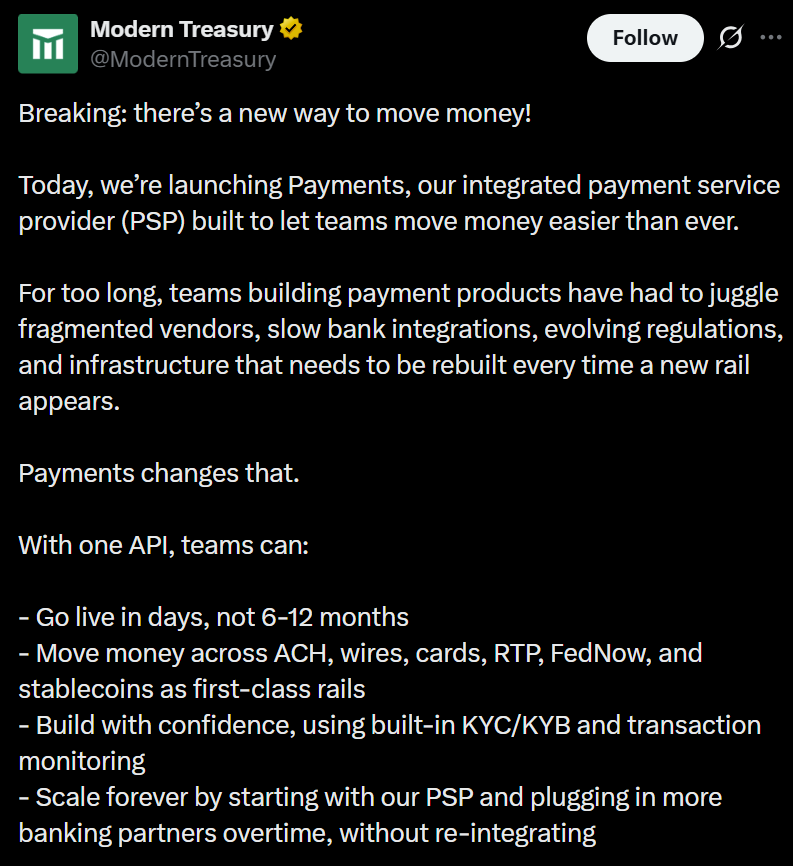

Modern Treasury, a payments operations software provider that helps businesses manage and coordinate the movement of funds, has introduced a unified payments service provider (PSP) that supports both traditional fiat rails and stablecoins.

The company announced Wednesday that it has added stablecoin payments to the same infrastructure that businesses already use for ACH transfers, wire transfers, and real-time payment networks. At launch, the platform supports Global Dollar (USDG), Pax Dollar (USDP), and $USDC ($USDC), USDt (USDT) will be added in the future.

Modern Treasure acquired stablecoin and fiat payments platform Beam in October.

The company partnered with Paxos to integrate regulated stablecoins and payment functionality into its platform and joined the Global Dollar Network. San Francisco-based Modern Treasury also participates in Circle’s Alliance program. this is, $USDC Stablecoins in payments and financial services.

This move will bring stablecoins into a single compliance framework alongside traditional banking rails. Businesses using Modern Treasury no longer require separate vendors or technical integrations to process crypto-based and fiat payments.

This update allows stablecoins to become another payment option within traditional payment flows, potentially lowering operational barriers for companies looking to integrate blockchain-based payment rails.

Related: 2026 Investment Strategy for Cryptocurrency: Bitcoin, Stablecoin Infrastructure, and Tokenized Assets

Stablecoins have penetrated deep into mainstream financial infrastructure

Modern Treasury’s latest integration comes as stablecoins become more widespread across the payments industry, particularly following the passage of the US GENIUS Act last July, which established a federal framework for dollar-backed stablecoins.

