Bitcoin (BTC) has soared above $125,000, setting a new all-time high and solidifying its dominance as the world’s leading cryptocurrency. The Sharp Rally that pushed BTC to $125,708 during Intray trading was not a random market event.

Instead, it reflects the pattern of constructive accumulation seen in previous cycles, driven by investor confidence and structural demand.

Bitcoin investors are optimistic

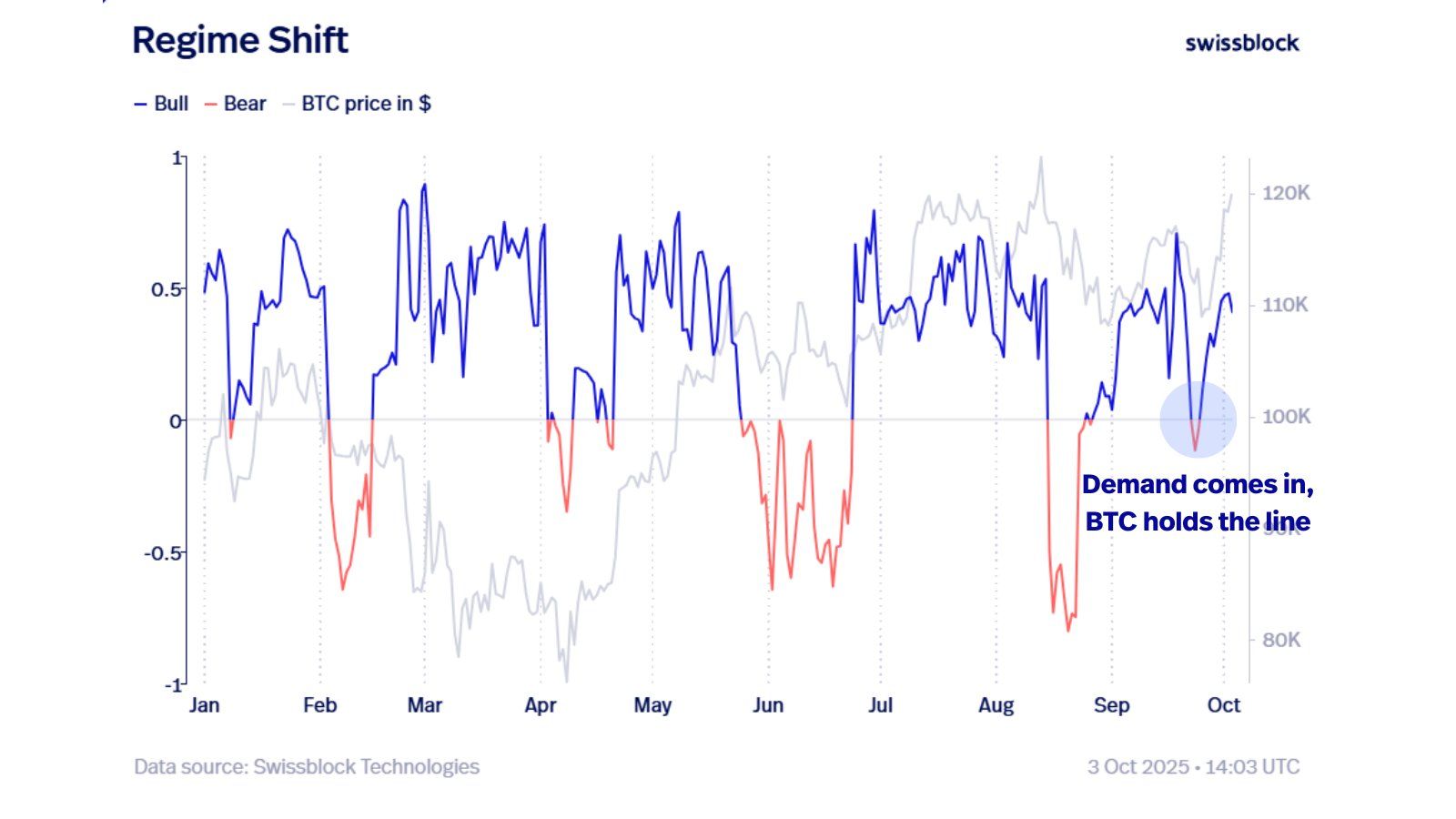

According to SwissBlock analysis, the Bull Bear indicator reveals that Bitcoin’s recent rally is fueled by real demand rather than speculative excess.

Even though the market briefly corrected before this surge, demand continued to absorb supply. Structural shifts remained in an uptrend across the DIP, highlighting investor conviction.

This sustained demand points to a healthy market reset rather than vulnerability. Institutional interest, combined with increased retail participation, has created a steady flow of capital into Bitcoin.

Such resilience highlights a constructive phase in which market participants view pullbacks as buying opportunities rather than exit signals.

Want more token insights like this? Sign up for editor Harsh Notariya’s daily crypto newsletter.

