US-listed crypto ETFs are flashing red across the board, with one notable exception.

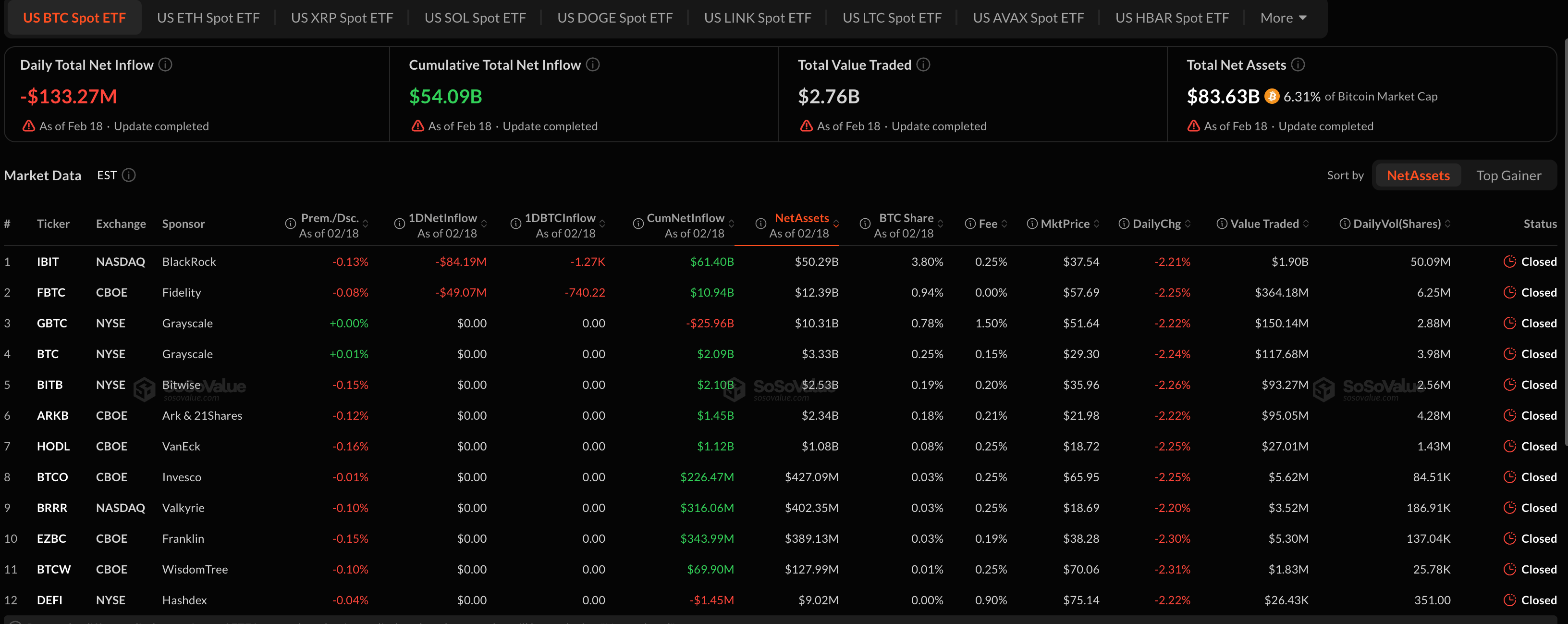

The Bitcoin Spot ETF recorded net outflows of $133.3 million per day as of February 18, led by BlackRock’s IBIT, which lost $84.2 million, and Fidelity’s FBTC, which lost $49 million. The total net asset value of Bitcoin funds as a whole is $83.6 billion, or about 6.3% of Bitcoin’s market capitalization, but recent trends suggest that financial institutions are reducing their exposure rather than increasing their exposure.

