Ethereum is showing early signs of recovery after a long period of stagnation that sent its price plummeting. $ETH has sought to stabilize around key support levels, but further upside will depend on sustained support from investors and broader market conditions.

At the moment, Ethereum appears to have at least one of these factors working in its favor, keeping the outlook for recovery intact.

Ethereum investors change stance

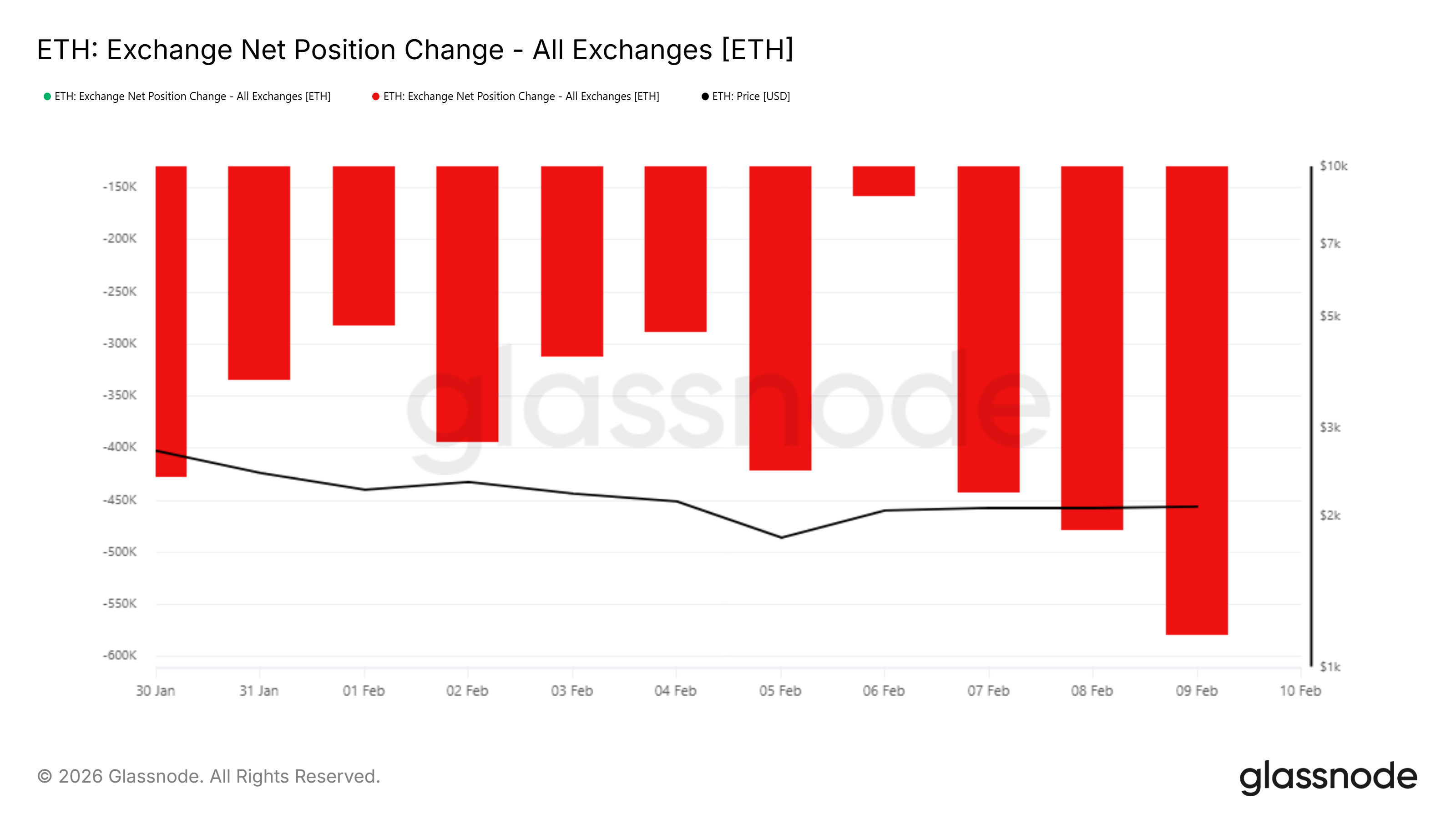

On-chain data suggests a notable shift in investor behavior. The exchange’s net position change indicator, which tracks the flow of capital into and out of exchanges, turned negative for Ethereum. This shows even more $ETH Leaving an exchange rather than joining it. This is usually a pattern associated with accumulation rather than distribution.