Bitcoin Bull Bear Indicator. Source: SwissBlock

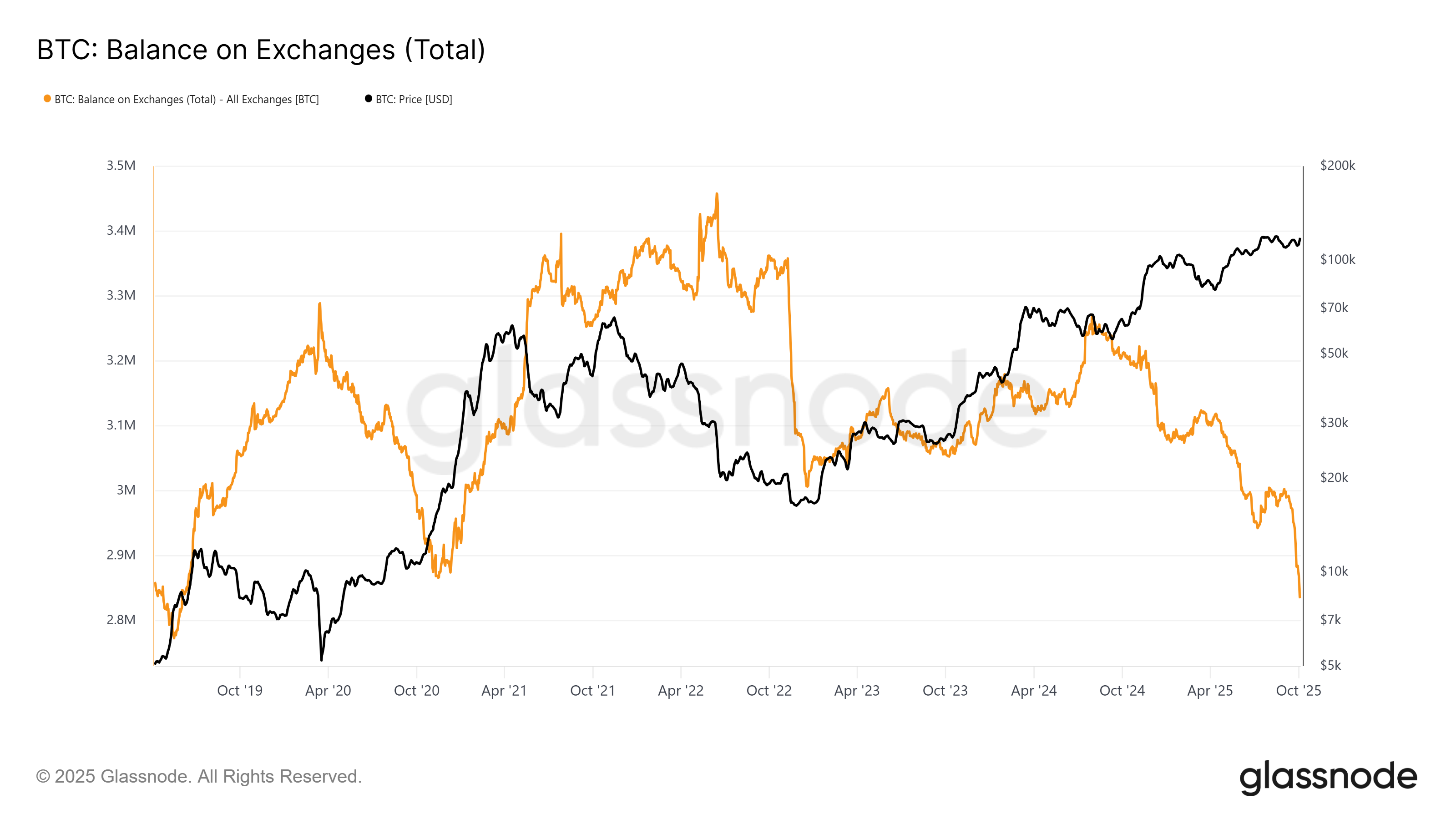

The macro picture for Bitcoin remains bullish. According to Exchange data, BTC supply is at a six-year low, with only 2.83 million coins currently available on exchanges. This reflects widespread accumulation by investors over the past month and indicates strong long-term confidence in the asset.

A decrease in replacement supply usually indicates a decrease in selling pressure. This is historically a bullish sign. This accumulation trend confirms that market participants interpreted the recent correction as an opportunity to acquire more BTC rather than weakness.

Exchange Bitcoin Balance. Source: GlassNode

BTC price forms new ATH

Bitcoin price hit a new all-time high at $125,708 before consolidating near $122,963. This retracement looks healthy considering the size of the recent gains. A break above $122,000 remains important to maintain momentum.

A combination of demand strength, accumulation, and limited supply could help Bitcoin form all-time highs in the coming days. Continued inflows from institutional investors are likely to further support this trajectory.

Bitcoin price analysis. Source: TradingView

However, if gains intensify, Bitcoin could lose support at $122,000 and fall below $120,000. Such a move could signal a temporary cooldown and delay the next leg of the rally.

Post-Bitcoin price outlook after all-time high: bigger rally or correction? appeared first on Beincrypto.