Crypto strategists who continue to grow their follow with timely Bitcoin calls believe BTC’s bull market is far more over despite the general bearish sentiment.

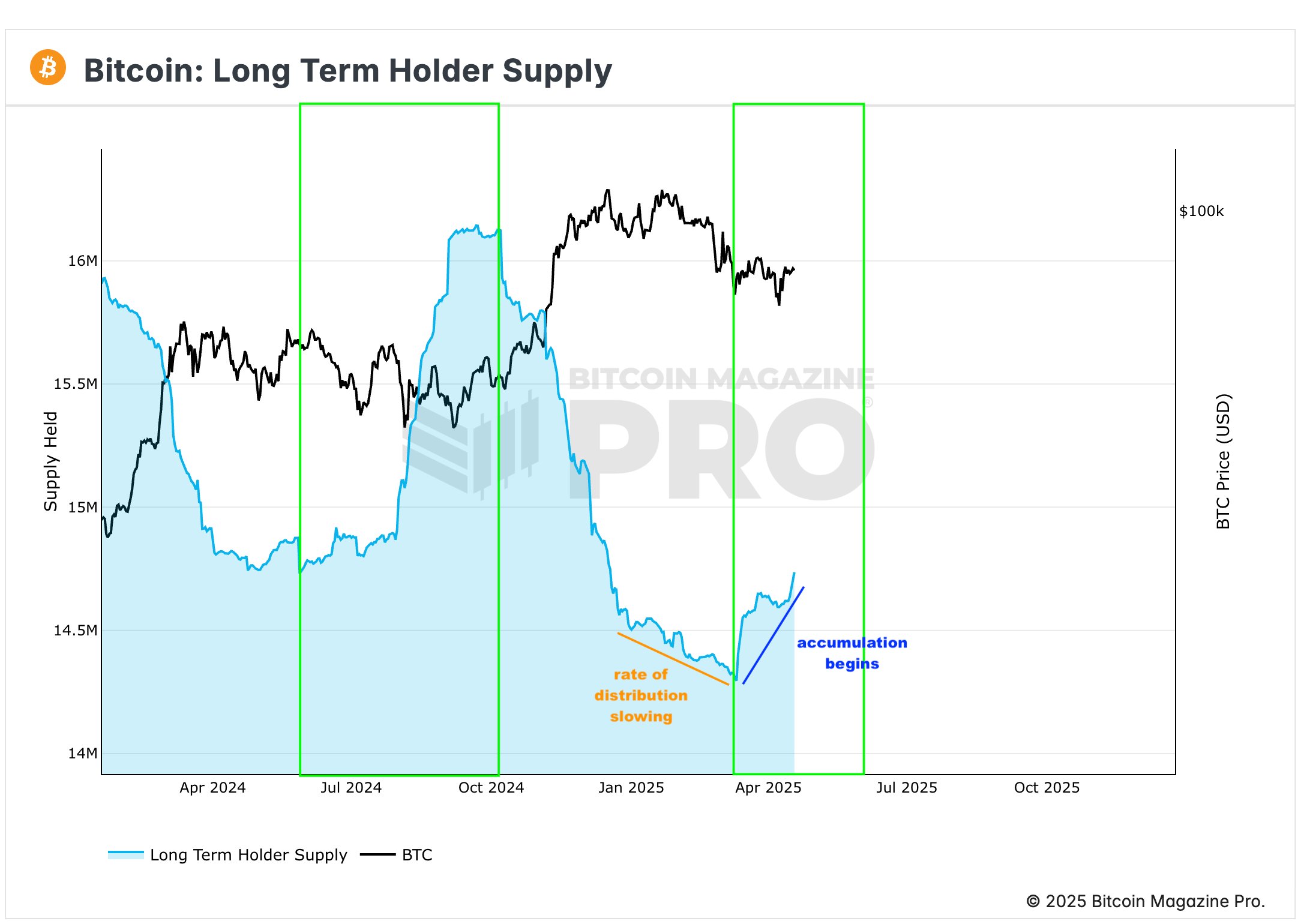

The trust of the pseudonymous analyst tells 467,000 followers of social media platform X that they are closely watching the activities of the Long-Term Holders (LTHS), an entity that has held coins for at least 155 days.

Reliable dictates that after several months of unloading the BTC stack, there are indications that LTHS is gobbling the Crypto King.

“It has been three to four months since our last post on supply of long-term holders, where we showed that long-term holders are making net distributions, up from BTC of $68,000 to $110,000.

This distribution almost always occurs during impulsive price action, as long-term holders are sold to pumps. This is normal/expected in bull markets. Sales were aggressively continued to $110,000, but then slowed (but continued) until March.

As of April, LTHS had once again officially started accumulating BTC.

For the past seven months, long-term holders have been sold to RIP.

Now they’re buying dip. ”

Source: Trustworthy Crypto/X

As long-term holders take advantage of market modifications, Bitcoin believes that it can now end the bull cycle with a gathering that can send BTC to the highest level ever.

“But with things like BTC, the time to buy spots is much lower and much lower. Certainly, you can make this cycle higher, but this cycle is relatively limited (and by that, if the top doesn’t exist yet (it’s personally unbelievable).

The best risk/reward level for BTC’s Swing Longs (A Trade) is $69,000-$74,000 (this may not be available) and is in high time frame demand. ”

But in the short term, trustworthy predicts that Bitcoin will witness another downswing before it can cause another leg to swell.

“Liquidity approaching the first area of interest from upside down to over $86,000.”

Source: Trustworthy Crypto/X

At the time of writing, Bitcoin is trading at $87,377.

Generated Image: Midjourney