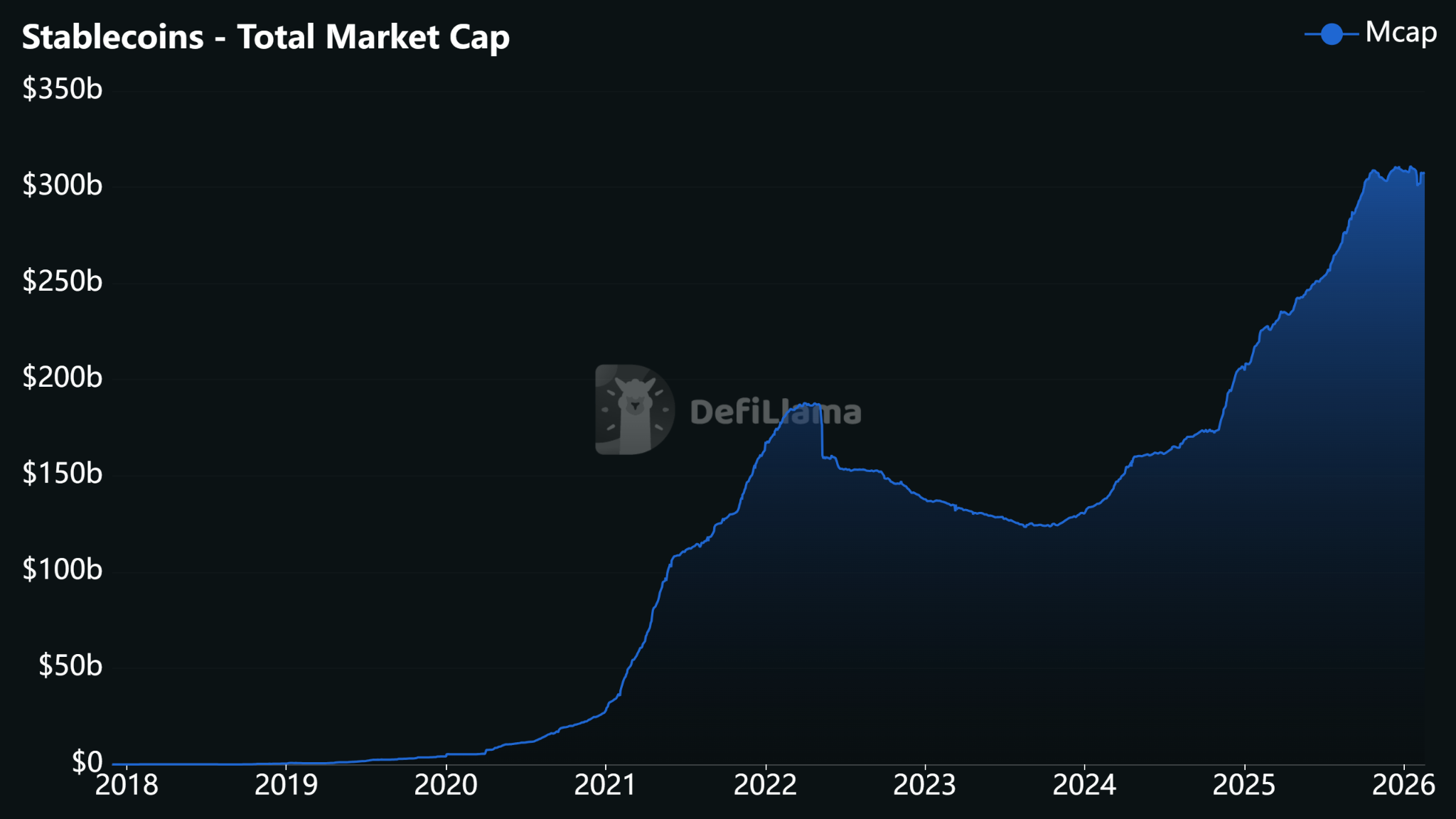

The total amount of stablecoins in circulation increased by nearly 50% last year, surpassing $300 billion for the first time. Supply has been hovering around that level, with growth slowing in recent months due to tight liquidity conditions and a cooling crypto market.

Still, issuance remains close to record levels, reflecting sustained demand for dollar-pegged digital assets in trading, cross-border remittances, and payments.

The stablecoin market has expanded rapidly since 2020. source: Defilama

America’s largest banks have also expressed interest in stablecoins and related technologies. JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo are reportedly in early talks about a joint stablecoin initiative, but the plan is still in the conceptual stage.

Last month, Fidelity Investments announced plans to issue a new stablecoin called the Fidelity Digital Dollar. Mike O’Reilly, president of Fidelity Digital Assets, described stablecoins as “fundamental payment and settlement services.”

Related: How TradFi Bank is driving a new stablecoin model