Bitcoin’s price may still dominate the headlines, but among analysts and institutional strategists, attention is quietly shifting elsewhere.

Instead of debating whether Bitcoin can regain its upward momentum in the short term, market observers are increasingly focusing on the deeper question of whether the structural signals that once reliably guided Bitcoin’s four-year cycle are starting to break down.

Analysts are no longer focused on Bitcoin price as demand signals quietly deteriorate

The changes are occurring against a backdrop of declining demand indicators, rising currency flows, and widening gulfs among analysts.

On the other hand, some believe that Bitcoin is entering a traditional post-peak correction. On the other hand, some argue that the pioneering cryptocurrency may be completely breaking free from its historical cycles.

Analyst Daan Crypto Trades argues that recent price movements have already cast doubt on one of Bitcoin’s most reliable seasonal assumptions.

“BTC Looking forward, Q1 is generally a good quarter for Bitcoin, but Q4 was no different, and this time it didn’t work out. There is no doubt that 2025 was a very troublesome year. Massive inflows and capital accumulation, combined with large whales and a four-year sell-off. The first quarter of 2026 will be Bitcoin’s chance to show whether the four-year cycle continues.” I wrote.

Poor performance does not indicate a definitive failure, but rather friction. ETF inflows and corporate accumulation are being absorbed by long-term holder distributions, weakening the impact these inflows once had on BTC prices.

This structural tension is also reflected in US spot market data. Coinbase’s Bitcoin premium, which is often used as a proxy for U.S. institutional demand, has remained negative for an extended period of time, according to Kyle Doups.

Coinbase’s $BTC premium has remained negative for 7 consecutive days and is currently around -0.04% per Coinglass.

This typically indicates that U.S. spot demand lags behind other markets.

Institutional investors are less aggressive, risk appetite has slowed, and capital remains cautious.

I’m not panicking, but… pic.twitter.com/HtjNSorO1I

— Kyle Doops (@kyledoops) December 21, 2025

The message is not surrender but hesitation, meaning the capital is there but not willing to go after it.

Exchange flows refer to dispersion, not accumulation.

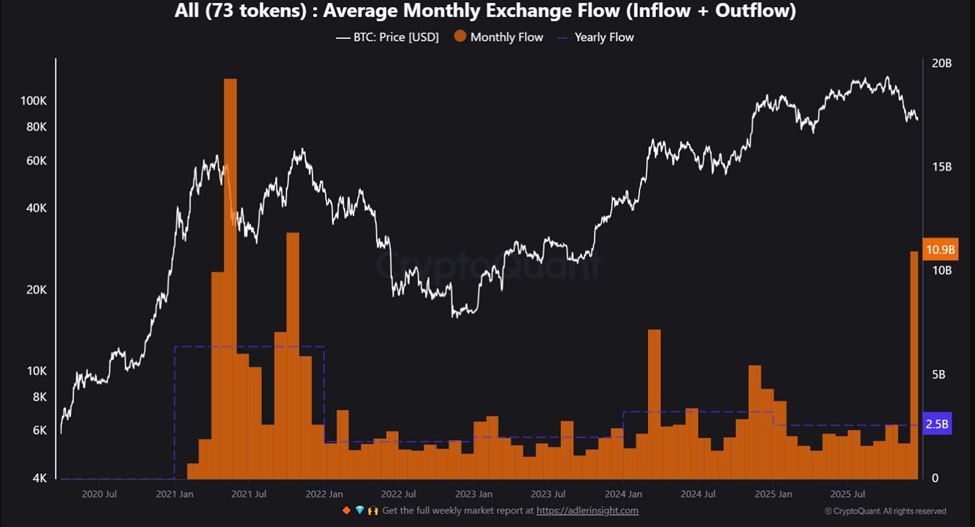

On-chain data highlights the need for cautious interpretation as Bitcoin exchange inflows surge to levels historically associated with late-cycle behavior.

“Monthly foreign exchange flows surged to $10.9 billion, the highest level since May 2021. The height means selling pressure is building. This is further evidence that the market has hit a ceiling and a bear market has begun amidst increased volatility,” said analyst Jacob King.

In the past, similar spikes have coincided with a profit-taking stage rather than an initial accumulation period.

Monthly exchange flow. Source: CryptoQuant

If history is true, the points for cycle math are still low because organizations are divided but disciplined

On-chain analyst Ari Chart argues that despite the structural changes, Bitcoin’s timing symmetry remains remarkable.

“Bitcoin price cycles follow a surprisingly consistent pattern in both timing and magnitude. Historically, it takes about 1,064 days from a market bottom to a market top, and about 364 days from a top to the next bottom,” he wrote, outlining how previous cycles closely followed that rhythm.

If this pattern continues, analysts suggest that the market may now be in a correction window. Historical retracement suggests further decline before a permanent reset.

At the organizational level, opinions are divided without confusion. Sean Farrell, Head of Crypto Strategy at Fundstrat, acknowledged short-term pressures while maintaining a bullish long-term framework.

“Bitcoin is currently in a ‘no man’s land’ valuation,” Farrell said, citing ETF redemptions, sales by original holders, miner pressure and macro uncertainty. Still, he added, “I still expect Bitcoin and Ethereum to challenge all-time highs by the end of the year, thereby ending the traditional four-year cycle in a shorter, smaller bear market.”

The cycle debate is now institutionalized

That possibility is echoed by Tom Lee, whose views are amplified throughout his cryptocurrency commentary, suggesting that Bitcoin will soon break its four-year cycle.

Tom Lee thinks Bitcoin will soon break the 4-year cycle! pic.twitter.com/eWZdW7xkgW

— Crypto Rover (@cryptorover) December 21, 2025

Fidelity’s Julian Timmer takes the opposite position. According to Lark Davis, Timmer believes Bitcoin’s October peak was the highest in both price and time, and that “2026 is the year of the decline,” with support forming in the $65,000 to $75,000 range.

“The bear market is here and Bitcoin is about to drop to $65,000.”

Julian Timmer, director of global macro at Fidelity, thinks so.

Julian is bullish on BTC$ in the long term, but believes Bitcoin is once again following its historic four-year cycle… pic.twitter.com/KFPcBWTcZP

— Lark Davis (@LarkDavis) December 21, 2025

Taken together, these perspectives explain why analysts are no longer fixated solely on Bitcoin price. The crypto pioneer’s next move may not decide who is bullish or bearish, but it may decide whether the framework that has defined the market for more than a decade still applies.

The post Analysts look beyond Bitcoin price as Tom Lee flags structural shift appeared first on BeInCrypto.