important notes

- Hayes transferred 327,869 $pendle $1.53 after purchasing around $2.06.

- 3.59 million sent to address $this The price has fallen from the entry point of $0.23 to $0.14.

- Hayes also deposited 2.31 million. $LDO The stock price was $0.42, below his reported entry of $0.56.

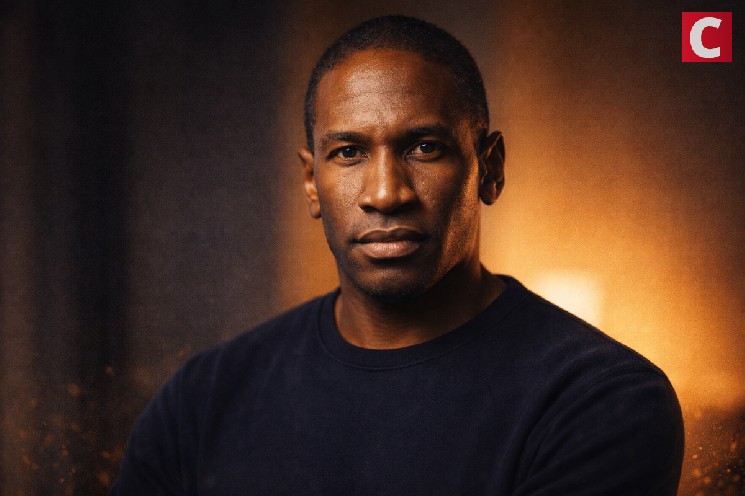

BitMEX co-founder Arthur Hayes is moving his crypto holdings to brokerage platforms despite short-term gains across the market.

According to on-chain data, these transfers all involve assets that were acquired at a higher price level and are now being transferred at a lower market price.

Hayes recently transferred 327,869 $pendle $pendle $1.53 24 hour volatility: 4.2% Market capitalization: $249.24 million Vol. 24 hours: $47.1 million Around $502,000 worth of tokens were transferred to crypto prime broker FalconX at an average price of $1.53.

Interestingly, Hayes had previously earned around $1.4 million. $pendle At a high price of $2.06.

3.59 million messages were sent from the same address. $this $this $0.14 24 hour volatility: 0.5% Market capitalization: $11 billion Vol. 24 hours: $130.08 million Tokens to FalconX, valued at approximately $499,340 at a price of $0.14.

This comes after it was previously purchased for approximately $15.8 million $this Approximately $0.23 per token.

Just In: Arthur Hayes (@CryptoHayes) sent 3,597,122 $this ($499.34,000) and 327,869 $pendle ($501.64K) to #FalconX with the possibility of transferring further funds.

8 hours ago he sent 2.31 million $LDO #FalconX is worth $980,3,000. https://t.co/BQ7n95sjDj pic.twitter.com/xeszyIFsjF

— Onchain Lens (@OnchainLens) February 3, 2026

Early on the morning of February 3, Hayes deposited $2.31 million. $LDO $LDO $0.41 24 hour volatility: 1.7% Market capitalization: $351.25 million Vol. 24 hours: $31.11 million Tokens to FalconX, valued at approximately $980,000 at the time of transfer.

$LDO The stock was trading around $0.42 during the session, below his reported average purchase price for a full position of $0.56.

Related article: Best altcoins to buy in February 2026

Onchain Lens said further transfers may follow. Transfers to brokers often result in spot sales, but are also widely used for OTC execution and hedging.

Hayes commented on FalconX’s activities in vague social media posts. He said the transfer may or may not be completed, which has increased uncertainty in the market.

It’s over everyone…😝😝😝😝😝😝

Maybe… maybe not https://t.co/WTBhqKyED0

— Arthur Hayes (@CryptoHayes) February 2, 2026

What’s next for altcoins?

The transaction comes after the market capitalization of cryptocurrencies rose 2.5% to $2.64 trillion on February 3.

Market data shows an 85% correlation between Bitcoins. $BTC 78 410 dollars 24 hour volatility: 1.0% Market capitalization: $1.57 trillion Vol. 24 hours: 6.023 billion dollars and the S&P 500, pointing to a common response to interest rate expectations.

Bitcoin’s dominance currently stands at 59.43%, while the altcoin seasonal index has fallen from 32 to 29 in the past day. This indicates continued capital turnover. $BTC.

While Bitcoin is trading approximately 83% above its previous cycle high, the TOTAL3 index tracks the following altcoins: $BTC and $ETH $ETH $2,296 24 hour volatility: 0.2% Market capitalization: 27.701 billion dollars Vol. 24 hours: $36.99B which is only about 6% higher than that.

From the cycle low, Bitcoin has recovered about 730%, while TOTAL3 has recovered about 300%.

difference between $BTC And altcoins (#TOTAL3) are reaching a historic tipping point.

Bitcoin is up +83% above its previous cycle high, while altcoins are up just +6%. The difference in recoveries from lows is even more pronounced.

$BTC:… pic.twitter.com/Cw2AWFhajF

— Altcoin Vector (@altcoinvector) January 29, 2026

Some market observers argue that expectations for a broad rally in altcoins may be overstated. However, many believe this market is at the root of a massive and delayed altcoin rotation.

#altcoin

Friendly reminder:

An altcoin bull market begins when the SMA100 bearishly crosses the EMA100 (yellow). 🟡

The altcoin bull market ends when the SMA100 bullishly (red) crosses the EMA100. 🔴

SMA100 has bearishly exceeded EMA100. 👀🔥 pic.twitter.com/AFjf95nluZ

February 2nd

Disclaimer: Coinspeaker is committed to providing fair and transparent reporting. This article is intended to provide accurate and timely information but should not be taken as financial or investment advice. Market conditions can change rapidly, so we recommend that you verify the information yourself and consult a professional before making any decisions based on this content.