Bitcoin’s hash rate, an important indicator of the network’s total computational power, recorded a sharp V-shaped recovery in February.

This sudden turnaround raised hopes that Bitcoin could end its five-month losing streak and make a strong recovery.

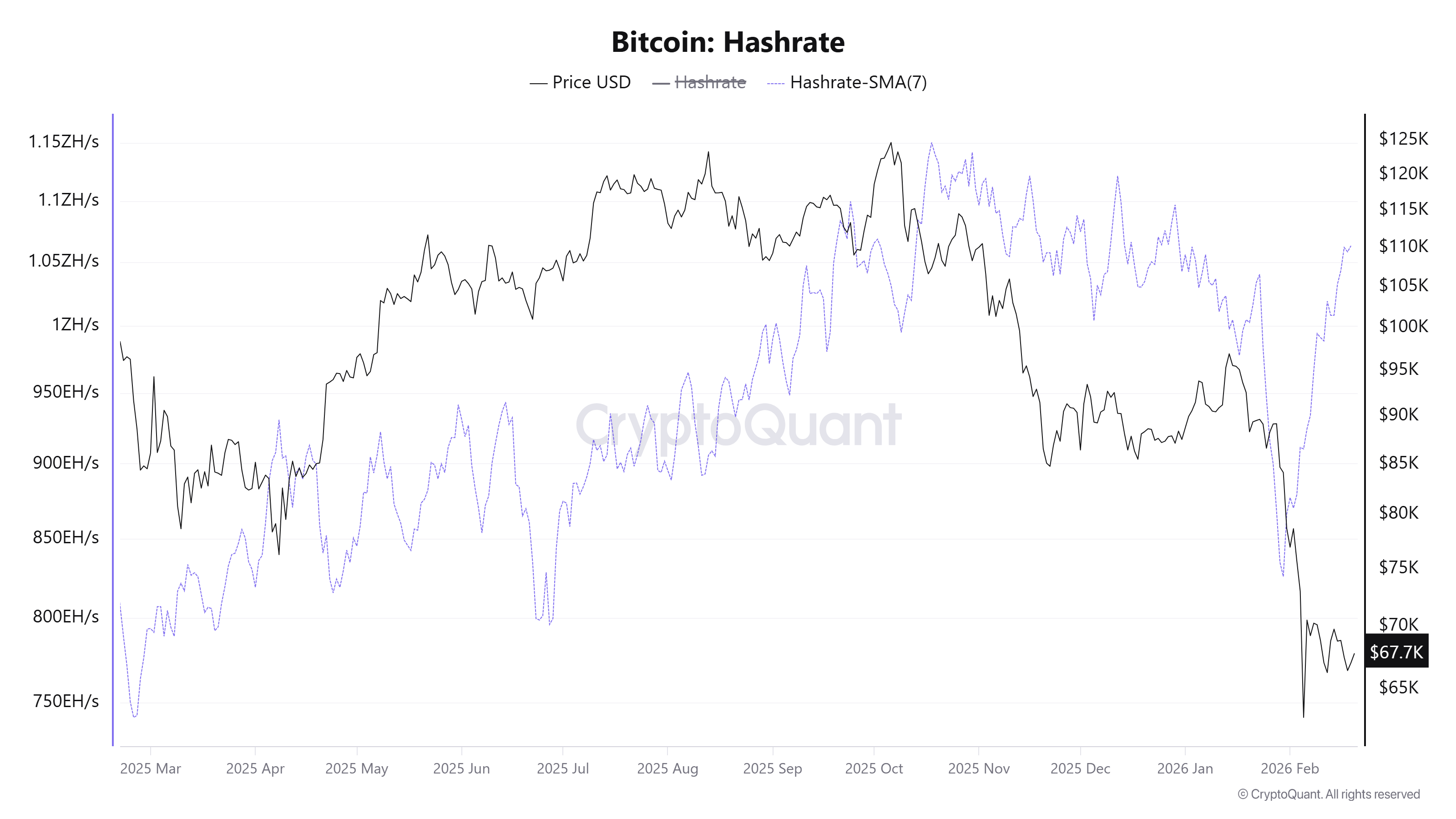

Hashrate and price correlation indicates a potential upside scenario

A previous report by BeInCrypto noted that Bitcoin’s hashrate suffered a major shock in early 2026. An extreme arctic cold wave has hit the United States.

Subzero temperatures, heavy snowfall and a surge in heating demand strained the nation’s power grid. Authorities issued a request to conserve energy, causing localized power outages in several areas.

