Concerns about a bubble that could soon burst appear to have gone beyond the ecosystem, throwing cold water on what was supposed to be a year-end rally.

The growing aftermath of the AI bubble: Stocks join Bitcoin’s decline

These days, when the stock market sneezes, Bitcoin catches a cold. This idiom partially explains the puzzling price movement that BTC has exhibited over the past eight weeks. Billions of dollars in institutional capital, favorable crypto laws, and acceptance by trillions of dollars of asset managers all stopped short of sparking a year-end rally in cryptocurrencies. And now stocks could suffer a similar fate, with many blaming the bearish pullback on AI hype.

read more: Irrational pessimism: Are Bitcoin investors crazy?

There are two leading theories linking the AI bubble and the Bitcoin price decline. Some say investors are cycling from digital assets to overhyped technology stocks like Nvidia (NASDAQ: NVDA).

“Bitcoin started the year as the hottest investment story,” Alex Thorne, Galaxy’s head of corporate research, said in a November note to clients. “But AI, hyperscalers, gold, and the Magnificent 7 have absorbed the capital and attention that could flow into BTC.”

Another theory simply posits that concerns that the AI bubble is about to burst are causing investors to retreat from risk-on assets such as Bitcoin into value assets such as gold and silver, which are currently trading near all-time highs.

(Chip maker Broadcom fell nearly 12% on Friday, despite beating revenue expectations the day before./CNBC)

But just as traders began to grow wary of Bitcoin eight weeks ago, perhaps due to a combination of the October 10-11 liquidation event and AI over-exuberance, investors are also starting to grow weary of AI stocks, despite the companies doing everything right. California-based semiconductor maker Broadcom (NASDAQ:AVGO) announced its fourth-quarter financial results on Thursday, and they were impressive. The company beat analysts’ expectations, earning more than $18 billion in the quarter, up 28% year over year. Broadcom counts Google, Meta, Bytedance, and Anthropic among its biggest customers, and CEO Hock Tan expects the company’s AI chip sales to double in the first quarter of 2026. But despite such impressive financials, the company fell nearly 12% on Friday.

“Frankly, it’s hard to see what else one could hope for as the company’s AI story continues to not only overachieve, but accelerate,” Bernstein analyst Stacey Rasgon said in a report, echoing the same opinion that Bitcoin analysts have been expressing since October. “The fear about AI stocks appears to be continuing, with Broadcom stock falling,” Rasgon added.