Such outflows suggest that holders are opting to buy and transfer $ETH Instead of preparing it for sale, put it in your personal wallet. This behavior is often encouraged by falling prices as investors brace for a potential rebound. This change in stance reflects improved confidence, even though prices have not yet fully reflected increased demand.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Changes in net positions on the Ethereum exchange. Source: Glassnode

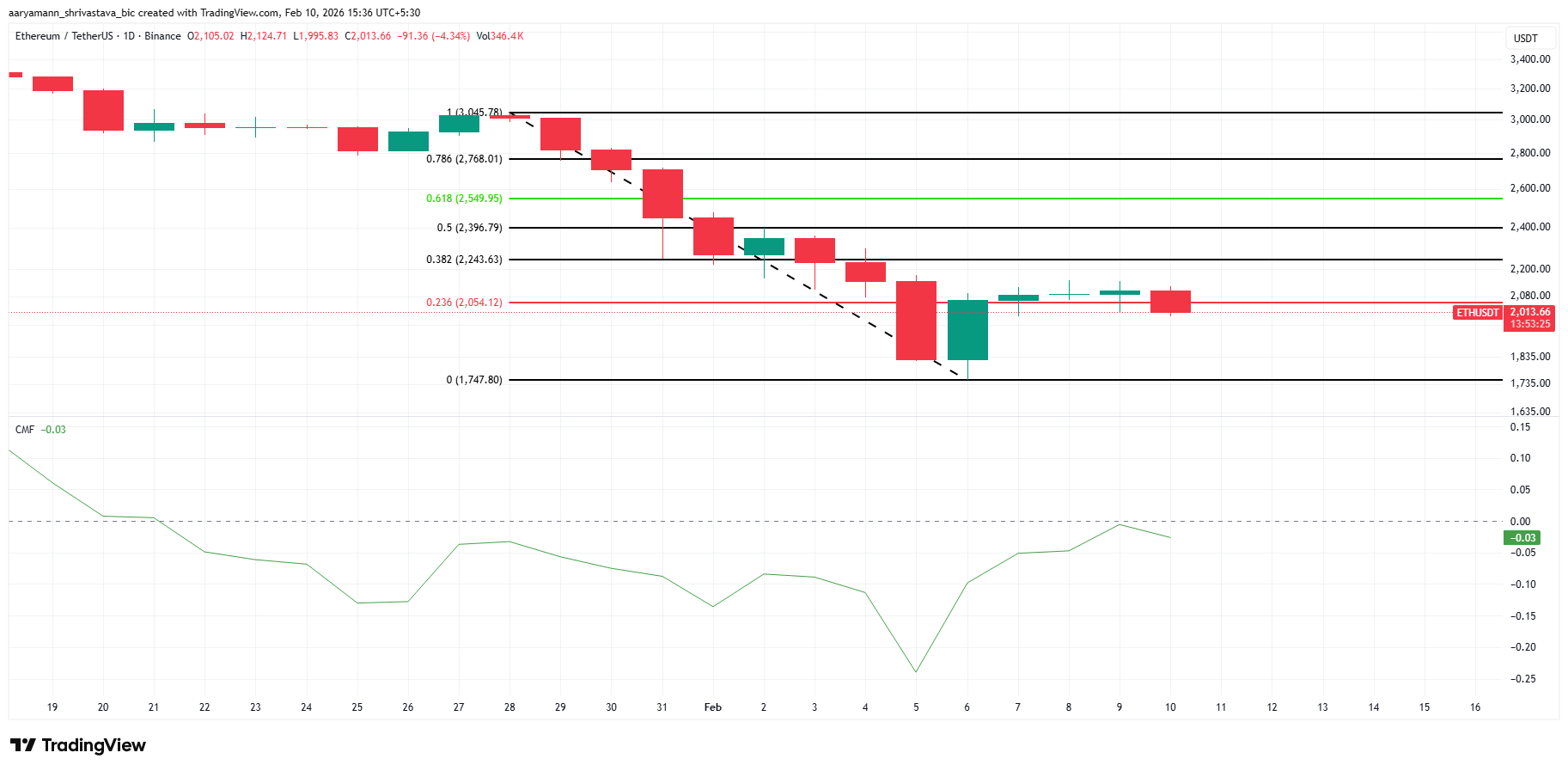

Broader momentum indicators support this story. Chaikin money flows have shown a steady increase over the past week, reinforcing the trends observed in currency data. The rise in CMF values indicates that outflows are decreasing and the dynamics of capital flows across the Ethereum market are improving.

A move above the zero line will be a bullish development as inflows will exceed outflows. $ETH. At the same time, Ethereum has managed to hold above the 23.6% Fibonacci retracement near $2,054. Sustaining this level often acts as a trigger for new participation and encourages investors to deploy capital as downside risks appear to be more contained.

Ethereum CMF. Source: TradingView

What is $ETH What’s Price’s next target?

At the time of writing, Ethereum is trading around $2,018, indicating that there is still demand below the current price. The challenge lies in converting that demand into a sustained upward trend. A successful rebound from the $2,000 level could lead to an upside move. $ETH To the key short-term resistance level at $2,205. Additionally, the psychological goal of $2,500 comes into focus.

