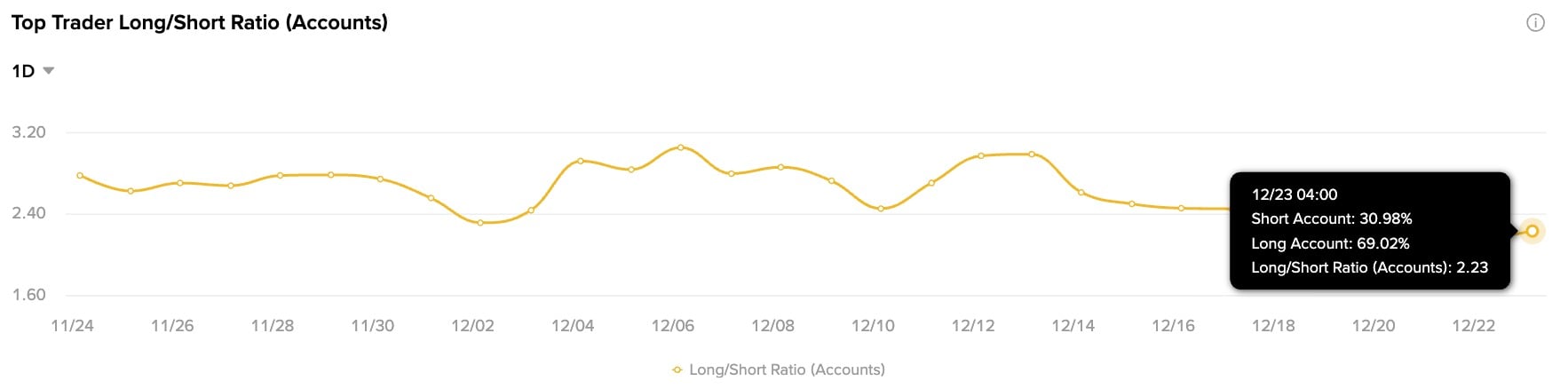

Cardano’s derivatives suite is once again heavily tilted to the bullish side, with Binance’s top traders currently 69% long on the ADA token, with a long-short account ratio of nearly 2.23, the highest since early December.

The buildup comes as Charles Hoskinson’s NIGHT became a $1 billion asset in its own right this week, reaching a capitalization of $1.25 billion before finding resistance.

The dual momentum between ADA and NIGHT depicts an unusual situation. ADA itself continues to hover around $0.36, down almost 60% from its October high, but top traders appear to be looking at an eventual reversal rather than further decline.

It is worth noting that the position ratio of 1.33 suggests that most long accounts are not overly leveraged. This is a dynamic that typically indicates an accumulation phase rather than a speculative burst.

“New ADA” takes over

Midnight’s own charts tell a similar story. “The new ADA token exploded 39% in one week, peaking above $0.12 before falling back around $0.076. 24-hour sales exceeded $1.6 billion and a volume-to-market capitalization ratio of 127%, indicating a crazy rotation.”

Despite the pullback, the circulating supply of N16.6 billion already supports a valuation higher than many established layer 1 tokens launched in 2024.

If Binance’s elite traders are correct, ADA’s current risk-reward zone could reflect an early cycle setup, with professional accounts accumulating through a phase of low volatility and retail sentiment drifting elsewhere. And if Midnight maintains traction, the connection between old and new ADA could prove to be more valuable than the price chart shows.