Bitcoin (BTC) could trade above $100,000 in the first three months of 2026, despite increased volatility in the asset, according to insights from an AI model.

In fact, Bitcoin is closing out 2025 having lost its key support zone at $100,000, and is at risk of falling below $80,000.

To determine how major cryptocurrencies will trade in the first quarter of the new year, Finbold sought insights from OpenAI’s ChatGPT model, which outlined several scenarios.

ChatGPT predicts that Bitcoin is likely to emerge from the consolidation phase in the second half of 2025 and enter the first quarter of 2026, with price trends favoring a gradual continuation of the rise rather than an immediate explosive rise.

ChatGPT’s baseline forecast sees Bitcoin trading between $95,000 and $120,000 in the first quarter, supported by post-halving supply constraints, new accumulation of long-term holders, and stabilization of spot Bitcoin ETF flows after year-end rebalancing.

The model also predicts that risk appetite will improve slightly as macro uncertainty eases, allowing Bitcoin to regain the $100,000 level and begin a more orderly rally. This remains the most likely scenario if the current market structure holds.

In ChatGPT’s bullish scenario, Bitcoin is expected to reach between $130,000 and $150,000 in Q1 2026, driven by early catalysts such as fresh institutional inflows into spot ETFs, clear signals of monetary easing and liquidity expansion, or broader returns on risk-on assets, which could accelerate price discovery above historical highs.

On the downside, the model outlines a bearish range of $70,000 to $80,000 if ETF outflows continue, the macro environment tightens unexpectedly, or key long-term support levels break, triggering a forced sell. Even in this case, ChatGPT views this move as a cyclical reset rather than a break in the broader bull market structure.

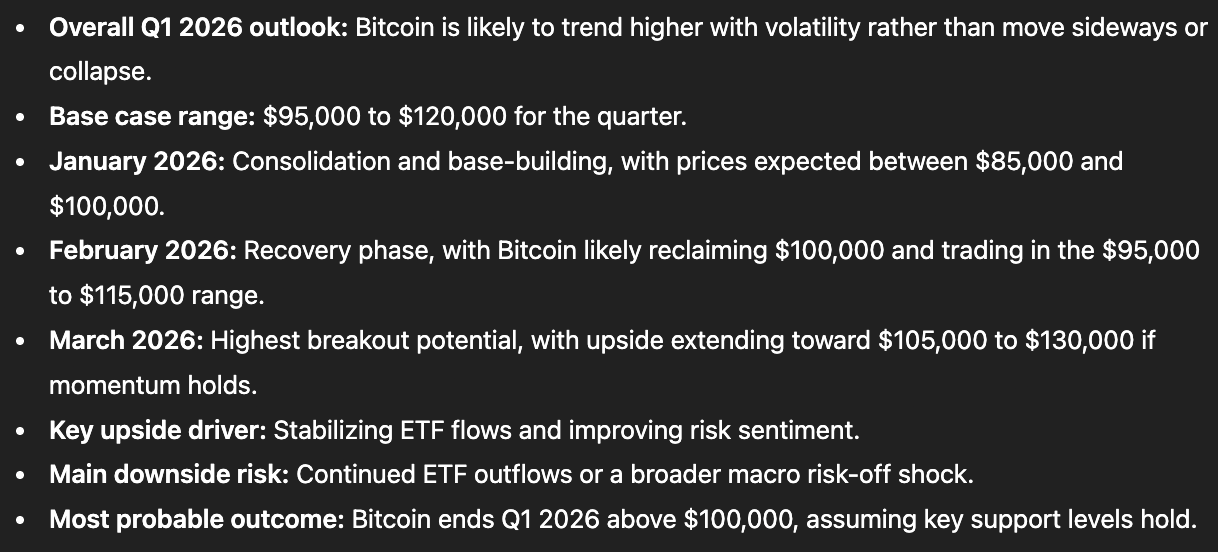

Bitcoin monthly price in 2026

On a monthly basis, ChatGPT predicts that January 2026 will be the transition period and Bitcoin will trade between $85,000 and $100,000. Residual selling pressure, ETF rebalancing, and thin liquidity could keep volatility elevated while long-term buyers absorb the downside. If it can sustain above the mid-$80,000s, it will show that it has a durable foundation.

Bitcoin is expected to trade between $95,000 and $115,000 in February as uncertainty fades, ETF flows stabilize, and a supportive macro environment allows for a recovery to the $100,000 level despite periodic declines.

March is most likely to make a decisive move, with a forecast range of $105,000 to $130,000, as continued acceptance above $100,000 will attract capital, leverage, and new speculative demand.

Overall, ChatGPT estimated that there is a 60% chance that Bitcoin will end the first quarter of 2026 between $105,000 and $120,000, a 25% chance of range trading between $90,000 and $105,000, and a 15% risk of a larger pullback towards $70,000 and $80,000.

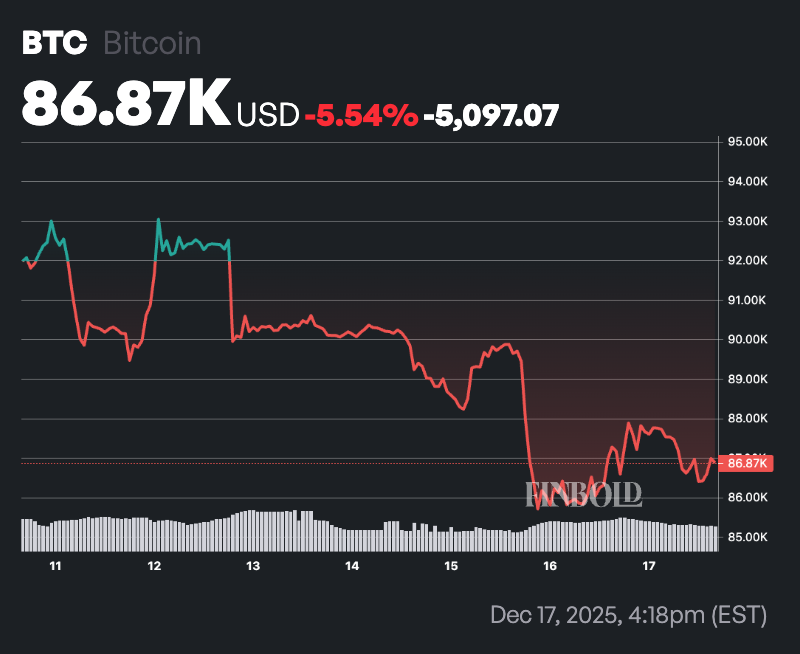

Bitcoin price analysis

At the time of writing, Bitcoin was trading at $86,877, down 0.4% from the past day. On a weekly basis, the asset also fell 5.5% and was in the red.

As it stands, Bitcoin is trading well below its 50-day SMA of $95,970 and 200-day SMA of $102,221. This positioning indicates a solid bearish trend with the price below the major moving averages and the 50-day SMA below the 200-day SMA, indicating continued downward momentum in both the medium and long term.

Meanwhile, the 14-day RSI is at 41.32, firmly in neutral territory but leaning towards the lower bound. This suggests that there is moderate selling pressure without reaching an oversold situation and that there is still room for further declines before a strong reversal signal emerges.

Featured image via Shutterstock