Jamie Coutts, Chief Crypto analyst at Real Vision, highlights Bitcoin (BTC) outperformance in the revisions stocks and crypto assets experience.

Coutts says that, although Bitcoin has traditionally been more volatile than stocks, it has recently witnessed a relatively lower correction than expected based on historical price fluctuations.

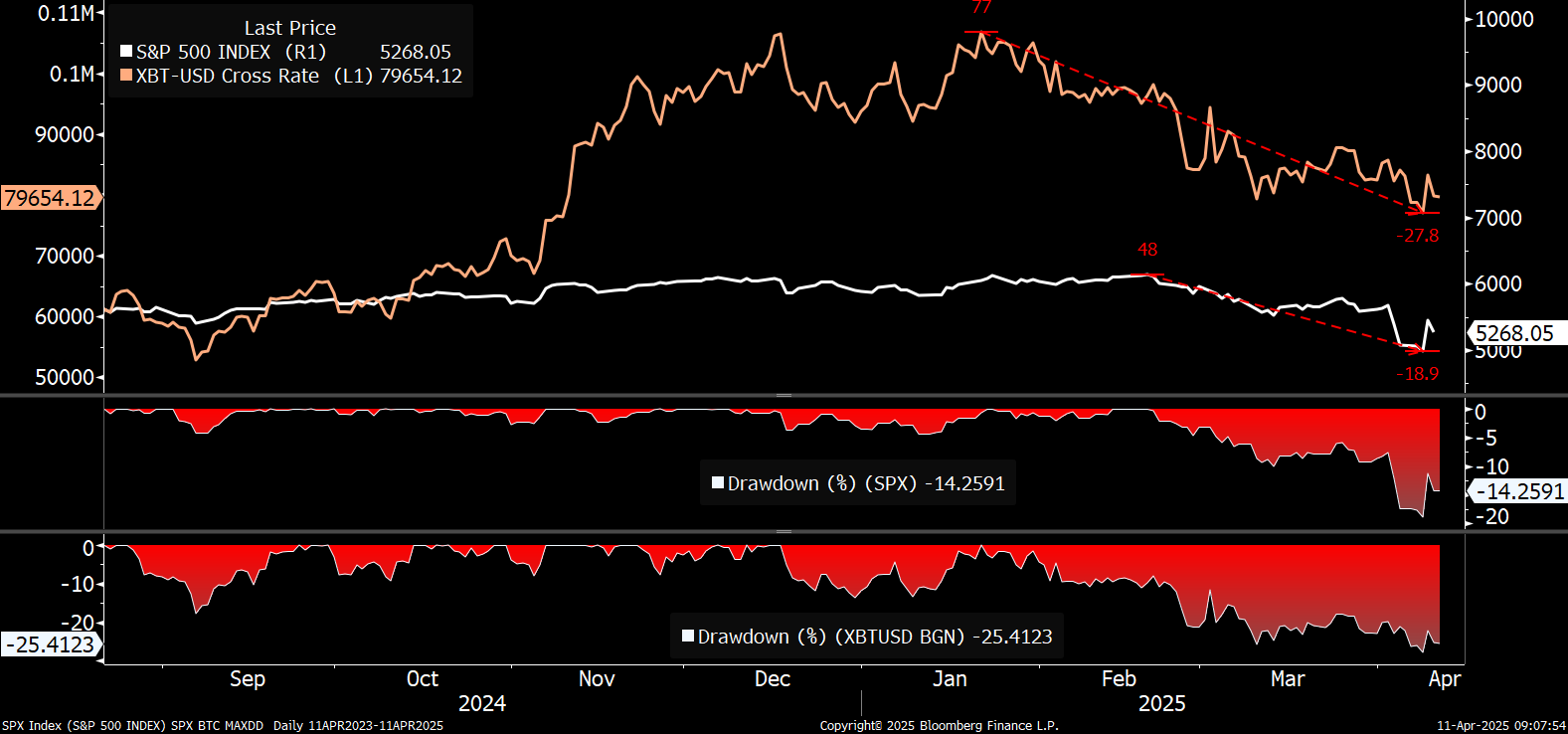

“People don’t understand what’s going on with Bitcoin during this risk asset panic. The volatility of the BTC S&P 500 at 2.5 times has experienced a drawdown of 28% against the 19% of the S&P 500. This is a massive outperformance.

Perhaps it reflects not only the strength of BTC, but also the increasing vulnerability of the Fiat system and its asset market. Complex systems are essentially a trend towards entropy/chaos. Bitcoin reflects this clarification. ”

Source: Jamie Coutts/X

Going forward, Coutts says Bitcoin will become more important as two use cases become more prominent around the world.

“What’s going on now is epic. Things are broken. The vulnerabilities of the Fiat Fraction Reserve Credit-based system are fully on display. Looking at the next few days, we understand the predominance of Bitcoin as a global payments class and collateral asset.

I understood this before the pleb, and this time it was a nation-state. ”

Bitcoin is trading at $83,227 at the time of writing.

Generated Image: Midjourney