Growler Mining, the Argo blockchain’s biggest lender, is taking control of the struggling cryptocurrency miner through a debt-for-equity swap that leaves existing shareholders with a tiny stake in the company.

The reorganization, filed under UK Companies Law, will see Growler convert approximately $7.5 million in secured loans and provide new funding in exchange for 87.5% of Argo’s recapitalized shares.

Bondholders of Argo’s $40 million unsecured notes will receive a combined 10%, while current shareholders will only own 2.5%. The deal is part of a court-supervised restructuring plan called “Project Triumph” aimed at preventing bankruptcy and keeping the mining company listed on the Nasdaq.

“Unless the plan company (Argo) undertakes a balance sheet restructuring, the plan company will not be able to obtain the funding it needs and will become insolvent on both a cash flow and balance sheet basis,” Argo said.

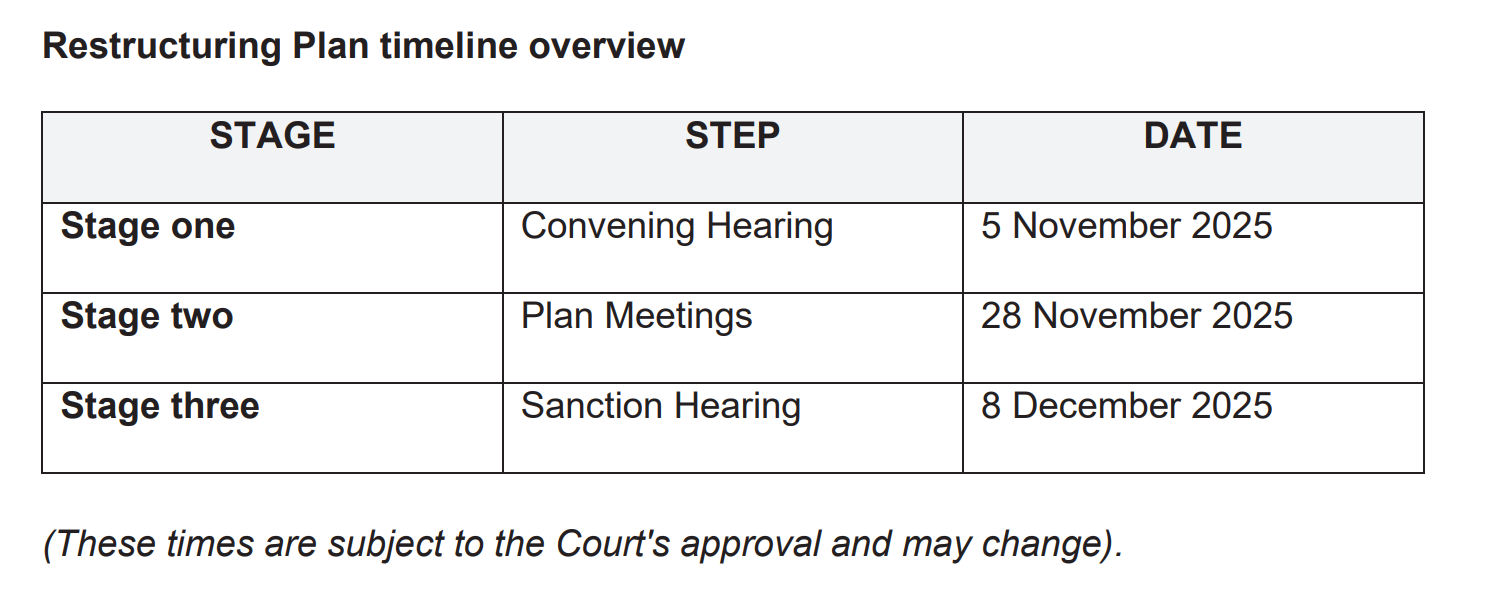

Overview of Argo’s restructuring plan timeline. sauce. Argo

Related: Bitcoin miner Argo repays $35 million in Galaxy relief loan

Argo to be delisted from LSE

Argo will also be delisted from the London Stock Exchange, ending its six-year existence as one of the UK’s few listed crypto companies. Provided the company meets compliance conditions, including a planned reverse stock split by January 2026, its shares will continue to trade on the Nasdaq.

The company will remain incorporated and headquartered in London, but its capital markets focus will shift entirely to the United States. In 2018, Argo became the first crypto company to list on the London Stock Exchange, raising approximately $32 million at a valuation of $61 million.

Argo’s Bitcoin (BTC) production has plummeted over the past two years, from nearly six coins per day in 2022 to just two coins per day in 2024, as aging machinery and high energy costs weighed on profitability, according to the filing.

The mining company sold its Helios facility in Texas to Galaxy Digital and concentrated its operations at its Baycomo site in Canada and its U.S. hosting centers in Tennessee and Washington.

Related: Argo Blockchain cuts debt in half to $75 million in 2022

The end of Argo’s era as a UK public company

The Growler acquisition includes a plan to inject new capital known as “exit capital” and transfer ownership of Growler USCo, a subsidiary with new mining assets, to Argo in exchange for new stock. The move will give lenders operational control and a means to update Argo’s fleet, which will become obsolete in 2026.

If approved by the High Court of England and Wales, the restructuring would eliminate most of Argo’s debts, save its Nasdaq listing and hand control of the company to its creditors. For investors, this is almost complete extinction and the end of Argo’s era as one of the pioneers of public market cryptocurrencies in the UK.

magazine: Sharplink executives shocked by BTC and ETH ETF holdings — Joseph Chalom