On April 1st, dozens of people gathered for a meeting of the “CBDC IL Forum” at the KPMG office in Tel Aviv, and representatives from the Bank of Israel and KPMG presented the findings of a study conducted by the Bank of Israel through the “Roschink” Institute. The survey included around 1,000 participants, and the results were published on the Bank of Israel website. In this article, we will review important points of the conference, comment on research published by the Bank of Israel, and share what we said to attendees at the end of the forum meeting.

CBDC IL Forum Meeting Brochure

Research: Israeli citizens willing to adopt digital shekels

Dr. Nir Yaacobi from the Bank of Israel’s Digital Shekel Team shared that participants in the study were randomly selected and representing all population segments. “The Institute is working with these individuals and is paid for participation,” he said. The amount paid has not been disclosed. Professor Ruth Plato Sinner, one of the authors of the study, said the questionnaire was in digital form. She said that even those with a very basic mobile phone can participate, but admitted that people who do not have digital access probably won’t participate, and probably don’t understand what a digital shekel is.

Analysis of research documents reveals some methodological problems.

- Sampling method: An online panel was used. That is, participants were already registered on the digital research platform. It distorts attitudes about digital currency towards tech-savvy individuals.

- Sample representation: Random sampling underestimated certain groups, particularly Arab citizens. By doubled the responses of some participants, this could be corrected again and impaired reliability.

- risk Loss of privacy, government overreach, and impact on the cash economy can be underestimated due to biases towards digitally subscribed respondents.

- Participant dropout:115 participants dropped out between the first and second surveys. This may indicate a selection bias. This indicates that you are interested in this topic.

Despite efforts to secure representative samples, these methodological limitations may affect the validity of the study.

Avoid disclosure of digital shekel risks

At the end of the meeting, I spoke critically about the partial and mostly positive information presented to study participants and participants in the CBDC IL Forum. The public was not exposed to the potential risks and limitations of such systems. This was explained in detail in many of my keynotes, articles and podcasts.

The following video shows that there is a lack of methods for digital shekels being presented to study participants. The description of digital shekels and their systems focused on benefits, as read by Professor Platosiner of the CBDC IL Forum Conference.

Furthermore, the study does not comprehensively address potential end-users risks, including financial actions, loss of privacy, asset attacks, the use of currency as a monitoring tool, and possible state controls, including restrictions on access to funds through regulatory decisions. The lack of emphasis on these risks is particularly problematic for individuals interested in government overreach and privacy violations, for those who simply don’t know the potential dangers and what they mean.

The study mentions:

- Limited privacy claims: Not only does “central banks have no access to certain information about their wallet balances and transactions,” but privacy levels are defined according to user type. This means privacy is not absolute.

- Enforcement ability and limitations: “This system supports the implementation and enforcement of restrictions,” and it relates to wallet balance, which could indicate possible usage restrictions. Digital shekels are designed with the technical ability to impose restrictions on the balance of your wallet. This means that you can define the amount you hold in your digital wallet and monitor it in real time. Although this document does not specify who is authorized to enforce these restrictions, the mere presence of enforcement abilities identifies control mechanisms that theoretically allow for freezes, blocks, or other restrictions on use.

- Government control: The Bank of Israel will become “the only authority granted authority to issue and redeem digital shekels.” That is, there is no decentralized alternative like cryptocurrencies such as Bitcoin.

Cash-based community impact

This study refers to the level of interest between different population groups and points out that among ultra-Orthodox communities, the lowest interest in digital shekels. However, we have not explicitly discussed the consequences of the transition to digital currencies in communities that rely heavily on cash. Digital shekels could pose major challenges for these groups if cash usage is ultimately reduced.

Possible reasons for low interest among the Haredi (Ultra-Orthodox) community:

- Clear cash preference: Most Hardims use cash because they retain privacy concerns, a desire to avoid reliance on banks, and traditional opposition to the modern financial system.

- Digital literacy gap: Some of the ultra-Orthodox communities have lower financial digital literacy than the general population.

- The fear of regulatory control: Cash offers some economic independence, while digital shekels may increase government control over payments.

senior citizen

In 2023, the Israeli Internet Association conducted a survey among Israelis over the age of 65. It almost found it 30% don’t use the internet at alland “at least some of them don’t fill the access gap.” This collective segment (60+) is made up of around 25.3% of Israel’s total population (Data for 2020). This is another example of a group with limited access to technology, and it could also limit the ability to use digital shekels.

