Ethereum continues to struggle below key resistance on the 4-hour chart as price compresses within a tight range. Although sellers continue to dominate the short-term structure, the weakening trend strength suggests that consolidation may prevail before the next decisive move.

Price structure and major technology levels

$ETH It is trading below the supertrend barrier near $2,073, limiting any immediate upside attempts. This structure reflects a lower high and lower low after rejection near the 0.786 Fibonacci area around $3,050. Therefore, near-term momentum remains fragile.

Instant support ranges from $1,975 to $1,960. A break below this zone could increase pressure towards $1,746, which represents a major structural foundation. Therefore, bulls should protect $1,960 to avoid more severe retracement risk.

$ETH Price dynamics (Source: Trading View)

On the upside, $2,073 serves as the first pivot level. A sustained rise above this barrier could initiate a recovery towards $2,209, which is consistent with the 0.236 Fibonacci level. Additionally, $2,380 and $2,576 represent stronger supply zones if buyers regain control.

Related: XRP Price Prediction: Can Permitted DEX Catalysts Reverse Downtrend?

The DMI indicator shows that negative pressure is outweighing positive momentum and sellers maintain a slight advantage. However, ADX is still around 14, indicating weak overall trend strength. Therefore, Ethereum may continue to move sideways until volatility increases.

Open interest and spot flow signals

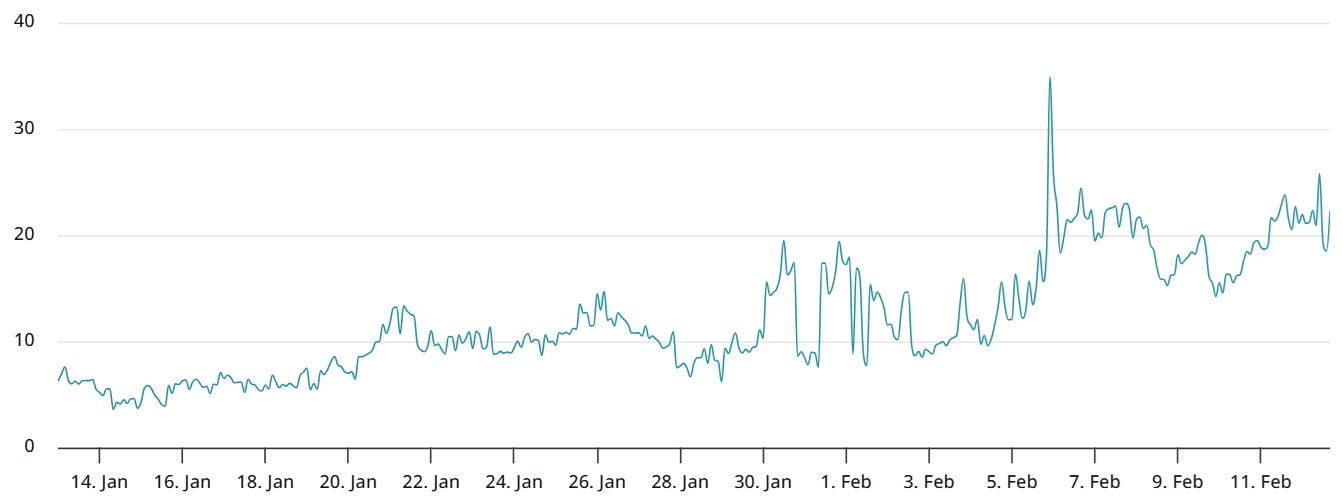

Ethereum open interest shows a clear shift from active speculation to reduced leverage. During the last rally, open interest soared to more than $50 billion as traders increased their exposure. However, the loss of price momentum led to unwinding and liquidation of positions.

Current open interest is close to $23.5 billion. The decline reflects a cooling derivatives environment and lower risk appetite. Importantly, as new confidence emerges, leverage often declines ahead of sharper directional moves.

