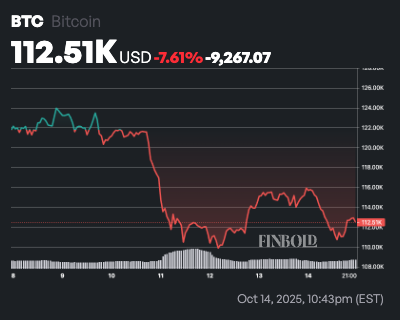

Bitcoin (BTC) is facing heightened volatility following its historic sell-off on October 10, but artificial intelligence tools suggest the asset could reach an all-time high of nearly $200,000 by the end of 2025.

At the time of writing, Bitcoin is trading at $112,474, down 2.7% in the past 24 hours and over 7% this week.

Looking to OpenAI’s ChatGPT for the outlook for the end of 2025, Finbold predicts that Bitcoin could trade near $195,000, supported by improving macroeconomic conditions, steady inflows from institutional investors, and resilient on-chain activity.

AI predictions are based on four key factors: monetary policy, institutional investors, blockchain health, and market sentiment.

We expect modest interest rate cuts by the Federal Reserve by late 2025 to restore liquidity and reinvigorate investor appetite for risk assets, while consistent demand from spot Bitcoin ETFs could push prices further as crypto supplies remain limited.

On-chain data shows a stable intermediate stage, reflected in strong activity from long-term holders and active wallets.

Although market sentiment remains cautious after the recent correction, ChatGPT noted that it appears to be on the mend, a pattern that has historically been seen before new rallies take advantage of resets.

Bitcoin price prediction

In creating the December 31st price outlook, ChatGPT’s model began by pegging the 2024 closing price at around $95,000 and the mid-October 2025 level at around $113,000.

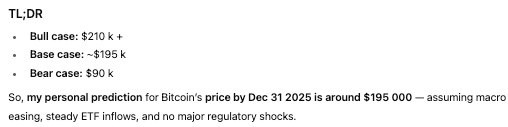

Using historical cycle data, we estimate a potential return of 60% to 110% over the next year and project a target range for Bitcoin by December 2025 of $185,000 to $210,000, with a base forecast of around $195,000.

The model assumes continued institutional adoption and a supportive macro environment, but warns of downside risks if sentiment weakens or regulatory pressures increase. In a bearish scenario, Bitcoin could retreat to between $85,000 and $100,000, roughly in line with past cycle highs.

Overall, ChatGPT expects Bitcoin to enter 2026 at or near record levels if liquidity remains strong and institutional participation continues to grow.

Featured image via Shutterstock