Bitcoin (BTC) has undergone a sharp revision, falling 23% from its recent peak, raising concerns about whether the market is entering a long-term bearish stage.

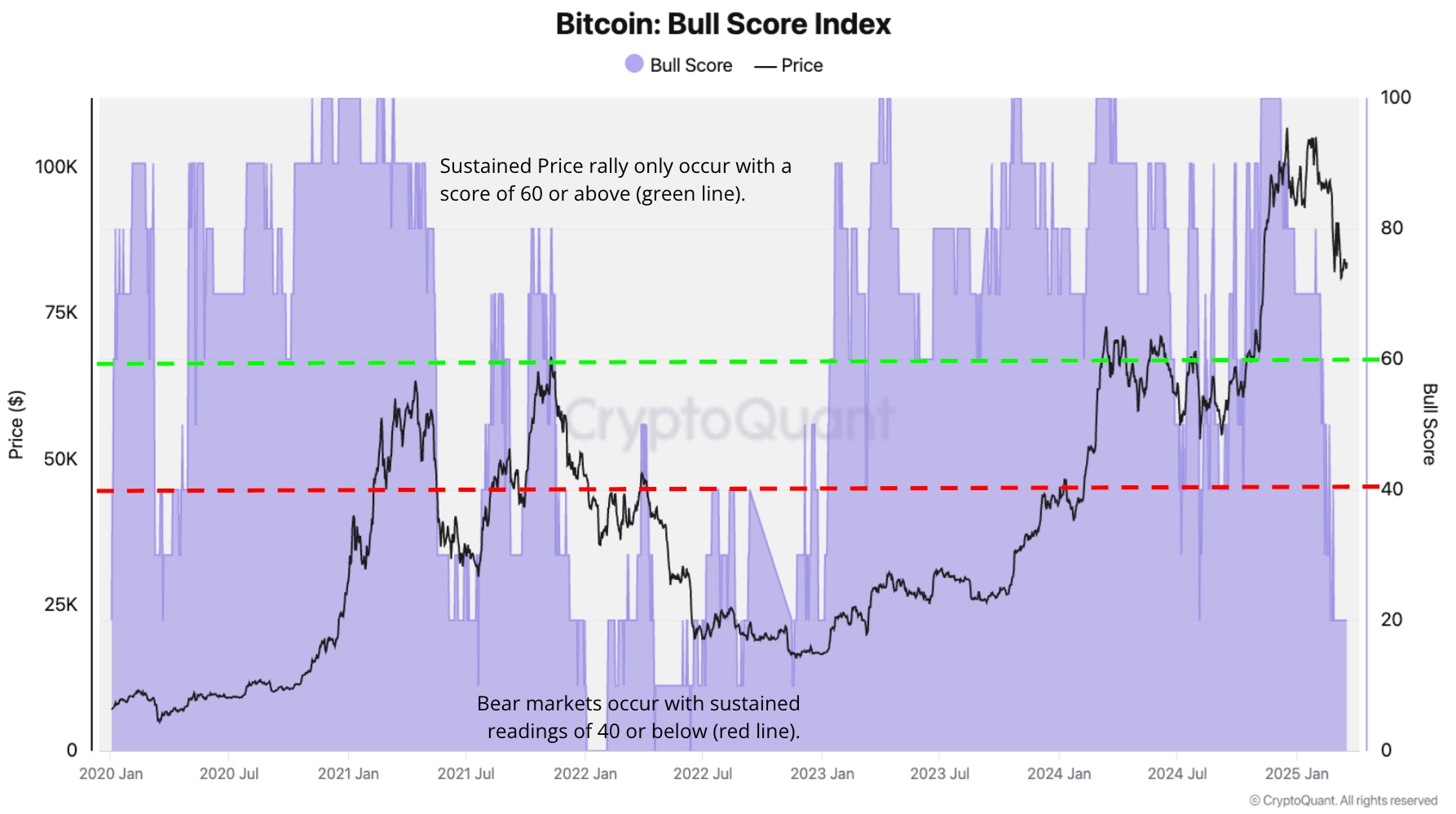

Cryptocurrency Analytics Firm Cryptoquant introduced a bull score index to assess whether this reduction is part of a temporary fix within the wider bull cycle or the onset of a deeper decline.

Cryptoquant’s Bullscore Index, which assesses 10 key metrics of network activity, investor profitability, Bitcoin demand and market liquidity, is currently at 20, the lowest level since January 2023. The index is designed to measure the percentage of bullish metrics in the market that show higher value, higher value, and higher value.

Historically, Bitcoin has maintained a major price increase when the bullish score index exceeds 60, but measurements below 40 correspond to the bare market. Given that the index is well below this threshold, CryptoQuant analysts warn that the current market situation is weak and could indicate further downside risk.

If the Bullscore index remains below 40 over a long period of time, you can see a continuation of bearishness similar to the previous downtrend. Bitcoin has seen similar fixes in past Bull Cycles, but the current weak market environment can make rapid recovery difficult unless the basic metrics improve, analysts point out.

A chart showing bull index shared by Cryptoquant.

*This is not investment advice.