As a result, the network’s hashrate dropped by about 30%. Approximately 1.3 million mining machines were taken offline, delaying block production.

But by February, the data showed a rapid turnaround. Hashrate has recovered from below 850 EH/s to over 1 ZH/s, recovering almost all of the previous significant downward correction.

Bitcoin hash rate. Source: CryptoQuant.

“Bitcoin mining has become approximately 15% harder, the largest increase in absolute difficulty ever, completely erasing the significant downward revisions of the previous era,” Menpool developer Mononaut commented.

Despite the hashrate recovery, Bitcoin price continues to fluctuate below $70,000 and does not reflect the same strength. According to market analysis platform Hedgeye, it costs about $84,000 to mine one Bitcoin in February. This suggests that many miners are still operating at a loss.

The increase in hashrate reflects the return of computing power. Miners are powering their machines back on and appear to be becoming more optimistic about Bitcoin’s long-term profitability.

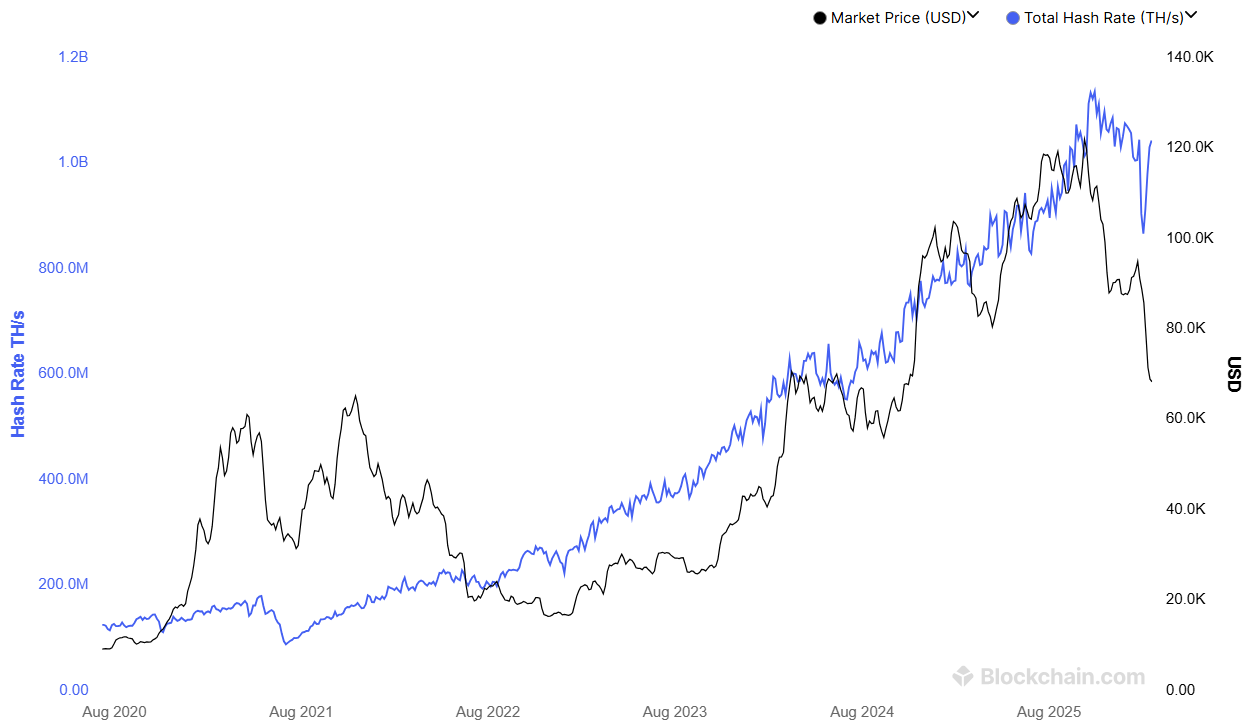

Historical data shows that V-shaped recoveries in hashrate often coincide with strong rebounds in price.

Bitcoin hash rate and price. Source: Blockchain.com

A notable example occurred in mid-2021. After China imposed a total ban on Bitcoin mining, the hashrate plummeted by more than 50%, dropping from 166 EH/s to 95 EH/s in July. A few months later, a V-shaped recovery in hashrate was paralleled by a strong rebound in price. Bitcoin rose from about $30,000 to more than $60,000 by the end of the year.

“Bitcoin network hashrate has rebounded sharply after its recent plunge. This is a strong signal that miner confidence is intact and is coming back online. Historically, hashrate is a leading indicator of recovery. Price tends to follow hashrate,” said Bitcoin OG Satoxis.

