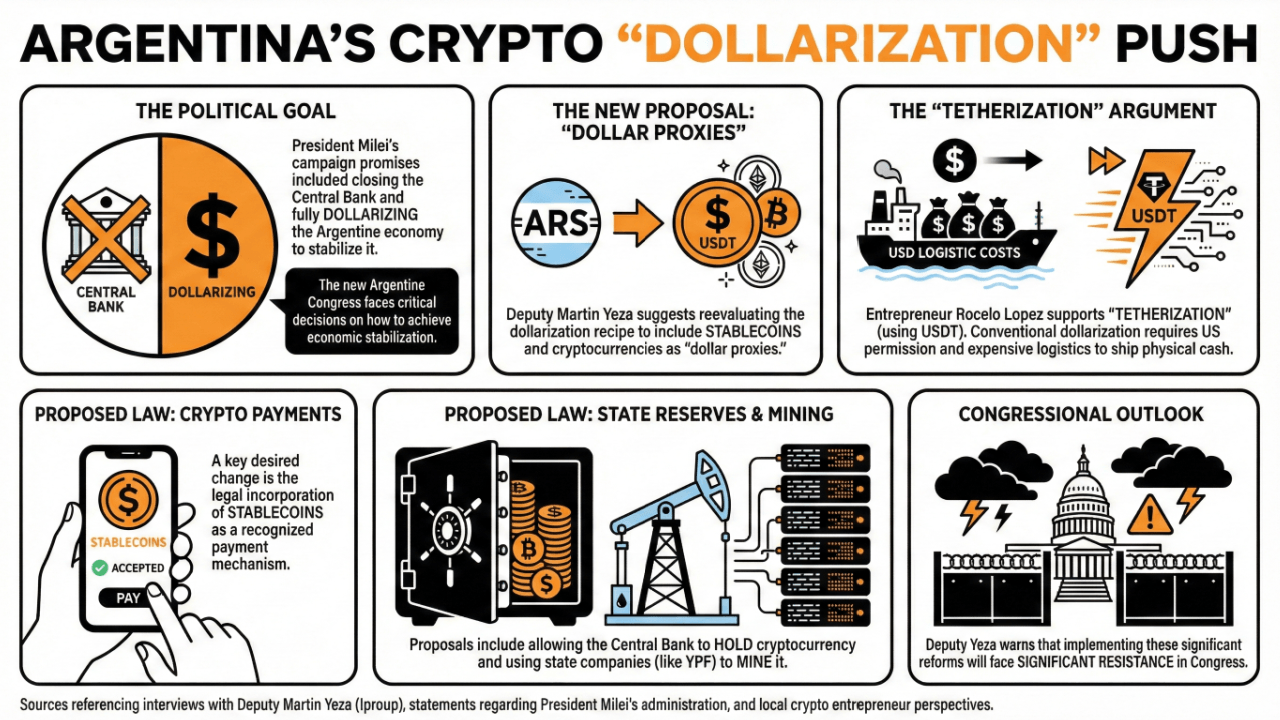

Martin Ezza, a deputy in the new parliament, said stablecoins could play a new and pivotal role in the country’s payments structure. He believes it would be positive for central banks to own cryptocurrencies and allow state-owned enterprises to mine them. Local analysts also supported the so-called “tetherization” of the economy.

Argentina’s new parliament could give new power to cryptocurrencies in 2026

The new Argentine parliament will need to address several important crypto and stablecoin-related issues in the new year.

According to Deputy Minister Martin Eza, the government will reevaluate the dollarization recipe this year to stabilize the economy and include stablecoins and cryptocurrencies as alternatives to the dollar.

In a conversation with Iproup, he said:

If a series of reforms were to be implemented, they would face significant resistance, and such a meeting would certainly not be welcomed in parliament.

But one change he would like to see is the inclusion of stablecoins as a payment mechanism. He is also considering allowing central banks to hold cryptocurrencies and mine them through state-owned enterprises such as YPF, even if governments do not take advantage of these possibilities immediately.

One of President Milais’ major campaign promises was to close the central bank and dollarize the economy to reduce inflation.

Local cryptocurrency entrepreneur Rosselló López supported the “tetherization” of the Argentine economy, referring to Tether, the issuer of USDT, the largest stablecoin by market capitalization.

A traditional dollarization of the Argentine economy would have to be given the green light by the United States, which would also have to consider the transportation and logistics costs of bringing American cash into Argentina.

“Tetherization” would offer advantages compared to the regular dollarization process, which does not involve the US government. Lopez emphasized that the operations will be traceable and will be a low-cost transaction.

Recent reports have revealed that Argentine banks are ready to offer crypto services to their customers and that the central bank is drafting special measures to open the crypto market to private banks.

read more: Argentina’s central bank considers banks offering cryptocurrency services

FAQ

What important issues regarding cryptocurrencies will be addressed in the new Argentine Congress?

Congress plans to reevaluate the use of. Stablecoins and cryptocurrencies As an alternative to the dollar for economic stabilization in 2026.What kind of reforms is Vice President Martin Eza advocating for the adoption of virtual currencies?

Yeza is a stablecoin payment mechanism and allow central banks to hold and mine cryptocurrencies through state-owned enterprises.How does Rosselló López see the idea of “tetherization” for Argentina?

Lopez advocates “tetherization” as a flexible alternative to traditional dollarization, offering benefits such as traceability and low-cost transactions without the need for U.S. permission.What developments are happening with cryptocurrencies in Argentine banks?

Reports say Argentine banks are preparing offers encryption service He also revealed that the central bank is working on measures to open up the cryptocurrency market to private banks.