US spot Bitcoin ETFs record five consecutive inflows.

Bitcoin ETF

Will Bitcoin maintain recovery and reach $95,000?

Despite short-term volatility in the derivatives market, increasing support for facilities is expected to result in higher Bitcoin prices. According to the 4-hour price chart, the current recovery could potentially retest the local support trendline, close to $83,000.

However, any breakdown below this support level could be further revised to a support level of $78,350. Bullish rebounds, on the other hand, could challenge long-standing trends of resistance.

Based on Fibonacci levels, the breakout rally could expand to a Fibonacci level of 61.80%, at around $95,350.