Since this study was conducted digitally, 30% of the segments of this population may not be represented in the sample. That being said, just 13% of study participants were over 60 years old (13% in the first survey, 12% in the second survey), people over 60 years old It’s underrated In the sample, it is about half the proportion of the general population.

This raises some concerns:

- Digital exclusion: The majority of people over the age of 65 were unable to participate in the survey.

- He overestimated his high-tech preparation: If only older adults with digital skills participated, this study could overestimate the interests of older adults.

- Accessibility gap: Those struggling with technology may have difficulty using digital shekels, but they couldn’t capture their perspective.

All of these factors may introduce biases to be considered when interpreting the findings. To achieve a more accurate situation, researchers were able to incorporate other research methods (such as telephone or in-person interviews) to contact people without digital access.

What’s new in the CBDCS world?

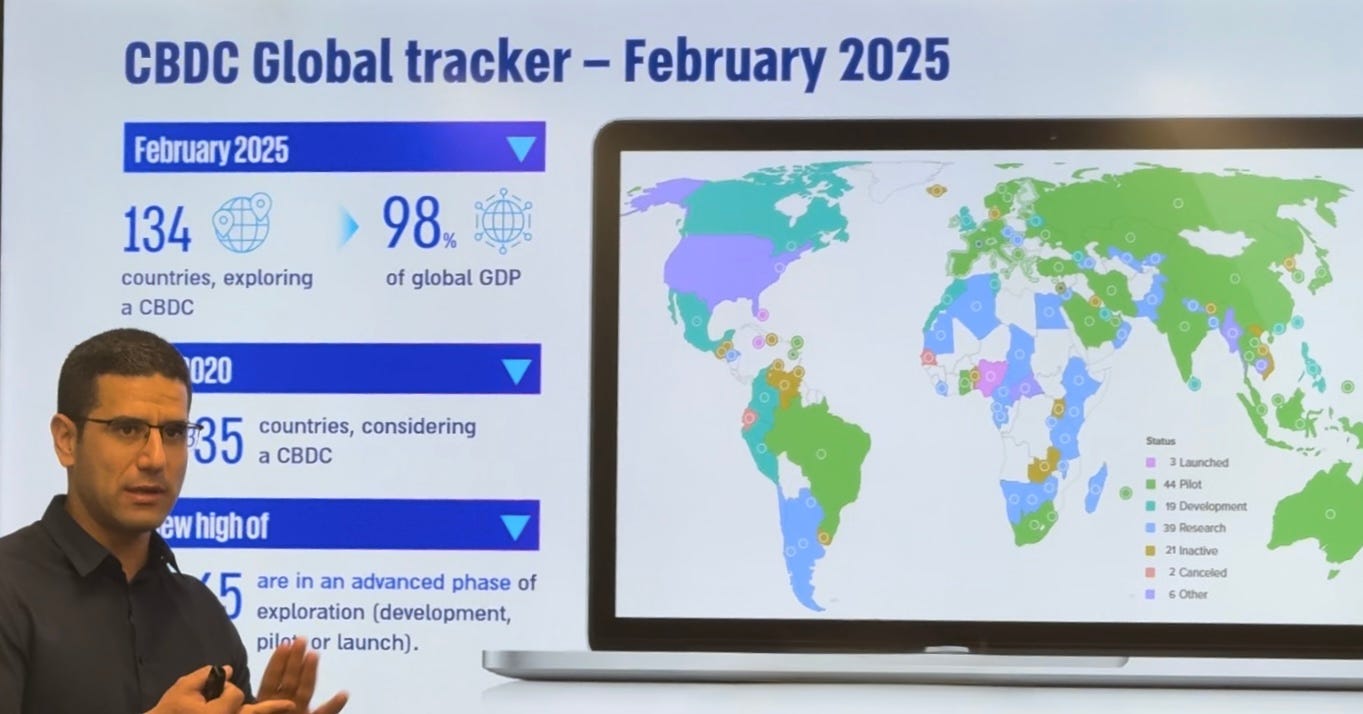

At the meeting, KPMG Israel’s Benbenakot presented the development of the CBDC space. He says that most countries in the world are investigating CBDC solutions at different stages, and that 65 countries are in advanced research stages.