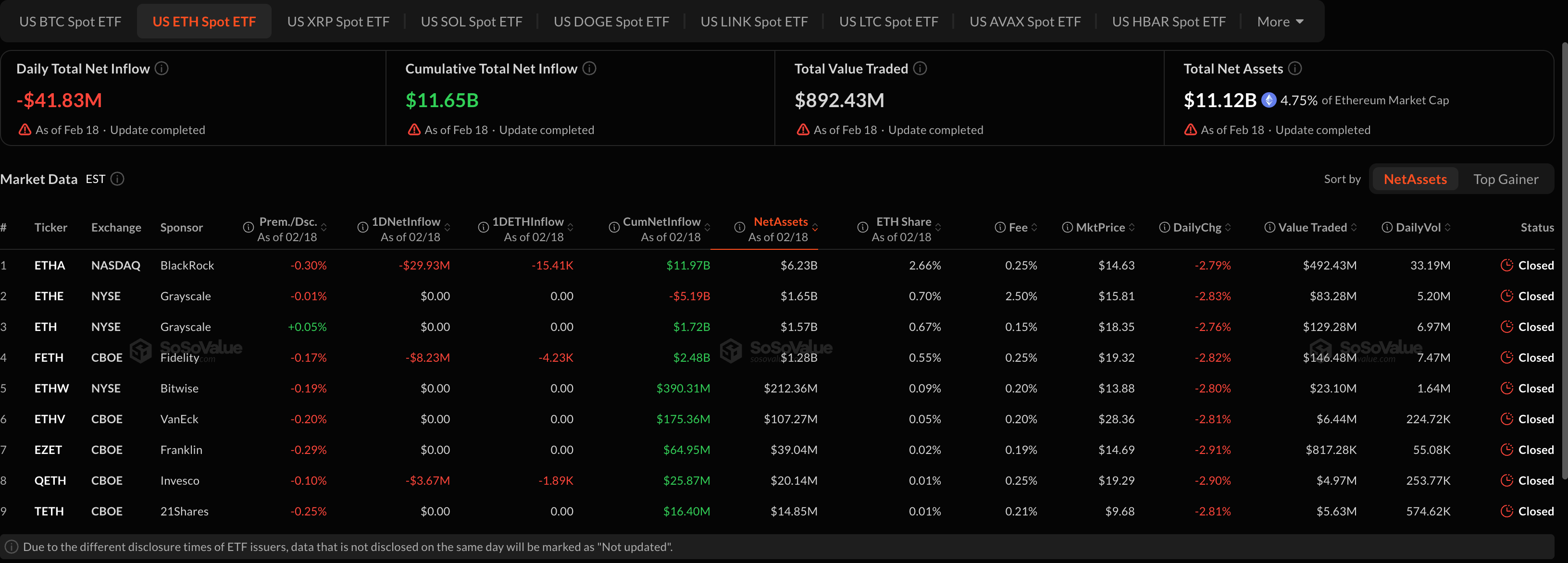

Ethereum products followed a similar pattern. us $ETH On the day, spot ETFs recorded net outflows of $41.8 million, and BlackRock’s ETHA lost nearly $30 million. The total net assets of the entire Ether Fund are $11.1 billion, equivalent to approximately 4.8% of the Ether Fund. $ETHmarket capitalization.

The steady hemorrhage comes as Ethereum prices trade below $2,000 and struggle to gain momentum despite widespread expectations of interest rate cuts later this year.

