Over the years, Bitcoin miners expanding across the United States have learned that access to cheap power or industrial land does not guarantee community acceptance. Now, as AI hyperscalers and developers race to build power-dense data centers, they are facing similar local resistance around power demand, infrastructure costs, and long-term environmental impact, according to the latest Miner Mag newsletter.

The similarities are becoming increasingly difficult to ignore. Bitcoin mining projects often promised to create jobs and strengthen local tax bases, but those benefits have not always materialized and opposition has grown in some regions.

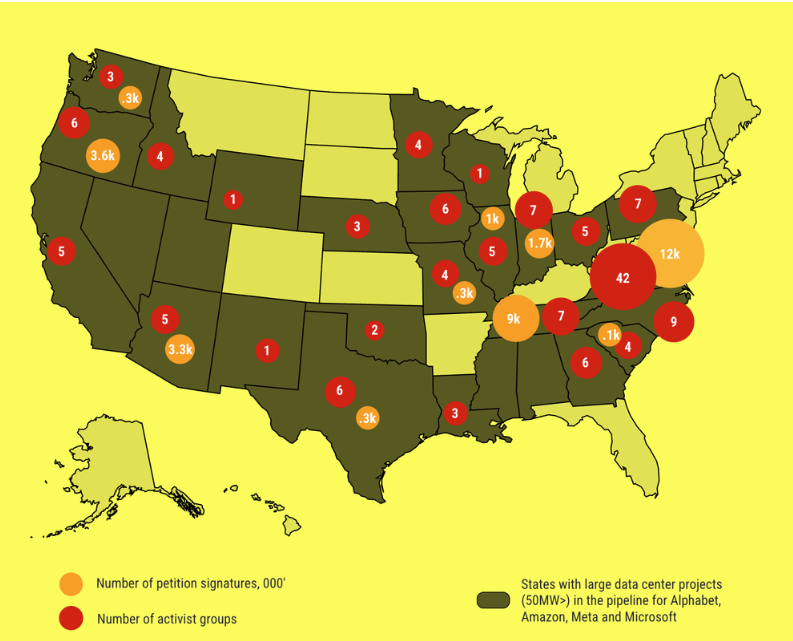

AI data centers are currently attracting many of the same concerns, especially in states like Texas, Georgia, Illinois, and Mississippi, where residents and local officials are questioning the long-term costs of installing energy-intensive infrastructure.

“Local governments and residents across the country are no longer passively waiting for guarantees that their AI infrastructure will be different,” Miner Mag writes.

In response, some communities have moved to temporarily halt new AI data center development while officials consider zoning rules, backup power plans, and the strain on local infrastructure.

Some $64 billion in U.S. data center projects have already been delayed or blocked due to local opposition, according to industry data cited by Miner Mag.

A map showing data center pushback against expansion plans proposed by companies such as Amazon, Meta, Microsoft, and Google parent Alphabet. sauce: Data center watchdog

Related: Rural Texas community fails in urbanization plan to curb Bitcoin miner noise

Microsoft and OpenAI chart a new path

Faced with growing local resistance, companies such as Microsoft and OpenAI are adopting more community-oriented infrastructure strategies to deal with the rising costs of power generation and grid upgrades associated with data center projects.

OpenAI says it will “own” the energy costs associated with expanding its AI footprint, signaling a shift toward increased cost responsibility as local communities and regulators scrutinize AI-driven power demands.

As Miner Mag pointed out, this approach seems familiar to the Bitcoin mining industry. Mining companies faced with local opposition were often forced to renegotiate power contracts and invest in mitigation measures to better demonstrate the community benefits associated with their operations.

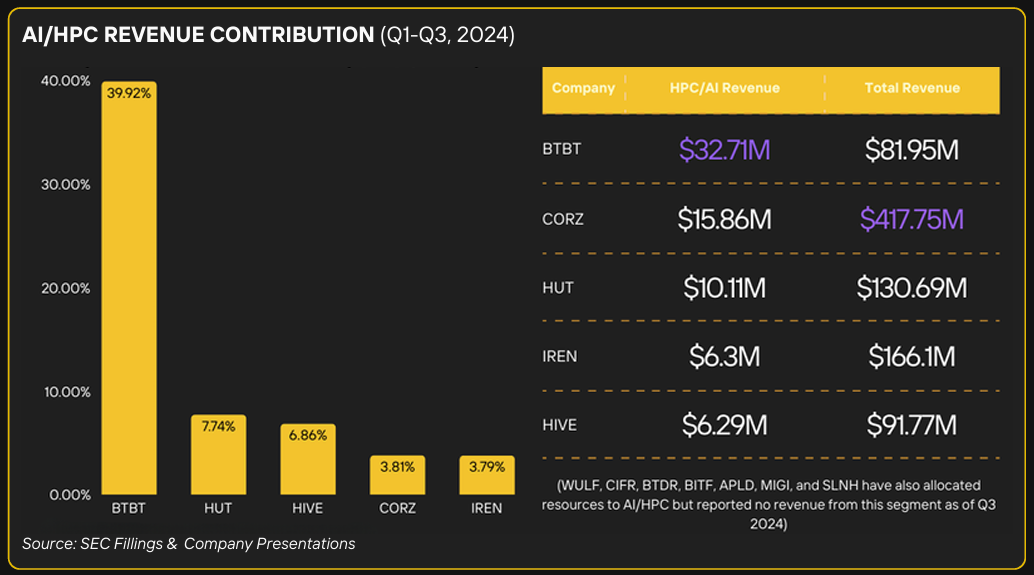

At the same time, Bitcoin miners have been moving towards AI and high-performance computing workloads in recent years. Companies such as Hut 8, MARA Holdings, Riot Platforms, TeraWulf, and HIVE Digital Technologies have pursued this transition amid increasing competition in the mining space and shrinking profit margins after the 2024 Bitcoin halving.

Pressure in the Bitcoin mining industry is driving more companies to pivot to AI and high-performance computing. sauce: Digital mining solution

Related: Bitcoin Mining 2026 Prediction: AI Turnabout, Margin Pressure, and Fight for Survival