Ethereum price analysis. Source: TradingView

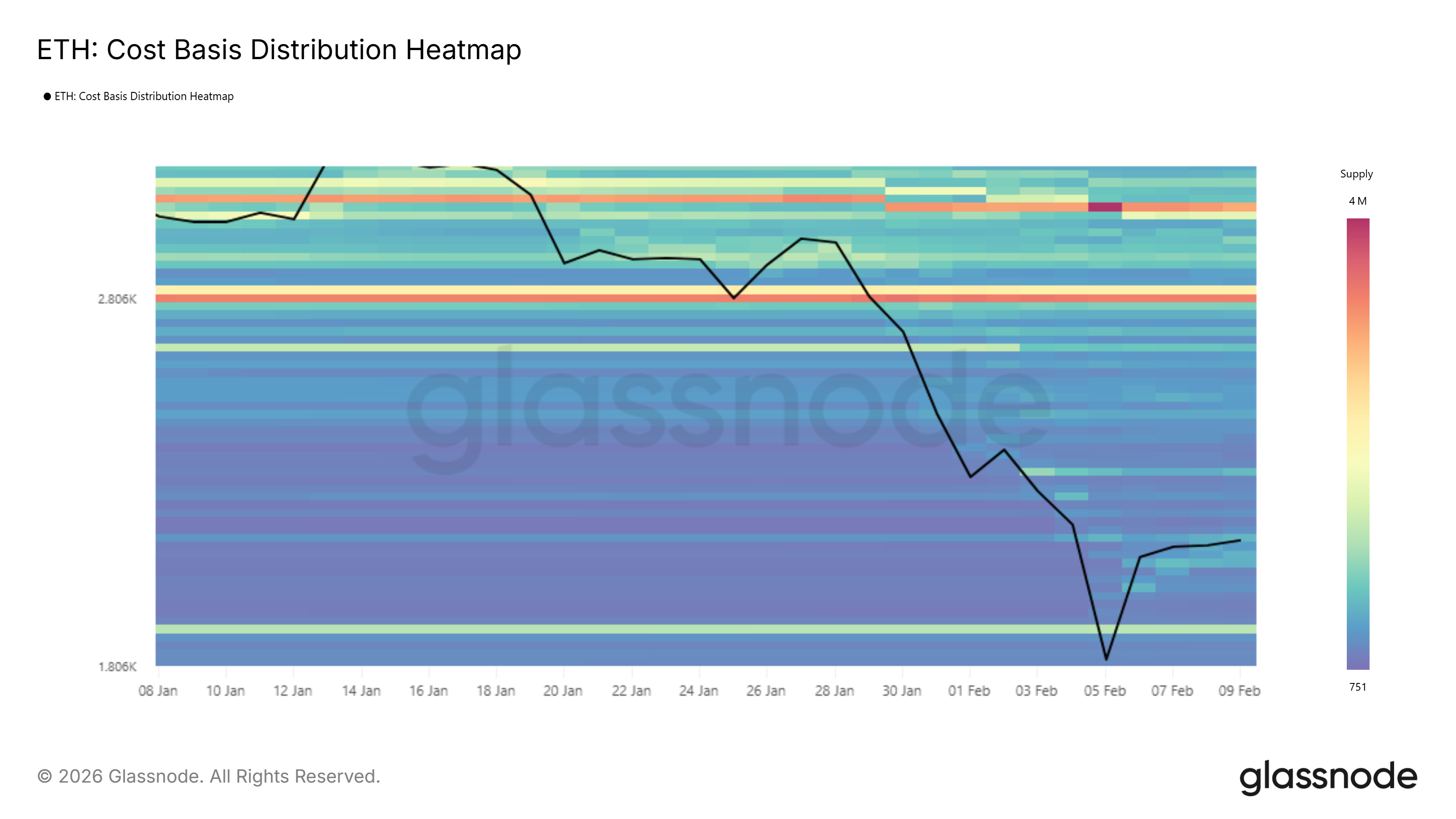

From a structural perspective, reaching $2,500 may not be difficult. Cost-based distribution data shows relatively light accumulation around this zone, suggesting limited overhead supply. As a result, $ETH As you gain momentum, you will be able to move through this range with less resistance. A stronger accumulation cluster appears to be approaching $2,800, which could act as a more meaningful barrier.

Ethereum CBD heatmap. Source: Glassnode

Before that scenario plays out, Ethereum needs to clear intermediate hurdles. A decisive move above $2,344 would confirm the strength of the resilience and validate the path towards $2,500 and potentially higher levels. However, failure to maintain current support will undermine our bullish setting. A loss at the $2,000 level is $ETH There is fresh downside risk, with $1,796 emerging as the next major support area.

The article Ethereum Holds $2,000 Support — Accumulation Keeps Recovery Hopes Alive appeared first on BeInCrypto.