Ethereum is looking to stabilize after weeks of intense selling. Prices are hovering around $1,950, up about 6% from recent lows. At the same time, the largest Ethereum whale began to actively accumulate.

But short-term sellers and derivatives traders remain cautious, with a tug-of-war over the next move intensifying.

Largest Ethereum whales increase as bullish divergence holds

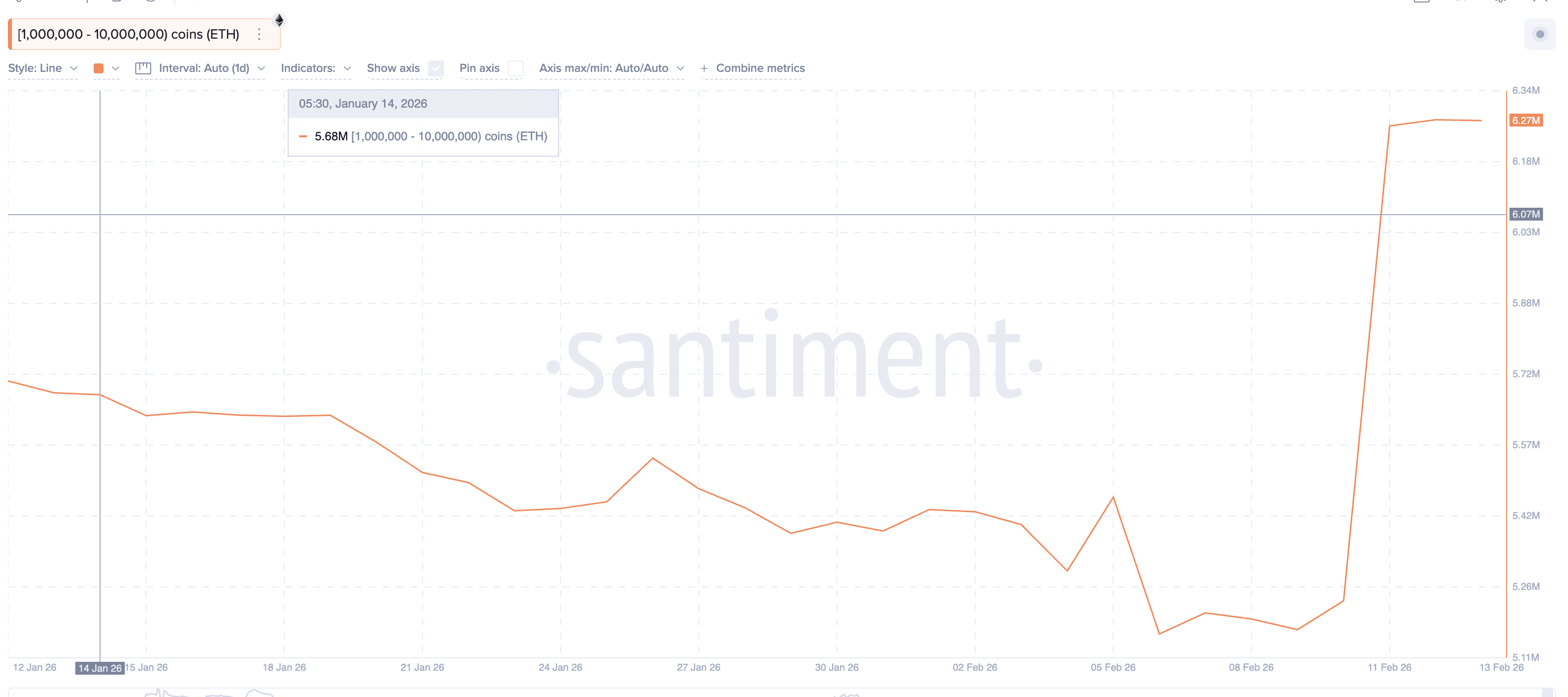

On-chain data shows that the largest Ethereum holders are poised for a rebound. 1 million to 10 million addresses after February 9th $ETH Increased the number of shares held from approximately 5.17 million shares $ETH Nearly 6.27 million people $ETH. That’s an addition of over 1.1 million $ETHworth about $2 billion at current prices.

Ethereum Whale: Santiment

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This accumulation coincides with a bullish technical signal on the 12-hour chart.

From January 25th to February 12th, Ethereum price formed an even lower low, and the Relative Strength Index (RSI) formed an even higher low. RSI measures momentum by comparing recent gains and losses. If prices are falling but the RSI is rising, it often indicates that selling pressure is easing.

This bullish divergence suggests that downside momentum is weakening.

Bullish Divergence: TradingView

This structure remains valid as long as Ethereum stays above $1,890, and the same signal flashed on February 11th and still appears to be holding. Below this level, the immediate divergence will be nullified and the possibility of a rebound will weaken.

For now, Whales appears to be betting that this support will hold.