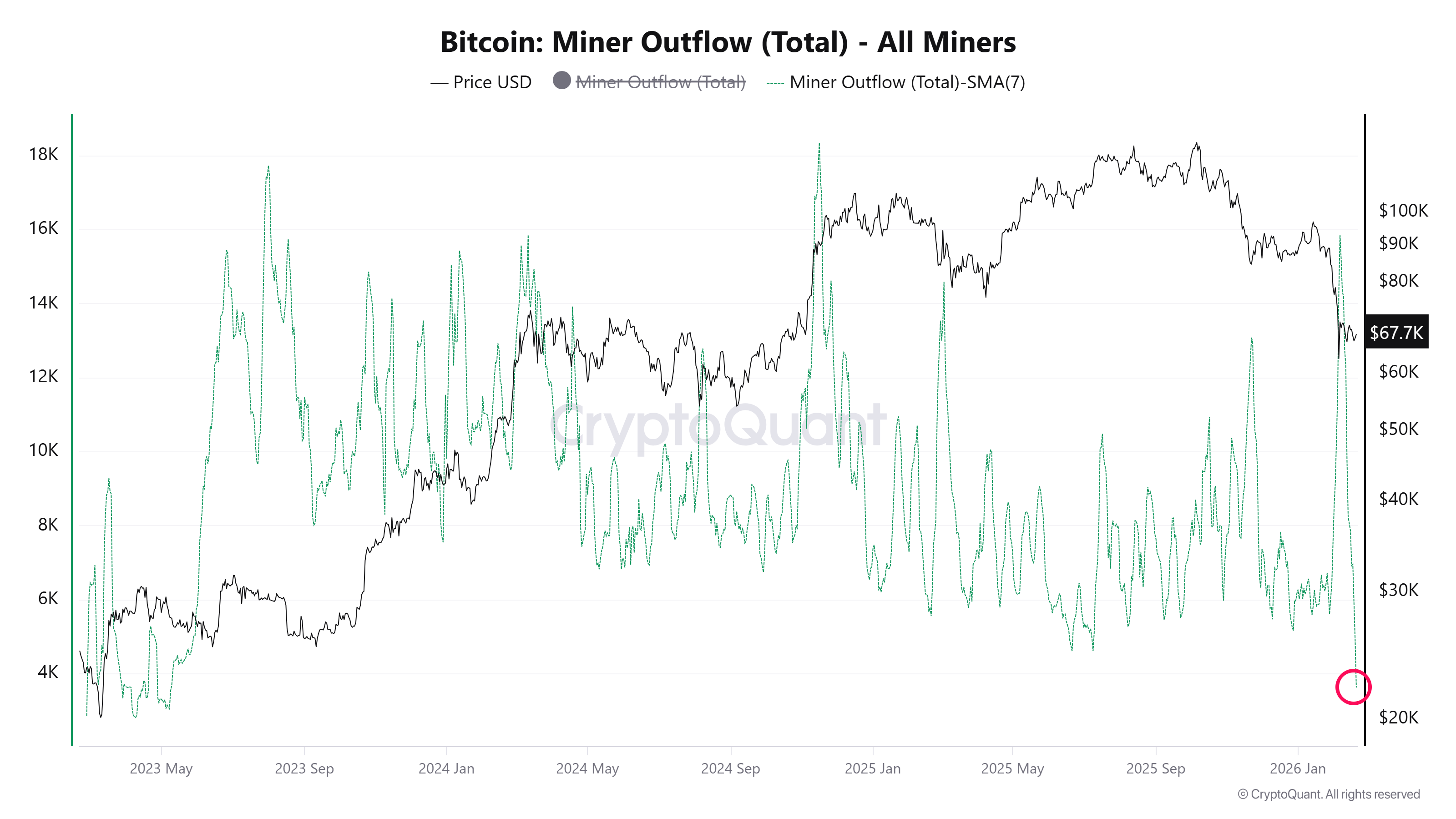

CryptoQuant data on Bitcoin miner outflows further supports the view that miners are expecting a price recovery. The seven-day average outflow from minor wallets has fallen to its lowest level since May 2023.

Bitcoin miner leak. Source: CryptoQuant

This trend indicates that miners are no longer actively selling their holdings. Rather, they seem to be holding on to the possibility of a rebound.

Additional analysis on BeInCrypto highlights that a sustained recovery at this stage would need to be confirmed through a breakout above $71,693.

The article “Bitcoin’s hashrate shows a V-shaped recovery – will Bitcoin price follow suit?” The post appeared first on BeInCrypto.