Rapid rise Bitcoingold and stocks are dazzling investors, but they have an underlying short-term volatility and their record highs may be distracting from the threat of a growing U.S. budget deficit, analysts said.

“All the government shutdowns, all the gridlock, all the borrowing talk highlights that America is living beyond its means,” Nigel Green, CEO of financial consultancy De Vere, said in a shared note. decryption. “Yet investors continue to act as if debt is irrelevant due to record high stock prices and ease of liquidity. They are not.”

The Congressional Budget Office predicted in January that the U.S. budget deficit would reach $1.9 trillion in 2025, but current Treasury Department data shows the actual deficit is $1.973 trillion, an increase of $76 billion from the same period last year.

At the time of writing, Bitcoin is currently trading at $122,000, down about 0.8% over the past day, according to crypto price aggregator CoinGecko. Earlier this week, BTC rose to an all-time high of over $126,000. But recently, the S&P 500, Nasdaq 100, gold, and silver have all outperformed Bitcoin.

It is typical for Bitcoin to lag stocks and precious metals, said Julio Moreno, head of research at CryptoQuant. decryption.

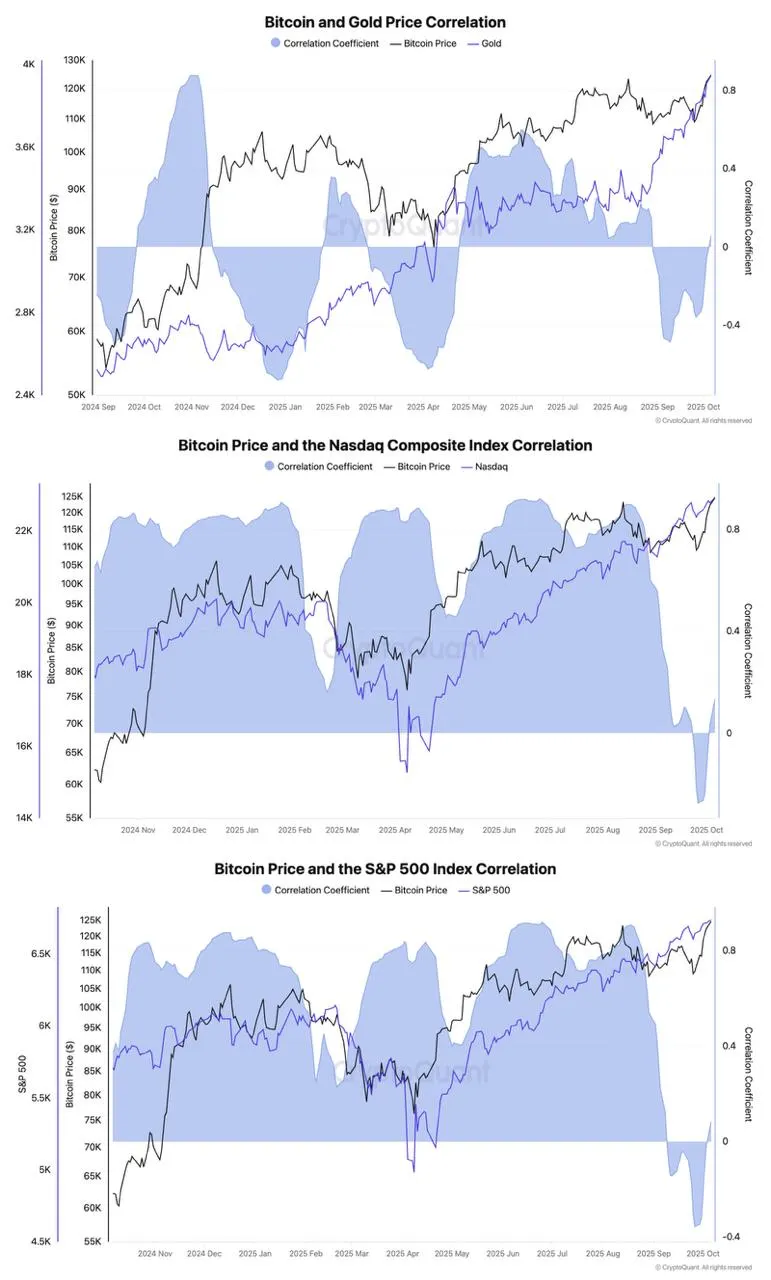

“Bitcoin could catch up with these assets in the coming weeks, as the correlation has now turned positive after being negative for a month,” he said. “When it comes to gold, Bitcoin typically follows its movements late.”

Source: CryptoQuant

However, Bitcoin’s volatility index is still soaring. The index tracks the volatility of Bitcoin prices in USD by measuring the standard deviation of daily returns over a 30-day period.

Since then, Bitcoin volatility has steadily increased to 1.17%, according to Bitbo. It was September 28th, just days before the US government shutdown on October 1st. This is about the same level as a month ago, but much lower than in late March, when Bitcoin volatility spiked to 2.87% amid tariff chaos.

“Crypto markets are likely to remain volatile, but unless ETF flows remain positive and there are no new macro shocks as the U.S. government shutdown continues, we should see widespread Bitcoin-led support next week,” Bitunix analyst Dean Chen said. decryption.

Data from London-based investment management firm Pharside Investors shows that even though trading has just begun on Friday, inflows into Bitcoin ETFs are already down compared to last week. As of Thursday’s close, Bitcoin ETFs had seen $2.7 billion worth of new inflows so far this week.

According to analysts, even if the market receives broad support next week, users of Myriad (a prediction market owned by Myriad) will decryption Parent company DASTAN expects there will be more red than green over the weekend.

Shortly after the opening bell rang in New York on Friday morning, Myriad forecasters estimated that there was a 51.2% chance that BTC would see more red candles than green candles between now and Monday, October 12th.

Analysts at crypto exchange Bitfinex were divided on whether stocks and cryptocurrencies would set new highs amid the U.S. government shutdown.

“Stock markets have been trading near all-time highs as the shutdown continues, creating a hopeful environment and suggesting that the macro environment remains supportive of speculative asset price appreciation,” they said. decryption. “However, as no official data on national indicators have been released, this could be seen as a disconnect masking growing fiscal stress.”