Ethereum (ETH) has been facing a sustained bearish for the past few weeks, with its prices struggling to gain upward momentum. The weakness of collarbone fracture data and lack of bullish sentiment has sparked concerns among investors and analysts regarding the long-term trajectory of cryptocurrency.

However, in an astonishing turnaround, Ethereum surged by more than 8% on March 19, regaining its significant $2,000 level for the first time since March 10. The rally has brought optimism to the Altcoin market, earning wider profits in major cryptocurrencies.

Finbold AI forecasts its Ethereum price target for April

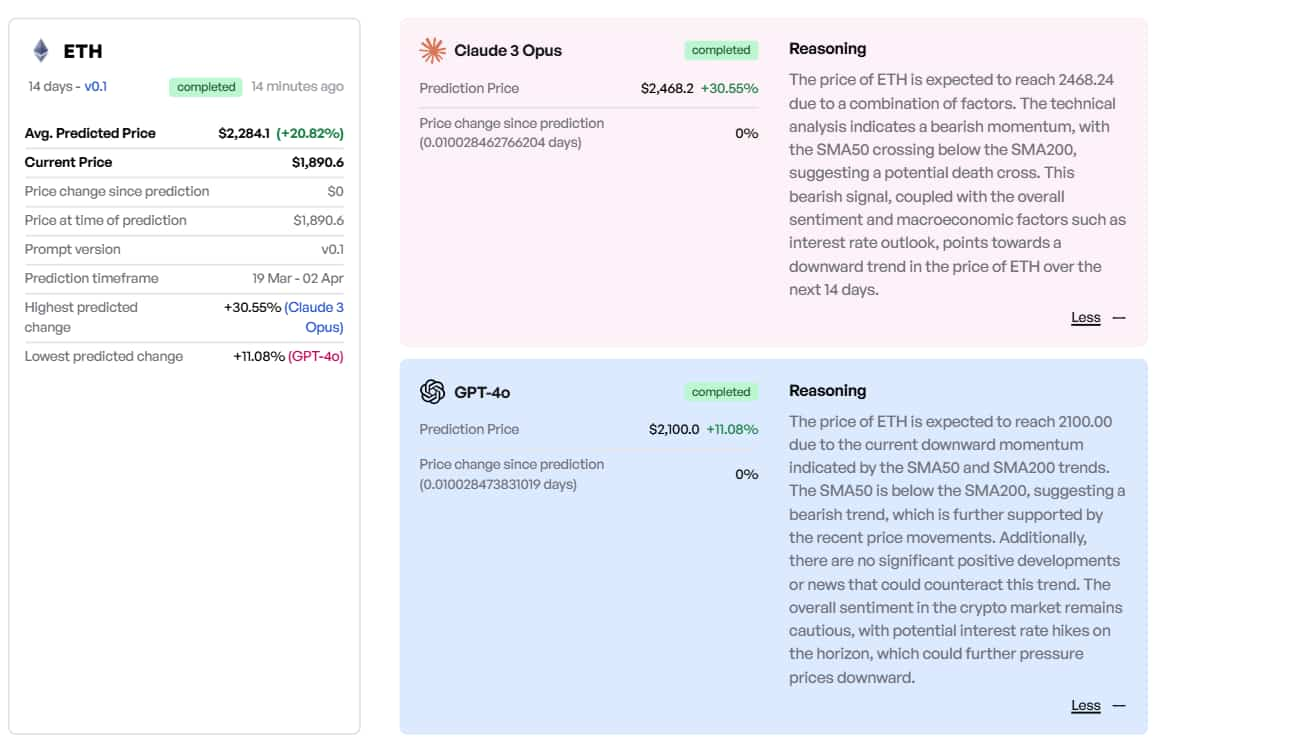

Despite general caution, Finbold’s AI-driven prediction tool predicts the potential bullish trajectory of Ethereum heading into early April.

The model predicted an average price target of $2,284.1, with a 20.82% increase from the forecast price to $1,890.6.

Among the models, Claude 3 Opus presents the most optimistic scenario, setting a price target of $2,468.2 with a profit of 30.55%.

Interestingly, we acknowledge the bearish momentum highlighted by the SMA50 crossing under the SMA200, indicating a potential death mating, but we expect a strong recovery, perhaps driven by changes in macroeconomic sentiment.

Meanwhile, the GPT-4o offers a more conservative outlook, with ETH projected to reach $2,100, with a profit of 11.08%, highlighting the downward momentum from the same technical indicators.

The GPT-4o also warns of potential downside risks from looming interest rate hikes and the lack of major positive developments in the crypto space, throttles short-term optimism.

Overall, the AI model shows a short-term bearish signal, but the predicted average price still indicates the potential for a significant rise in Ethereum over the next two weeks, in response to wider market conditions and macroeconomic developments.

The wider scenery of Ethereum

Beyond technology, the wider landscape of Ethereum could have a major impact on the next price shift.

One important development is the highly anticipated Pectra upgrade, which was recently released on Sepolia and Holesky’s testnets. After several bugs were discovered during the first testnet trial, Ethereum developers launched their third testnet, Hoodie, and chose to push the upgrade deployment into late April.

Upgrades designed to increase scalability, transaction speeds and cost-effectiveness could further stimulate ETH demand.

Institutional interest in Ethereum is also growing. In particular, World Liberty Financial (WLFI), a decentralized financial platform backed by Donald Trump, has significantly increased its ETH holdings, currently holding 7,166 ETH, demonstrating confidence in the long-term value of its assets.

From a technical standpoint, Ethereum entered the first week of recovery after three consecutive weeks of losses and found support at the lower boundaries of the megaphone pattern over the year.

This setup reflects the integration of 2019-2020, leading to a bullish breakout. Analysts now hope that ETH will potentially test its 1.5 Fibonacci expansion level, nearly $6,000, before the cycle peaks later this year. This goal reflects the long-term outlook, but highlights the strong potential for sustainable growth for Ethereum.

Featured Images via ShutterStock