Are short-term holders selling?

While large investors are accumulating assets, short-term holders behave very differently.

The spent coin age band for the 7-30 day cohort rose sharply. Since February 9th (the same time whale hunting began), this metric has increased from about 14,000 to about 107,000 whales, an increase of more than 660%. This indicator tracks the number of recently acquired coin movements. An increase in value usually indicates the possibility of profit taking or distribution.

$ETH coin”>

$ETH coin”>

$ETH Coin: Santiment

Simply put, short-term traders are closing out their positions. This pattern also appeared in early February. On February 5th, a spike in short-term coin activity occurred around $2,140. Within a day, Ethereum fell by about 13%.

This history shows how aggressive sales from this group can quickly reverse a move. As long as short-term holders remain active sellers, any upside movement is likely to encounter resistance.

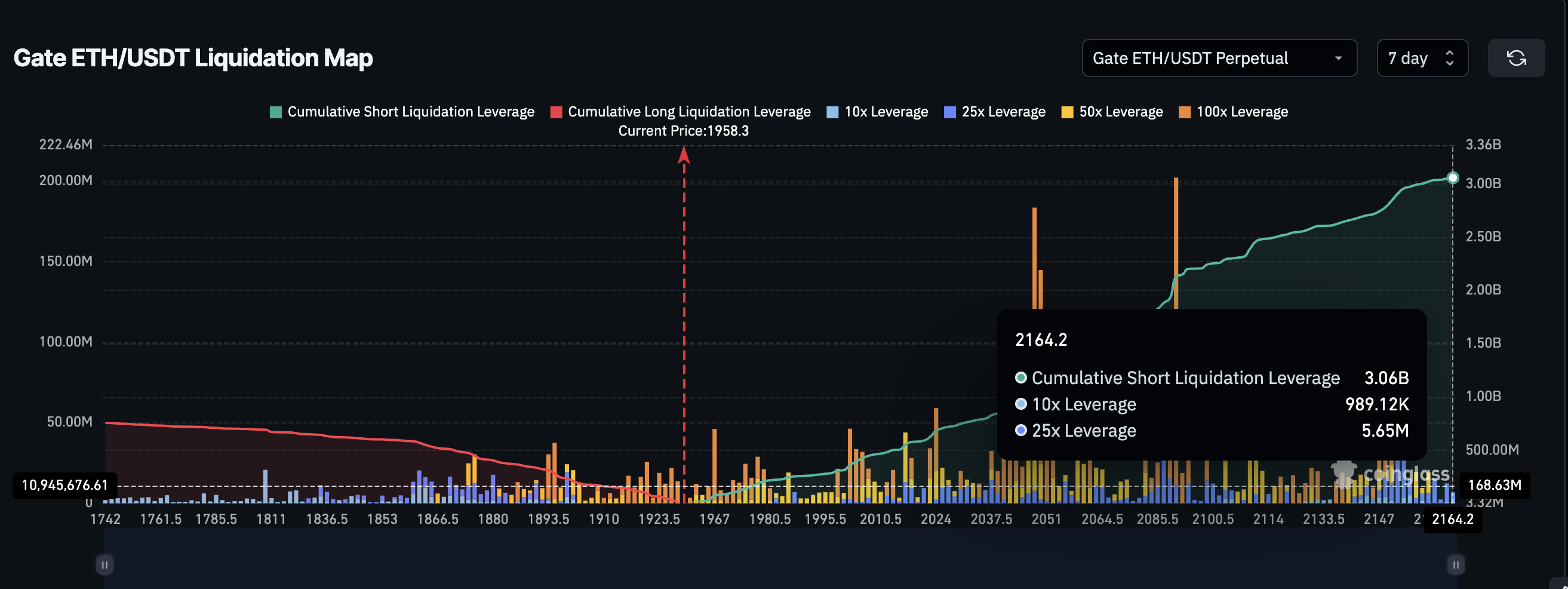

Derivatives data shows significant bearish positioning

The derivatives market is reinforcing this cautious outlook. Current liquidation data shows that long leverage is only about $755 million, while short positions are close to $3.06 billion. This creates a very bearish imbalance with almost 80% of the market betting on the short side.

Advantages of shorts: coin glasses

On the other hand, this setup creates fuel for a potential short squeeze if prices rise. However, it shows that most traders still expect further weakness. This has kept momentum in check, but hopes for a rebound remain if whale purchases push prices even slightly above the previous major clusters.

