For some institutional investors, $ETH Despite growing concerns about growing unrealized losses, anything below $2,000 represents opportunity rather than risk.

$ETH entered the sixth consecutive month of decline. This is the longest losing streak since the 2018 decline.

Tom Lee and K3 Capital Boost $ETH Ownership ratio hits record high

According to Lookonchain, Tom Lee, founder of Fundstrat and head of Bitmine, executed a large amount of funds. $ETH Purchased in the third week of February.

On February 18th alone, Bitmine earned an additional $35,000 $ETH Equivalent to approximately $69.37 million. Purchase included 20,000 $ETHworth $39.8 million, from BitGo, 15,000 $ETHworth $29.57 million from FalconX.

K3 Capital also made big moves. According to OnchainLens data, a wallet linked to an investment fund purchased $20,000. $ETH Binance worth $40.08 million.

These large trades reflect strong, long-term beliefs. $ETHEven if the asset is trading for less than $2,000.

CryptoRank data shows that long-term investors are increasing their Ethereum accumulations during the current economic downturn.

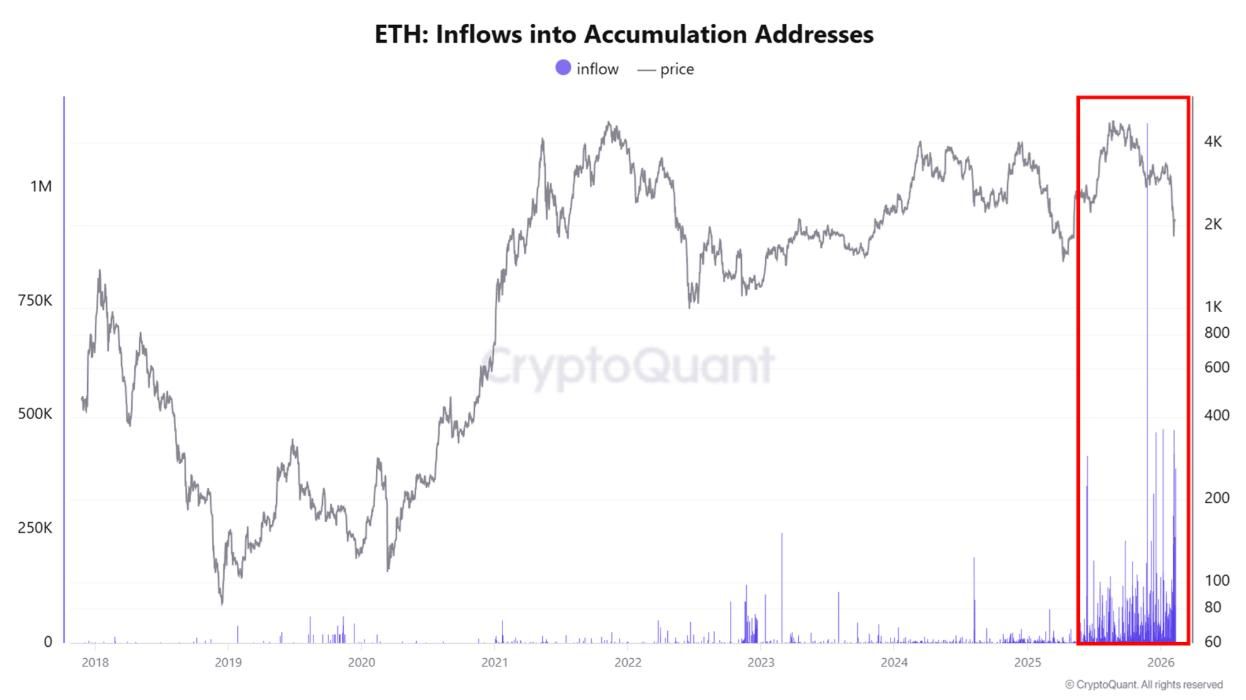

$ETH accumulation address. Source: CryptoQuant. “>

$ETH accumulation address. Source: CryptoQuant. “>

flow into $ETH Accumulation address. Source: CryptoQuant.

Meanwhile, according to data from CryptoQuant; $ETH Accumulated addresses over the past six months have reached their most active period in history. As history shows, in 2018, $ETH It experienced seven consecutive months of decline before recovering.

“The whales and the biggest banks are buying it and building it. $ETH. These are the largest inflows into Whale Savings wallets we have ever seen. Meanwhile, the retail industry is abandoning it and calling for its failure. They are exhausted after five years of seeing prices fall within this huge range. ” – commented crypto investor Seth.

