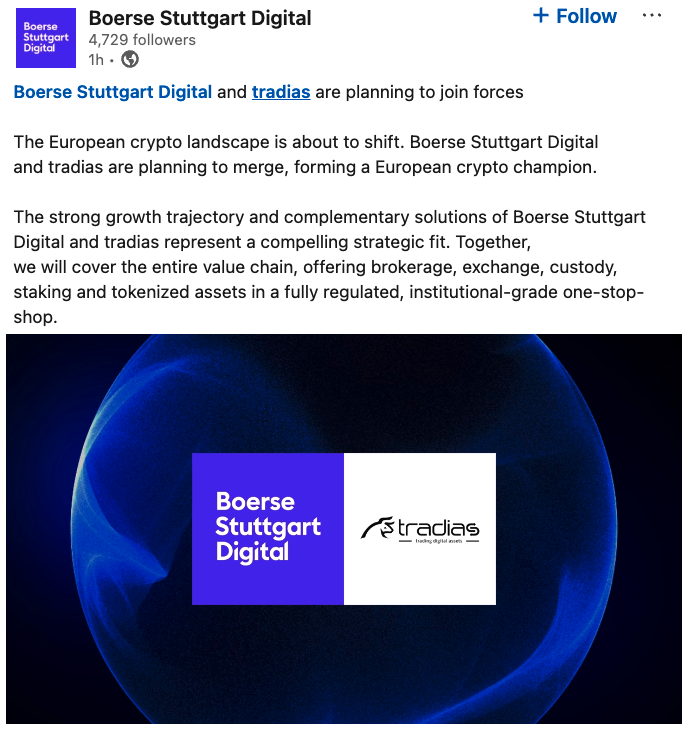

Bose Stuttgart Group, operator of one of Europe’s largest stock exchanges, has announced that it will merge its cryptocurrency business with Frankfurt-based digital asset trading company Tradias, in a strategic move to expand its presence in the institutional cryptocurrency market.

The deal will combine approximately 300 employees under the companies’ joint management team, according to Friday’s announcement.

This integrated division aims to cover multiple digital asset services including intermediation, trading, custody, staking and tokenized assets. The company will serve banks, brokers and other financial institutions across Europe, offering a fully regulated crypto infrastructure, according to the announcement.

Financial terms of the deal were not disclosed. Representatives for Borse Stuttgart and Tradias declined to comment to Cointelegraph on the terms of the deal. Bloomberg reported that the deal could value Tradias at around 200 million euros ($237 million), with the combined entity valued at more than $590 million.

MiCA Compliant Cryptocurrency Management Company Partners with BaFin Authorized Bank

Boisse Stuttgart has been developing regulated crypto infrastructure through its Boasse Stuttgart Digital division, which provides trading, brokerage and custody services in accordance with the European Union’s Cryptoassets Market Regulation (MiCA).

In 2025, the Stock Exchange Stuttgart reported that the trading volume of cryptocurrencies will triple and account for a quarter of total revenue in 2024. CEO Matthias Voelkel expressed his bullish stance on cryptocurrencies and revealed his personal Bitcoin (BTC) holdings at the time.

sauce: bolse stuttgart digital

The platform’s existing footprint in regulated digital assets positions the exchange group to expand its services by combining the technology and execution capabilities of Tradias.

Tradias, which operates as the digital assets division of Bankhaus Scheich, is licensed as a securities exchange bank by the German Federal Financial Supervisory Authority (BaFin). Last year, the company partnered with AllUnity, the MiCA-licensed issuer of the euro-pegged stablecoin EURAU, to integrate trading pairs into its over-the-counter platform.

“With the planned merger of Boerse Stuttgart Digital and Tradias, Boerse Stuttgart Group is driving the development and consolidation of the European crypto market,” said Voelkel.

Related: Denmark’s Danske Bank allows customers to buy Bitcoin and Ether ETP

“We have built strong growth momentum in recent years. By merging with Boerse Stuttgart Digital, we are taking the next logical step in our company’s development,” said Tradias founder Christopher Beck, adding:

“Together, we will create a new European champion with significantly expanded reach, strategic depth and creativity to cover the entire digital asset value chain and further market integration.”

magazine: How will cryptocurrency law change in 2025 and how will it change in 2026?