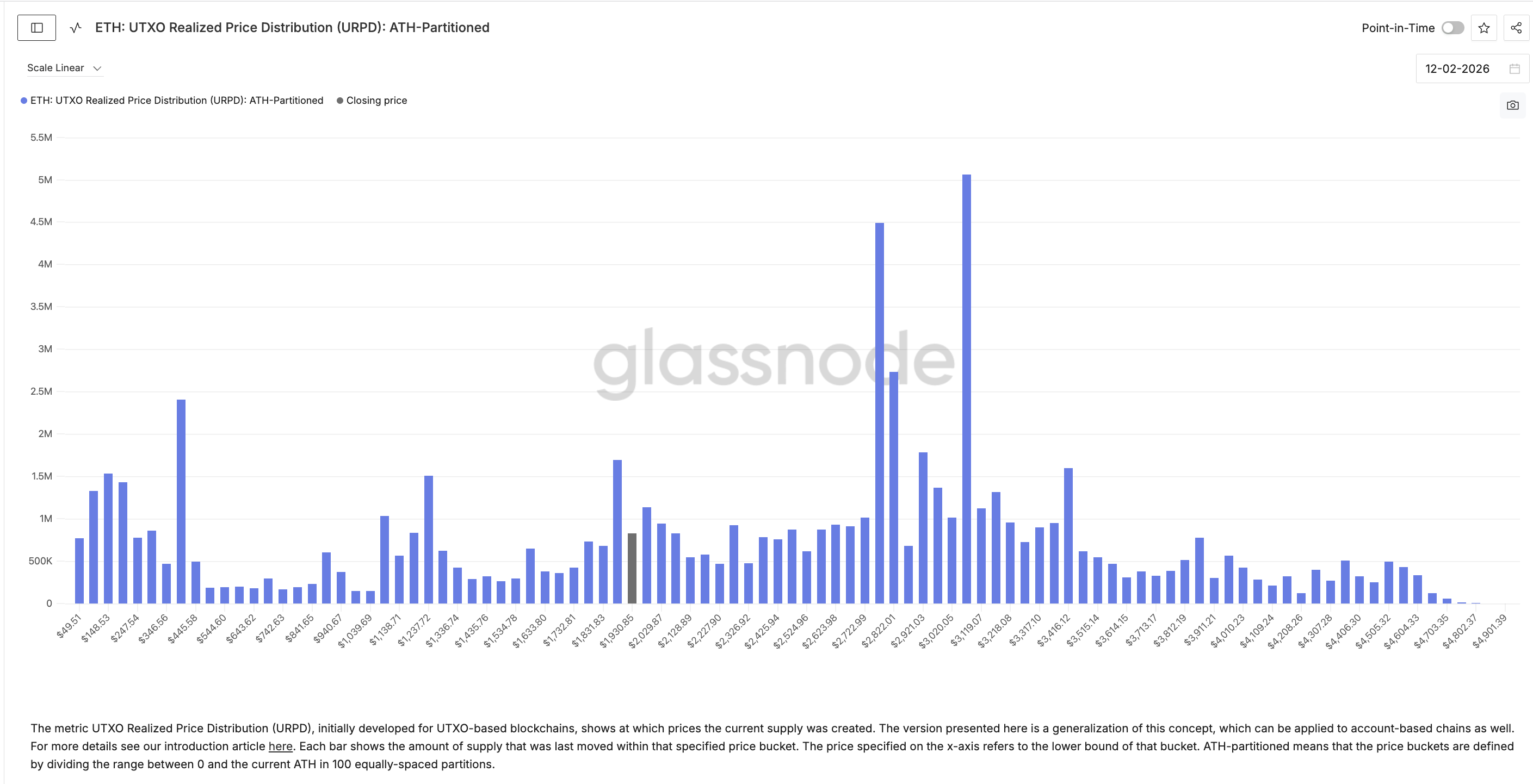

On-chain cost-based data helps explain why Ethereum has struggled to make new highs. Approximately $1,980, equivalent to approximately 1.58% of the circulating supply, was obtained. Around $2,020, another 1.23% of supply is at breakeven. These zones represent large groups of holders waiting to exit without loss.

Cost-based cluster: Glassnode

When prices approach these levels, selling pressure increases as investors seek to recover their capital. This has repeatedly curtailed recent rebounds. Only a strong leveraged move or a short squeeze may be powerful enough to break through these supply clusters.

Until then, these zones remain a major barrier.

Key Ethereum Price Levels to Track Now

Ethereum’s price level now matters more than the story as whale buyers and sellers push back.

On the upside, the first major resistance lies near $2,010. If the 12-hour closing price is above this level, the possibility of a short-term liquidation will increase. And it is located near major supply clusters.

If this happens, Ethereum could next target $2,140, a strong resistance zone with multiple touchpoints. Moreover, it remains at around 10% from the current level. On the downside, $1,890 remains an important support. A break below this level will invalidate the bullish divergence and signal new downside pressure. Below that, the next major support lies around $1,740.

Ethereum Price Analysis: TradingView

The rebound structure will remain intact as long as Ethereum sustains above $1,890 and continues to test $2,010. If conditions persist below support, the current recovery attempt will be cancelled.

The post Can Ethereum price attempt a 10% bounce as the biggest whales add $2 billion? appeared first on BeInCrypto.