Analyst Joao Wedson warns that Bitcoin can be set up for October’s “Judgement Day” to collide with $50,000 next year.

summary

- Bitcoin could be approaching the bear market, which can lower the price to $50,000

- The long-term chart suggests that Bitcoin is approaching its top.

- Wall Street could lead to Bitcoin moves in the near future

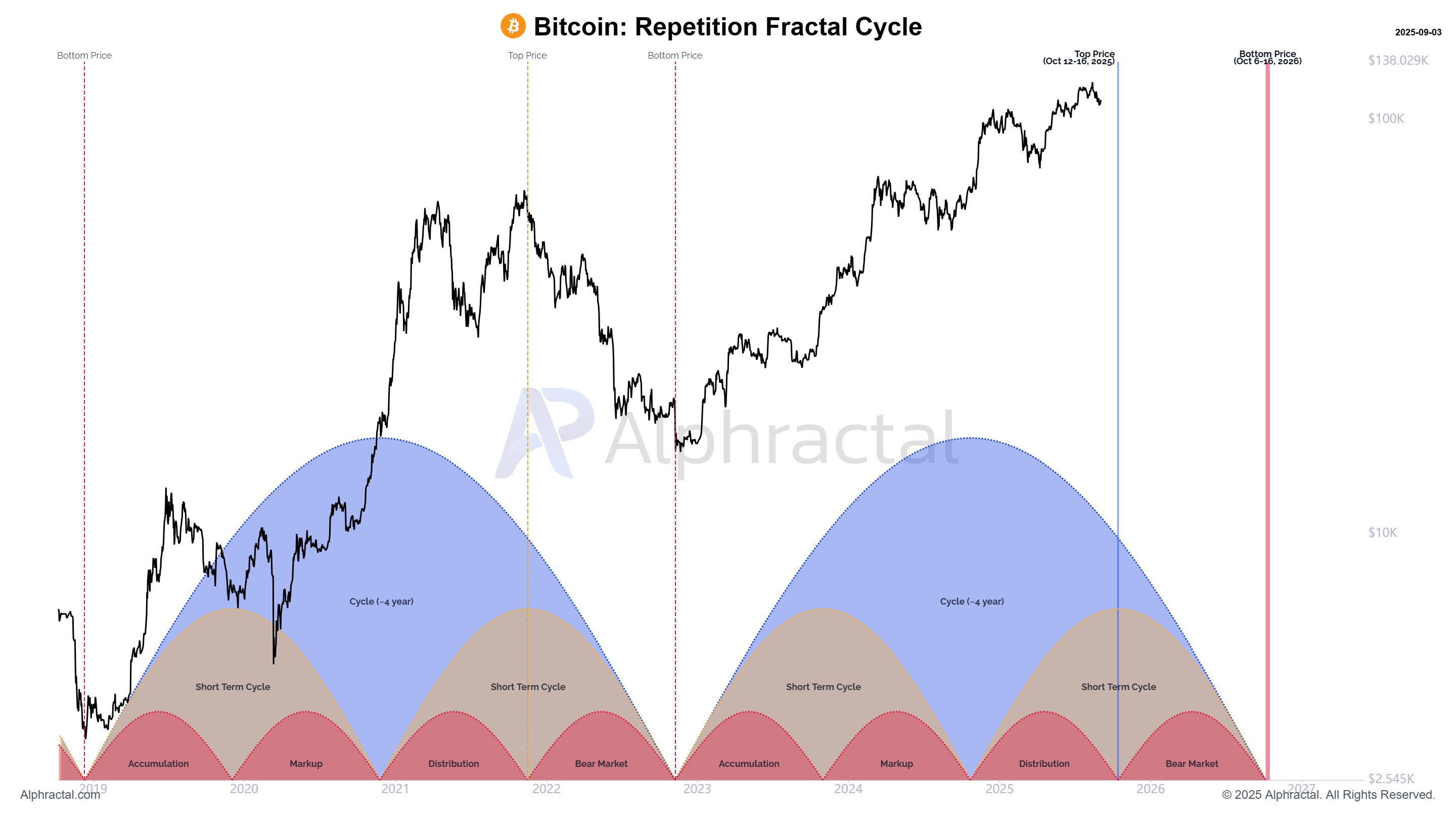

Reading from the long-term pattern suggests that Bitcoin (BTC) may be heading towards “Judgment Day” in October 2025. On Wednesday, September 3rd, analyst Joao Wedson warned that the market was closing down after a four-year cycle and approaching a bear market that could crash to $50,000.

Compare with Bitcoin Fractal Repeat Cycle Price | Source: x

Wedson warns of drawing conclusions based solely on charts that bring the market up a month ahead, but he says this is possible. In this case, Bitcoin could surge beyond $140,000 at $140,000 before immersing in $100,000. Traders can then expect a crash of up to $50,000 in the 2026 Bear Market.

You might like it too: Bitcoin can be hacked, Quantum’s biggest breakthrough is not,

Will Bitcoin collide with $50,000 in 2026?

Still, the real question is whether fractals are reliable, Wedson asks, given the institutional demand and the rising ETFs that are increasing in price. Still, there are potential headwinds that serve as anti-narratives. In particular, macroeconomic pressures still create fear in the stock market.

You might like it too: Inflation data will sink Bitcoin and make Trump less likely to cut its major

Most of Wall Street is concerned about the impact of tariffs on the stock market, but the Federal Reserve is concerned about the impact on inflation. Even Elon Musk, a former Trump ally, pointed out, Trump tariffs will be in late 2025. Since it’s deleted post.

Bitcoin could continue if inventory enters the bear market, particularly due to significant institutional exposure to assets. Bitcoin faces a serious liquidity crisis as institutions begin to flee to safer investments.

You might like it too: Bitcoin price forecast: Can BTC break $112K or revert to $100,000?