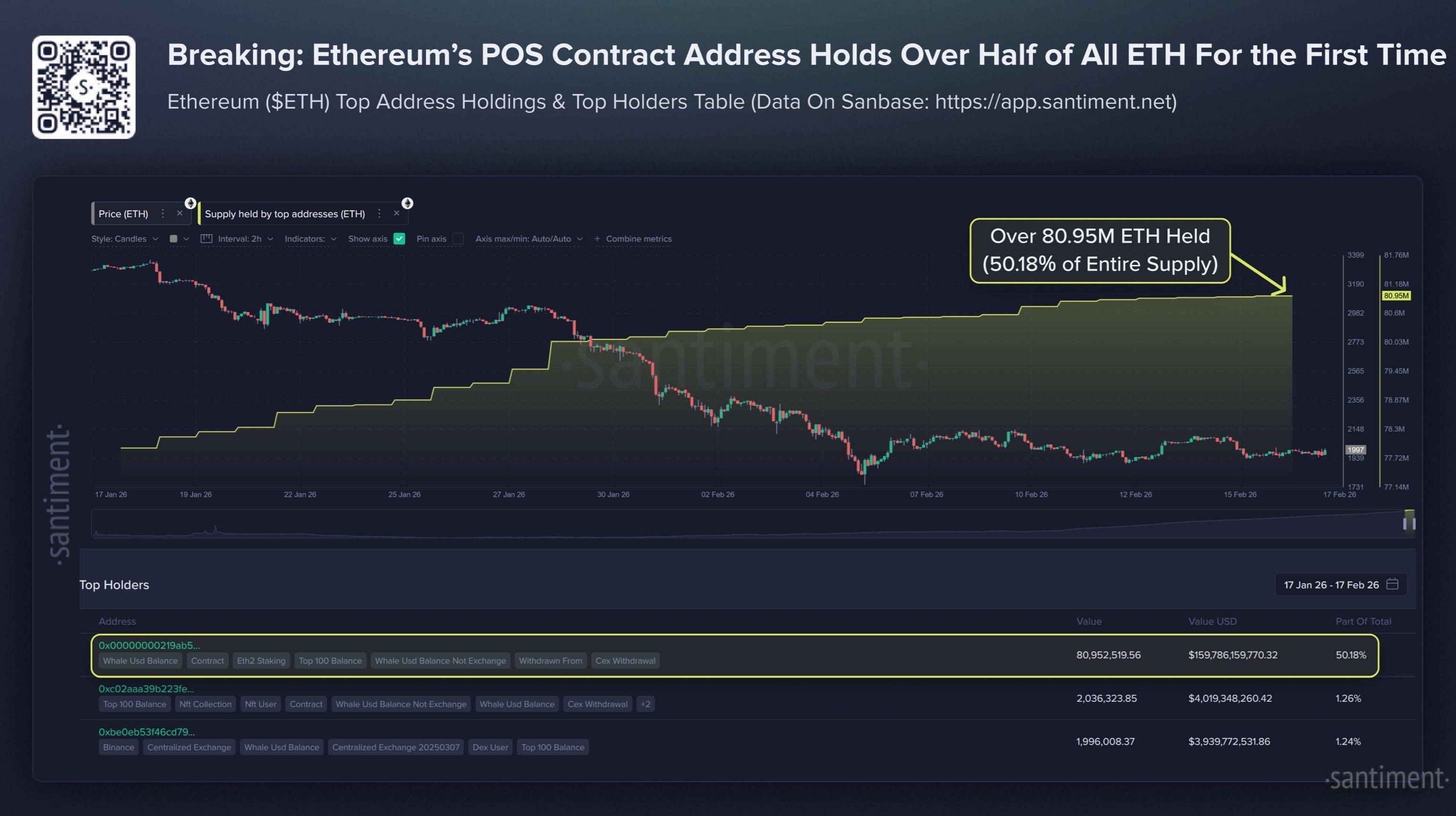

Another important milestone has appeared. For the first time in Ethereum’s 11-year history, more than half of the total $ETH Supply is at stake.

On-chain data platform Santiment reports that $ETH Currently, supply is within proof-of-stake (PoS) contracts.

$ETH is held by an Ethereum PoS contract address. Source: Santiment”>

$ETH is held by an Ethereum PoS contract address. Source: Santiment”>

total $ETH It is held by an Ethereum PoS contract address. Source: Santiment

This contract acts as a one-way repository. investor deposit $ETH Participate in staking to protect the network. Staked coins are temporarily taken out of circulation and cannot be traded.

Staking activity continues to increase, especially during bear cycles. moreover $ETH When locked, fluid supply is reduced.

“When more than 50% of the supply is locked into staking, the liquidity supply decreases. There are fewer coins available for trading. This reduces selling pressure and makes the market more sensitive to new demand,” said verifier Everstake.

Everstake revealed that 50.18% corresponds to the total $ETH The remaining 30% is active stake, held by Ethereum PoS contract addresses.

However, recent analysis by BeInCrypto does not exclude the following possibilities: $ETH Amid the most negative market sentiment in years, the stock could fall further to $1,385 in the short term.

Even if that scenario plays out, on-chain data suggests that large investors and institutions remain positioned for a long-term recovery.

This article “Ethereum falls for 6 consecutive months, but institutions continue to accumulate below $2,000” was first published on BeInCrypto.