One of the case studies he presented was in Brazil, where the central bank launched a PIX retail payment system during Covid-19. There was rapid adoption. Today, the Brazilian central bank is working on DREX, a wholesale CBDC system, and has completed a collaboration with META to enable payments via WhatsApp using PIX.

Ben pointed out that advanced Western countries have not yet launched CBDC systems. That’s one reason why the Bank of Israel is not in a hurry to make a decision. The Bank of Israel has previously said it is monitoring the EU central bank as a model.

Balancing the EU and China story

In my last statement at the CBDC IL Forum Conference, I also mentioned a study recently conducted in the EU. This study was not clearly mentioned by forum experts. I felt it was important to balance an overly positive storyline and bring the following to participants’ attention:

On March 12, the European Central Bank (ECB) published a working paper entitled “Consumers Attitudes to the CBDC,” surveying around 11 respondents in the eurozone. The report highlights important communication challenges that are expected to hinder adoption of the digital euro. We discovered that Europeans showed little interest in the digital euro and strongly prefer existing payment methods, and, taking into account many alternatives, we found that the new payment system had no real value added.

Nevertheless, the European Central Bank recently announced that it will begin rolling out the digital euro. October 2025pending regulatory approval.

For more information about the EU’s CBDC plan, see our recent article, “ECB is preparing a digital euro launch venue.”

Furthermore (at the CBDC IL conference) he explained that China’s high adoption rate of CBDCs is not necessarily a result of public enthusiasm, but a result of a top-down market strategy led by a central bank. In the early days of E-CNY (CBDC in China), the project was considered a failure due to its low adoption. Ultimately, the central bank directed major retail and tech companies to integrate E-CNY into their most popular apps: Didi, Meituan, Ctrip, Wechat Pay, Alipay. Today, E-CNY has around 180 million digital wallet users and a cumulative transaction volume of $1 trillion.

Trust factors

70% of Israeli study participants expressed their trust in the Bank of Israel. At the meeting, KPMG’s Ben Benakot commented on the issue of trust. “If you don’t trust the government, this becomes a problem. In theory, CBDC will provide more data to the state.” Benakot said that while Israel’s banks have designed the system to prevent direct access to user information, ensuring that approved payment providers do so there is no guarantee that future governments will not change the system and will not be able to access accounts and personal data directly.

He also said, for example, today Israeli tax authorities are already capable of monitoring citizens’ financial data (although not immediately or directly for monitoring). In theory, digital shekels aren’t that different.

Public awareness and messaging

Another point I raised at the meeting was the responsibility of the Bank of Israel to inform the public in a fair, honest and balanced way. I asked: Are banks really trying to understand the willingness of the public to adopt digital shekels? Why didn’t the government launch a national campaign during Covid-19, when it mobilized all its resources to educate the public through experts, influencers, media, social platforms, billboards and more?

Why is the Bank of Israel not making an effort to present a big picture that includes not only flattering, positive aspects, but also risks and shortcomings?

