River says companies receive far more bitcoin every day than miners create.

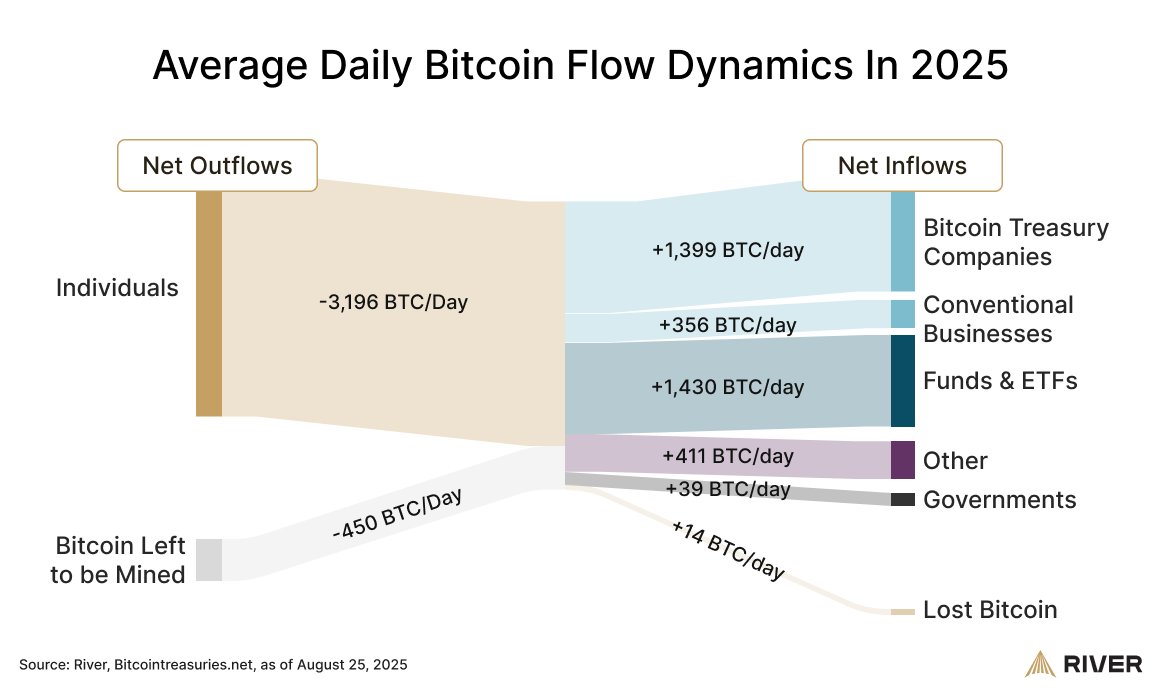

The US-based Bitcoin Financial Services company that operates mining operations with brokerages and publishes research, has released a Sankey-style flow infographic dated August 25th in an X post. In this layout, the flow is shown on the left side, with the thickness of each line representing the size of the net daily movement.

River’s August 25 snapshot shows companies absorbing about 450 mining versus about 1,755 btc/day.

River broadly defines “business.” This category combines Bitcoin finance companies (e.g., strategies to keep BTC publicly) with traditional companies that maintain Bitcoin on their balance sheets. Based on public applications, custody address tagging and its own heuristics, River estimates that around 1,755 BTC per day flows into business-controlled wallets.

By comparison, River calculates the supply of new miners at around 450 BTC per day in 2025. That figure reflects half of April 2024, reducing block subsidies to 3.125 BTC per block.

Bitcoin blocks average about 144 minutes per day, with a new issue, which means about 450 BTC daily, but the exact number fluctuates slightly as the block times vary.

That mathematics is the basis of River’s claim that companies absorb Bitcoin by almost four times the proportion they are mined.

The infographic also shows other major institutional influx.

The funds and ETFs account for around 1,430 BTC/day in net inflows, which further increases total absorption compared to new issuances. The small stream is sent to “other” entities (approximately 411 BTC/day) and government (approximately 39 BTC/day).

River also records a small but stable flow to “lost Bitcoin” (approximately 14 BTC/day), representing the coins the company has determined to be in permanent access through Kiros.

On the other side of the ledger, individuals appear as the largest net outflow of approximately 3,196 BTC/day. River stresses that this doesn’t necessarily mean retail investors are dumping coins. Rather, it reflects the movement of Bitcoin from addresses that the company classifies as individuals’ own, to addresses that institutionally classify IT tags.

River says takeaways are easy. When inflows into businesses and funds exceed new issuances from miners, the available supply will be strengthened. Still, the company warns that it should read infographics carefully.

First, the numbers are estimates, not accurate census for blockchain.

River relies on a combination of wallet tagging, public disclosures and external databases. This could lead to missing some holdings or misclassifying certain addresses. Second, net inflows do not necessarily equal direct spot purchases. The business wallet showing +1,755 BTC per day reflects exchange purchases as well as OTC transactions, custody transfers, or resharing by the Ministry of Finance.

For readers who are new to flow diagrams, this is the key. The line shows that the coins are balanced, not all transactions or transfers in the system. If more coins consistently end in business, funds and government wallets than miners produce, River claims that the agency is tightening supply with margins.

Although the River snapshot is not a price forecast, it shows how ownership patterns change. If more companies and funds than miners produce continue to be absorbed, the company argues that institutions can play a greater role in shaping the supply dynamics of Bitcoin.