Overview of market indicators

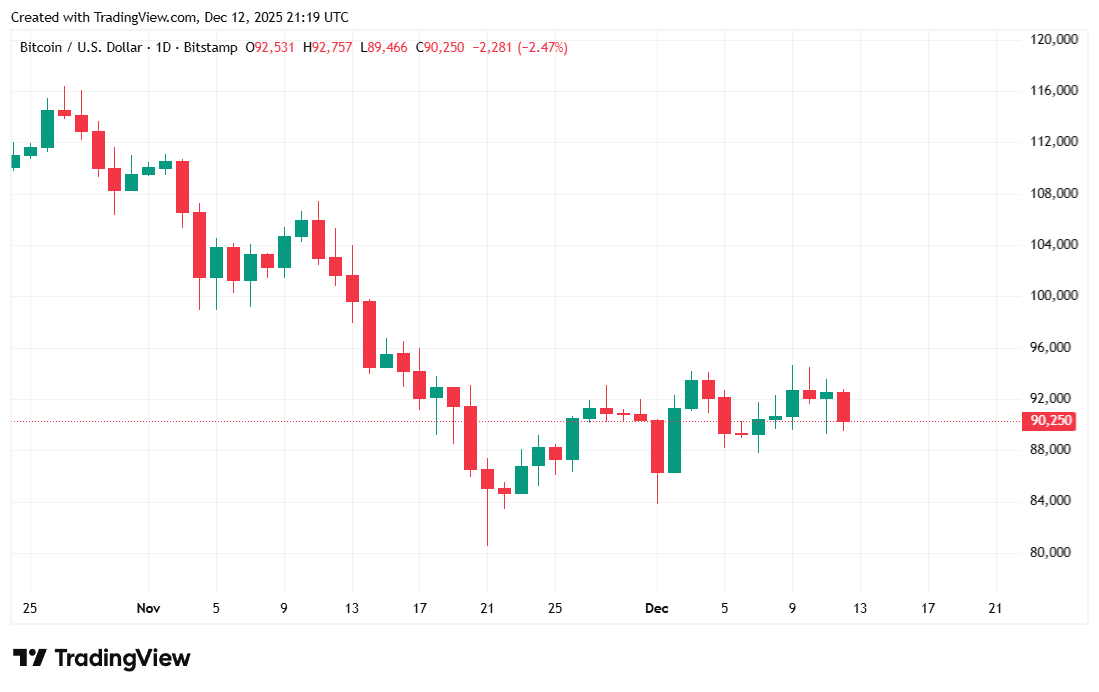

At the time of reporting, Bitcoin was trading at $90,308.12, down 2.33% in 24 hours but up 0.93% on the week, according to data from Coinmarketcap. The digital asset’s price has fluctuated between $89,532.60 and $93,554.27 since Thursday afternoon.

(BTC Price/Trading View)

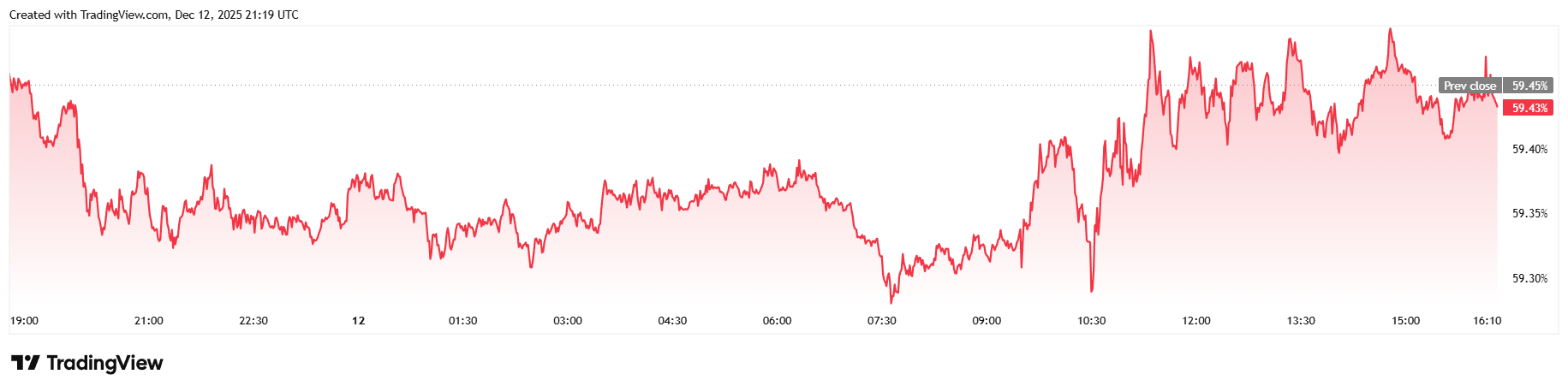

The daily trading volume increased by 34.61% to $82.08 billion, but the market capitalization decreased to $1.8 trillion. Bitcoin’s dominance remained flat at 59.43% over 24 hours.

(BTC Dominance / Trading View)

Total open interest in Bitcoin futures decreased slightly, dropping 1.61% to $59.12 billion, according to data from Coinglass. Liquidations decreased to $101.88 million on Friday, but the majority of this number is made up of losses for long investors who saw $77.85 million in liquidation margin. The remaining $24.03 million represents liquidations from bearish short sellers.

Frequently asked questions ⚡

- Why are Bitcoin and stocks both struggling right now?

Investors are worried that AI trading will expand too much and prompt an exit from risk-on assets such as Bitcoin and tech stocks. - How does the AI bubble relate to Bitcoin’s recent weakness?

While some funds previously rotated out of BTC and into AI stocks, widespread bubble concerns are now driving risk aversion across the market. - Why are powerful AI companies still driving down their stock prices?

Even with impressive earnings like Broadcom’s, it’s not enough when sentiment turns against you in crowded AI trading. - Does that mean a year-end rally is unthinkable?

Rising alarm and macro uncertainty surrounding AI put a damper on the end-of-year rebound.