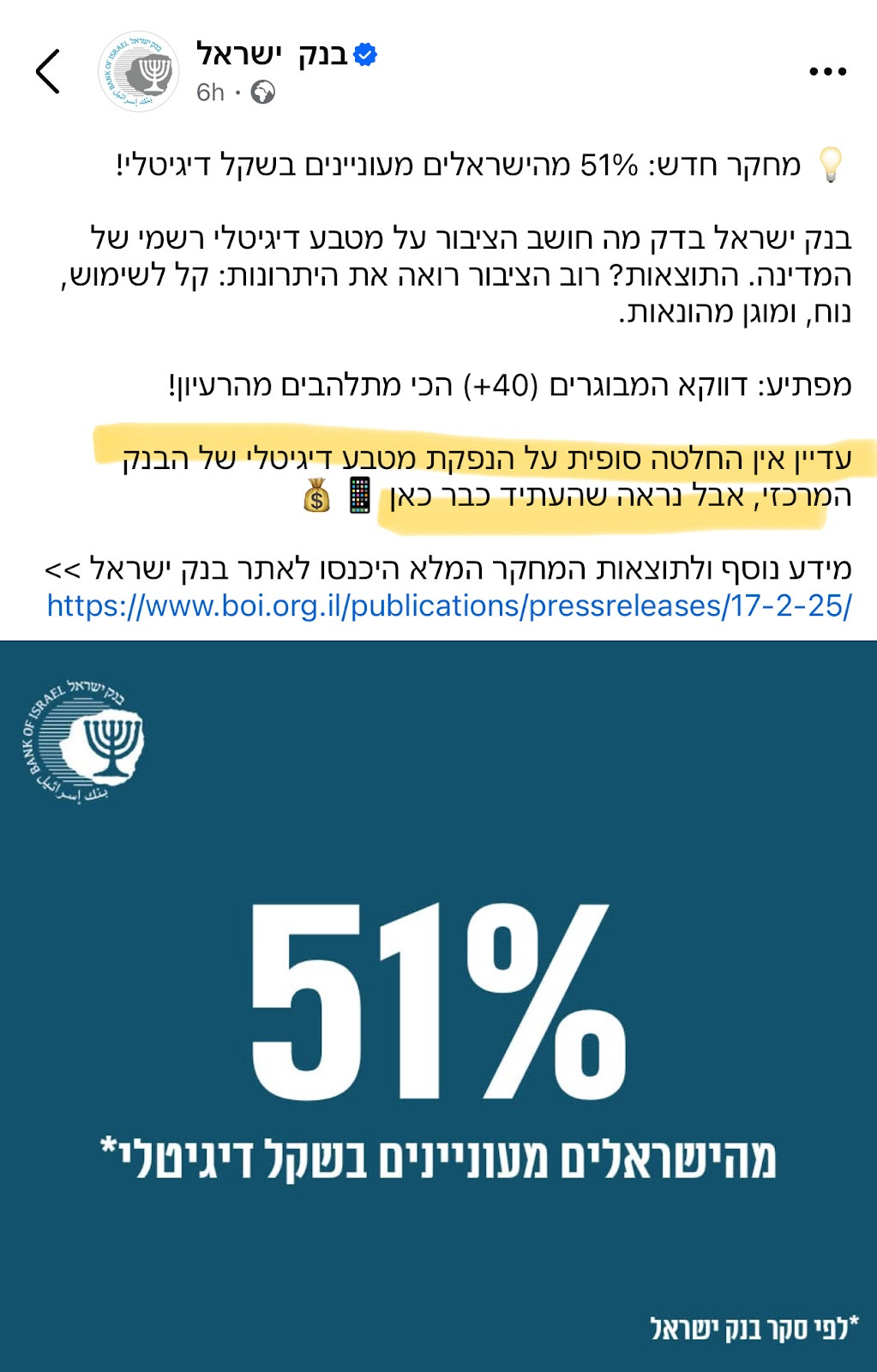

As someone with about 20 years of marketing experience, I also pointed out the rush that banks have moved from publishing research and reporting announcements to publishing posts (!) on social media (Instagram, Facebook).

Every beginner marketer knows that when you emphasize “yes”, you blurt the no. Yes, I’m interested, but what about the other 49%?

The post reads: “Most people see its benefits. They’re easy to use, convenient, and protected from fraud.” Most people? Is it based on a study of 1,000 people who 51% expressed interest?

Also, “No final decision has been made, but the future seems to be here.” This sounds like the decision has already been made. Release date is missing.

Conclusion

Dr. Nir Jaakovi, of the Bank of Israel’s digital shekel team, said at the meeting: “We are in unknown territory and currently have no strategy” – referring to which digital financial solutions are chosen in Israel.

“We are working on three aspects: digital shekels (CBDCs), stubcoins and tokenized commercial bank deposits,” he added: “You might go with one solution, or all three, like digital shekels. If you launch a wholesale CBDC, you probably won’t need the law.

After I finished my remarks, Asaf David Margarit of the Digital Shekel Team replied, saying that some of what I said were accurate, but most of them weren’t. When I asked what was not accurate, I didn’t receive a response. My invitation to David-Margalit is addressed with a specific explanation.

In conclusion: I think it is important to raise public awareness about digital shekels. Because it is obviously “the future is already here.” So it’s essential Openly presenting both risk and benefits A system of digital shekel systems, allowing informed public to participate meaningfully in conversations and make relevant choices about their lives.

This is a guest post by Efrat Fenigson. The opinions expressed are entirely unique and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.

This post: A new study in Israel shows that 51% of the public are interested in adopting CBDC (digital shekel). is that so? It first appeared in Bitcoin Magazine and is written by Efrat Fenigson.