Centralized exchange Gemini recently announced parting ways with three senior executives. The management change comes amid widespread business and staff reductions.

After the announcement, the company’s stock price fell further, extending the downward trend that has been going on since Gemini went public last September. Recent developments have prompted fresh scrutiny of exchanges’ long-term prospects.

Renewal of executive management due to significant reductions

In a recent blog post, Tyler and Cameron Winklevoss announced that Gemini has parted ways with its chief financial officer, chief legal officer, and chief operating officer. It said interim replacements have been appointed for the CFO and CLO roles, but the COO position will not be filled.

The founders characterized the change as part of the company’s broader transformation, calling the effort “Gemini 2.0.” They pointed out that recent developments in the crypto industry are influencing this change.

“During this time, and in fact more recently, rapid advances in AI have begun to dramatically change the way we work at Gemini. At the same time, the emergence of prediction markets has begun to dramatically change markets, including ours,” the blog post states.

The announcement followed Gemini’s decision several weeks ago to cut its workforce by 25% worldwide. Additionally, Gemini has withdrawn from several international markets, including the United Kingdom, European Union, and Australia.

🚨 Gemini stock fell -14% after the company’s COO, CFO, and Chief Legal Officer left just months after its IPO.

Gemini Exchange will also withdraw from the UK and EU markets in April, cutting 200 jobs as it says it plans to cut costs and increase usage of AI$GEMI pic.twitter.com/jG9MYMRQW2

— ALLINCRYPTO (@RealGoodCrypto) February 18, 2026

Recent developments have once again increased volatility in the company’s stock, continuing its steep decline since going public in September. Investors who bought GEMI at the IPO price of $28 are now facing losses of approximately 77%.

In a recent SEC filing, the company also disclosed an estimated net loss for 2025 of approximately $595 million.

Taken together, these developments have led to increased scrutiny of exchange valuations.

Public Markets Reprice Gemini Growth

The huge price increase in Gemini stock has renewed debate about whether the exchange was fundamentally overvalued at the time of its initial public offering.

The initial valuation reflected expectations for sustained volume and revenue growth. Given the cyclical nature of the crypto market, pricing may have been influenced by increased trading activity and increased retail participation.

The subsequent decline, which unfolded amid broader market weakness, suggests a reassessment of profit expectations.

This trend also highlights intensifying competitive pressures among centralized exchanges.

Market share and liquidity remain concentrated among larger platforms with deeper order books and stronger network effects. On the other hand, mid-sized exchanges do not have the same trading volume to support their margins and face increased fixed costs.

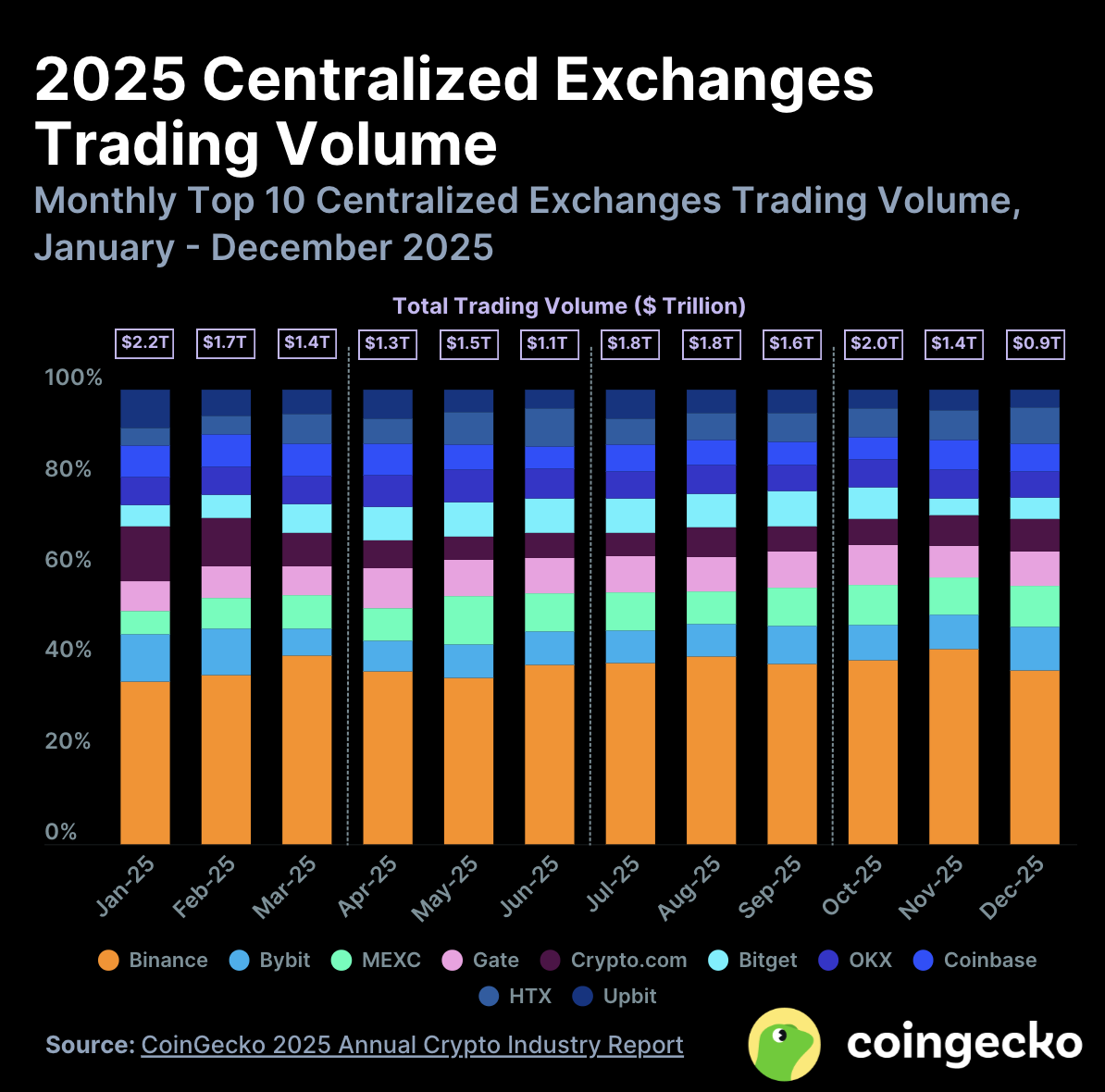

Recent data from CoinGecko confirms the situation.

Top centralized exchange by trading volume in 2025. Source: CoinGecko.

In a January report on concentrated exchange market share by trading volume, the data aggregator revealed that Binance will account for 39.2% of the spot trading volume of top exchanges in 2025, processing $7.3 trillion in trading volume. Other major platforms such as Bybit, MEXC, and Coinbase also maintain significant market share on a global scale.

Gemini did not make it into the top ten. According to CoinMarketCap data, the exchange is currently ranked 24th with a 24-hour trading volume of $54 million.

In that context, headcount reductions and geographic exits may represent cost control measures and strategic adjustments to increasingly consolidated markets.

How Gemini executes this transition will likely determine whether shareholders view the current turmoil as a short-term correction or a sign of longer-term structural challenges.

The post “Gemini Stock Drops Amid Leadership Upheaval and Business Downsizing” was first published on BeInCrypto.