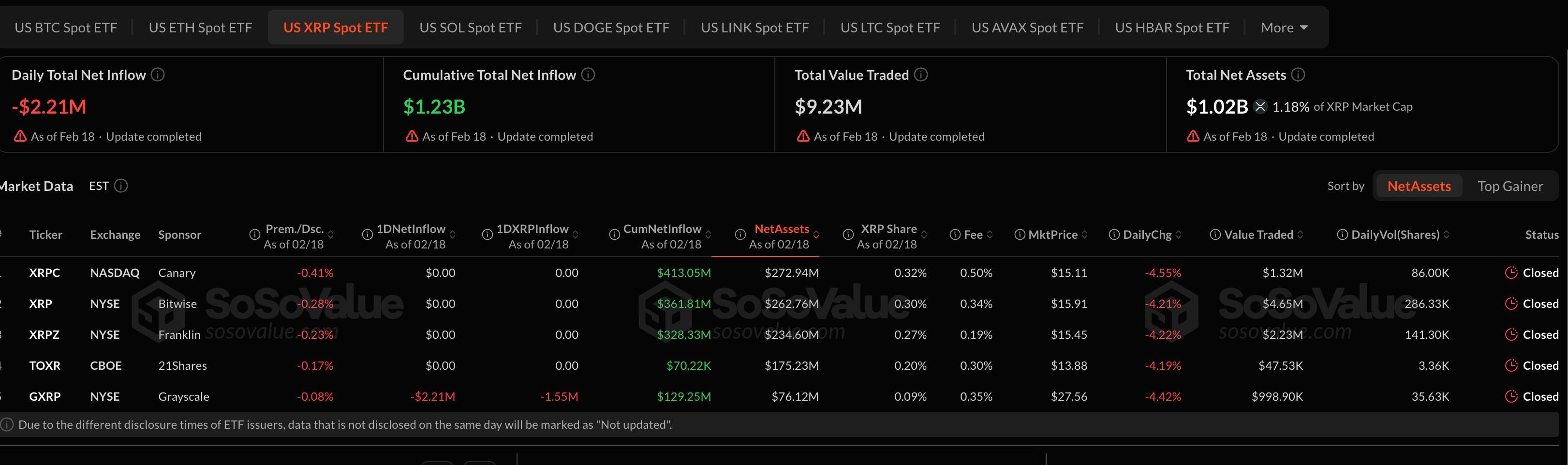

$XRP ETFs also fell into negative territory, posting daily outflows of $2.2 million. Total net assets $XRP Funding is just over $1 billion, or about 1.2% of the total. $XRPmarket capitalization. price action of $XRP Reflecting the cautious tone, the token fell more than 4% on the day.

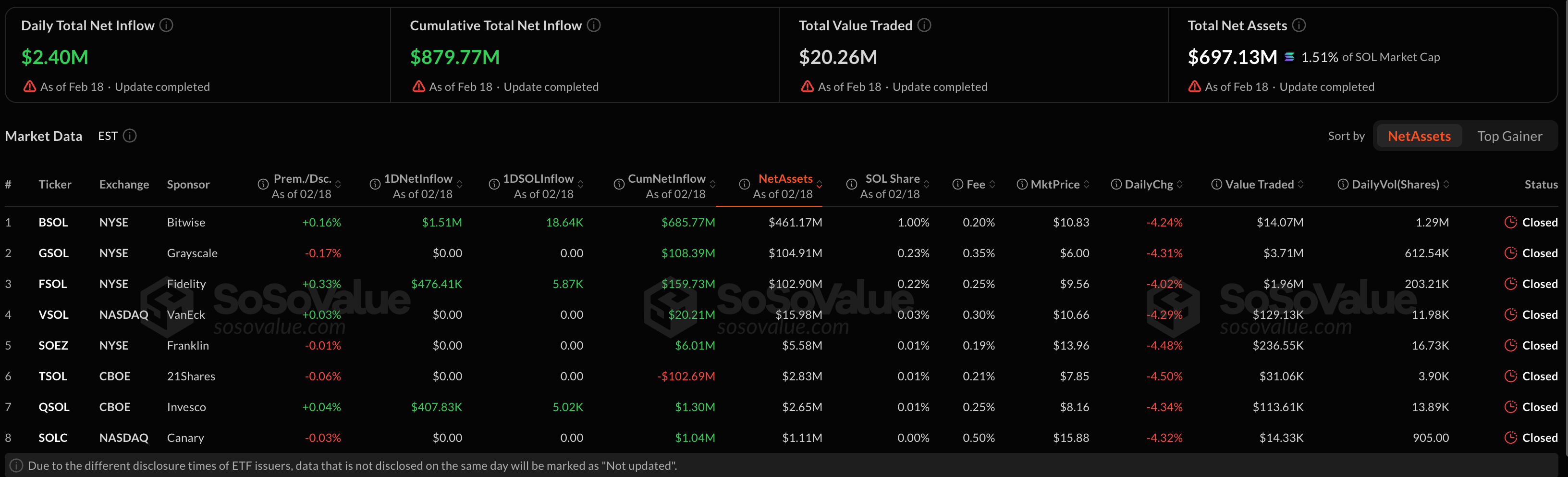

But Solana was outstanding.

The US SOL Spot ETF recorded net inflows of $2.4 million, bringing cumulative inflows to nearly $880 million. Bitwise’s BSOL takes the lead with $1.5 million in new capital. Although modest in absolute terms, this inflow contrasts sharply with the broader risk-off positioning across Bitcoin and Ether products.

Elsewhere, smaller altcoin ETFs such as LINK have seen modest inflows, but the overall picture is still one of selective exposure rather than widespread accumulation.

This divergence suggests that investors are rotating within the cryptocurrency rather than exiting completely. As macroeconomic uncertainty lingers and the dollar strengthens, ETF flows can provide a real-time read of where institutional confidence remains and where it is fading.