Source: Coin Glass

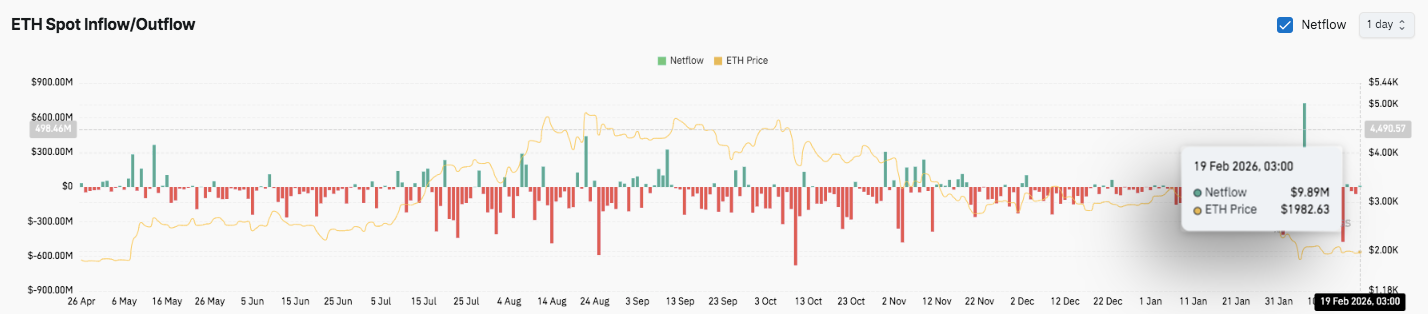

Spot flow data also show a concentrated distribution from mid-year to early winter. Outflows frequently exceeded $300 million and sometimes approached $800 million. However, a recent surge in inflows of more than $600 million suggests interest in new accumulations. Net flows are currently hovering around neutrality, indicating a possible transition phase.

Institutional accumulation adds long-term context

Looks like Tom Lee (@fundstrat)’s #Bitmine has bought another 20,000 pieces $ETH($39.8 million) From BitGo 2 hours ago. https://t.co/KR2SMP6Mrm pic.twitter.com/a59rFBukDb

— Lookonchain (@lookonchain) February 18, 2026

Additionally, Nasdaq-listed BitMine increased its Ethereum exposure by $20,000. $ETH The purchase price was nearly $39.8 million. The company currently has 45,759 people. $ETH After rapidly accumulating for more than a week. Furthermore, management aims to control 5% of the total Ethereum supply in the long term.

Related: Terra (LUNA) Price Prediction: Terra struggles to capitalize on spikes and reverse downtrend

Ethereum technical outlook ($ETH/USD)

Key levels remain well defined as Ethereum trades within a tightened 4H structure heading into the next volatility window.

Top level: $2,073 is the immediate resistance level and the pivot of the supertrend. A sustained break above this level could pave the way to $2,209 (0.236 fib). Beyond that, $2,380 (0.382 Fib) exists as a stronger supply zone. If the bullish momentum accelerates, the price could extend to the mid-range retracement barrier at $2,576 (0.5 fib).

Lower price level: $1,975 to $1,960 serves as immediate intraday support. A break below this zone will increase pressure towards the psychological support of $1,900. The main structural floor is $1,746 (0 Fib basis). Losing this level would expose Ethereum to even more severe declines, invalidating any short-term recovery attempts.

Upper limit of resistance: $2,073 remains a key level for reversing near-term bullish momentum. Until buyers regain this pivot, the rally could face supply absorption.

The technical structure shows that Ethereum is compressing within a descending range of highs and testing stable support. Meanwhile, DMI shows that sellers are still in the lead, while ADX near 14 reflects the strength of a weak trend. Therefore, expansion may be followed by consolidation.

Will Ethereum breakout?

Ethereum’s next move will depend on whether buyers can defend $1,960 long enough to challenge the $2,073-$2,209 cluster. Stabilization of open interest and suppression of spot outflows suggest that leverage has been reset. Additionally, new accumulation activity, including purchases by institutional investors, supports long-term conviction.

If inflows strengthen and the price closes above $2,073, Ethereum could retest $2,209 and $2,380. However, if you fail to hold $1,960, a retest of $1,746 is more likely.

For now, $ETH Stay in the definitive compression zone. Confirmation of momentum and capital flows will determine the next direction.

Related: Cardano Price Prediction: ADA Falls to $0.2760 Despite Coinbase Loan Consolidation

Disclaimer: The information contained in this article is for informational and educational purposes only. This article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the use of the content, products, or services mentioned. We encourage our readers to do their due diligence before taking any action related to our company.