An artificial intelligence model predicts that Ethereum (ETH) is likely to rise above the $3,000 support level by December 1st.

This outlook comes as ETH recovers in line with the broader market, reclaiming the $3,000 mark after days of widening losses that raised the possibility of a sustained decline below $2,000.

ETH price prediction

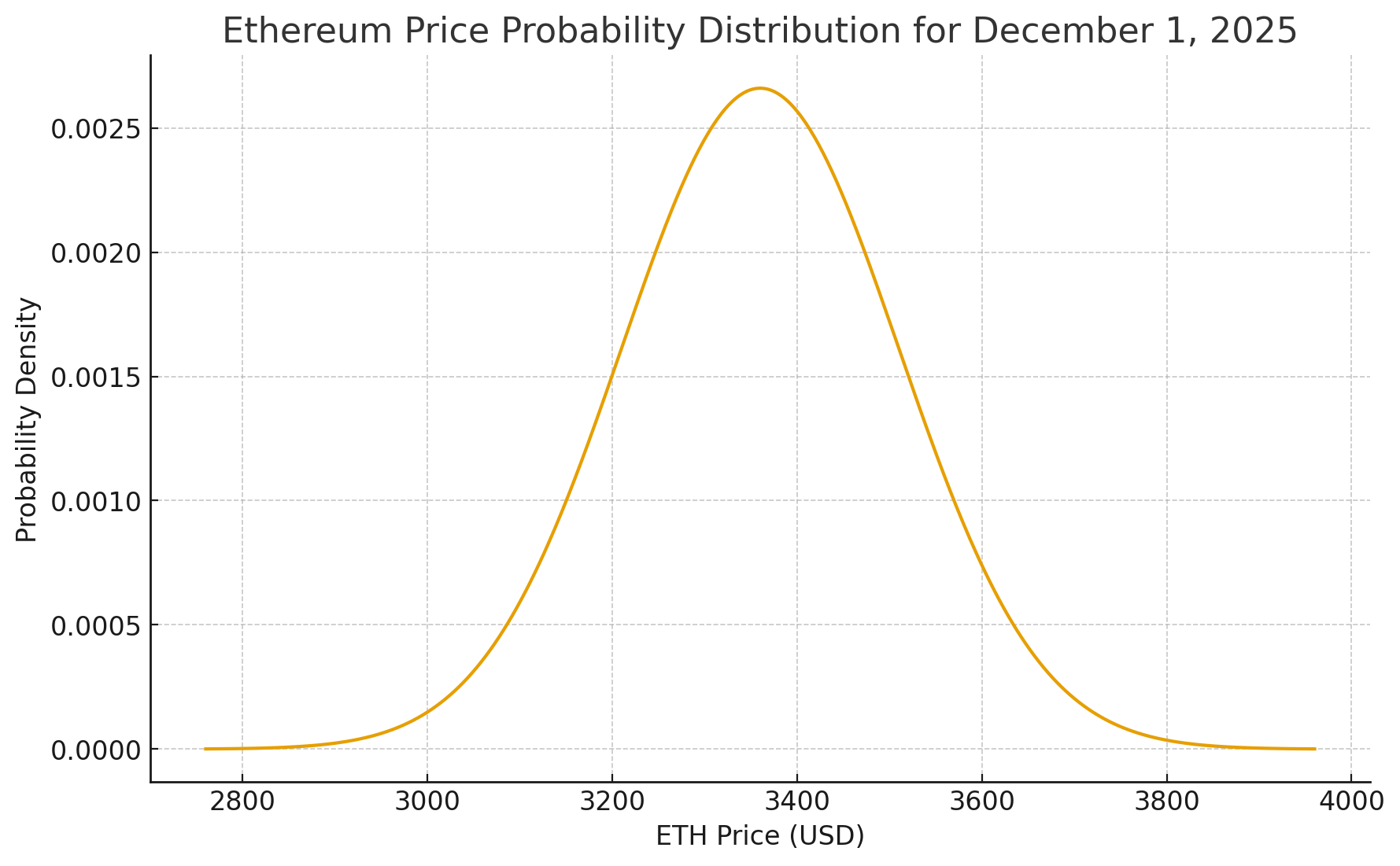

For his December 1st price prediction, Finbold consults OpenAI’s ChatGPT and expects Ethereum to trade around $3,360, with a realistic range of $3,300 to $3,420.

According to ChatGPT, recent market trends indicate that Ethereum has consistently attracted buyers in the $3,300-$3,350 zone, forming a solid base of support that limits downside risks.

Foreign exchange reserves have fallen to multi-year lows and fewer coins are readily available on trading platforms, suggesting that selling pressure is contained for the time being.

A moderately bullish catalyst also supports an upward bias, according to ChatGPT. DeFi and Layer 2 networks remain active, but staking continues to reduce circulating supply. The market is also positioning for the December Fusaka upgrade, producing a subtle pre-event rally, but not enough momentum for a rapid breakout.

At the same time, market sentiment has stabilized after recent volatility, with no signs of panic, forced liquidations, or chaotic selling. Open interest is strong, suggesting traders are cautiously re-entering positions, suggesting a gradual recovery rather than another decline.

Based on these fundamentals, ChatGPT noted that Ethereum’s ceiling remains well-defined, with repeated failures to break out of the $3,880-$4,000 resistance zone. This barrier prevents larger trend changes and limits the extent to which prices can rise in the short term.

Considering the current spot level near $3,000, strong fundamental support, and a backdrop of cautiously improving sentiment, ChatGPT estimates Ethereum’s most likely landing zone on December 1st to be around $3,360.

ETH price analysis

At the time of writing, ETH was trading at $3,004, down 1.6% in the past 24 hours, but on a weekly timeline, the second-ranked cryptocurrency by market capitalization was up over 10%.

Ethereum’s current levels indicate short-term bearish pressure compared to the simple moving average (SMA). The 50-day SMA is $3,509.66, and the price is currently 14% below it, highlighting the recent downside momentum and potential resistance overhead if buyers attempt to regain this level.

Conversely, the 200-day SMA of $3,400.05 provides stronger long-term support as ETH remains 12% above it, maintaining a bullish structural bias and suggesting resilience to a deeper correction.

Complementing this, the 14-day Relative Strength Index (RSI) of 42.8 indicates neutral territory, far from overbought levels above 70 or oversold levels below 30, suggesting a balanced situation suitable for consolidation or a modest rally.

Featured image via Shutterstock