Ethereum was trading between $2,014 and $2,028 per coin as of February 10, but much louder voices were being heard behind the scenes in the derivatives market. Futures open interest remains high, options positioning is heavily biased toward calls, and maximum pain levels across major exchanges are uncomfortably close to the spot.

Flash mixed signals between Ethereum derivatives, Binance, OKX and Deribit

Ethereum futures open interest continues to hover near cycle highs, with aggregate exchange data showing leveraged exposure is spread across concentrated exchanges. Although prices have fallen from recent highs, traders have not significantly reduced risk, suggesting that confidence remains intact, at least for now.

Among futures exchanges, Binance holds the largest share of Ethereum open interest at approximately $5.32 billion, which equates to more than $2.63 million. $ETH. Binance’s short-term positioning trended cautiously constructive, with 1-hour and 4-hour open interest rising despite softening 24-hour numbers, suggesting an aggressive repositioning rather than a wholesale exit.

CME ranks next, with approximately $3.48 billion in funds. $ETH Futures Exposure. Unlike the offshore market, the CME futures market showed steady growth across all time frames tracked, reinforcing the presence of institutional flows rather than rapid capital outflows.

OKX and Bybit follow closely, with open interest ranging from $1.7 billion to $2 billion, respectively. OKX rose sharply by more than 10% in 24 hours, indicating a resurgence of speculative interest despite modest declines in shorter intervals.

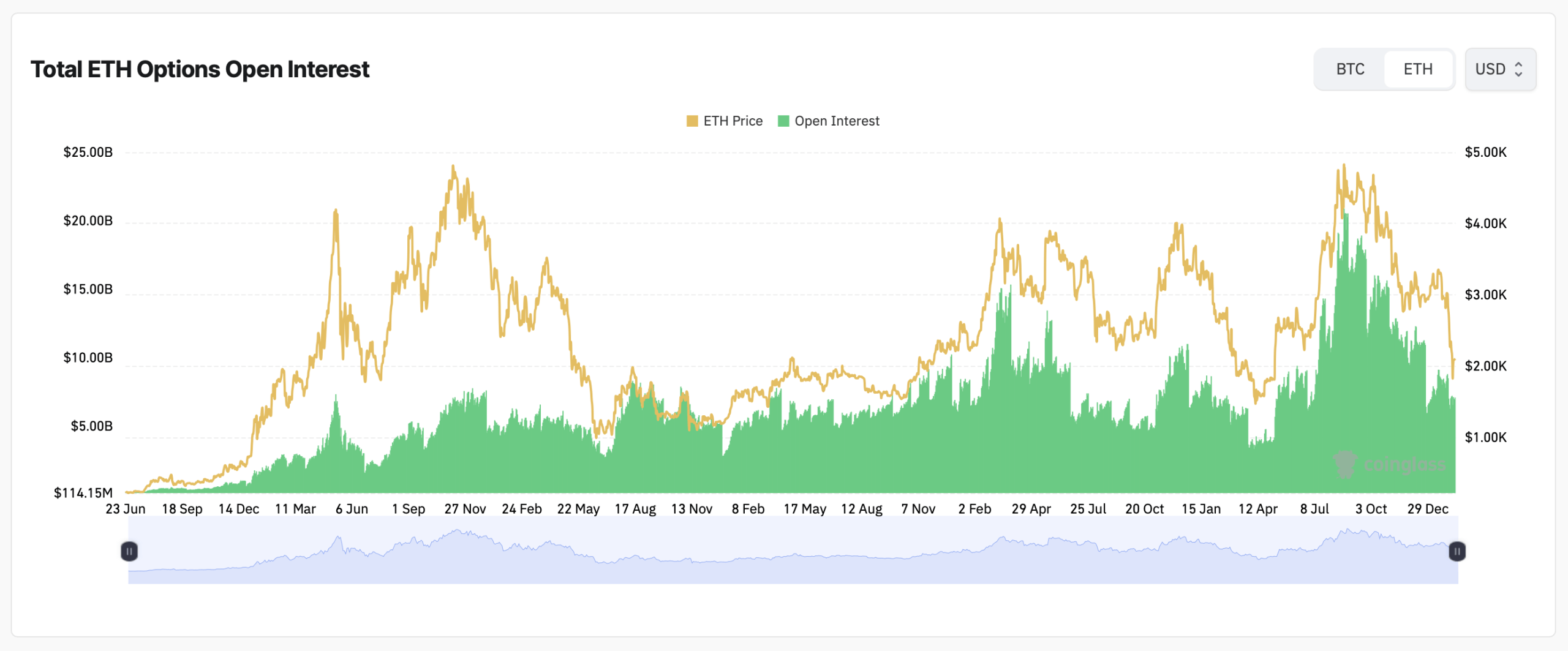

The Ethereum options market paints a similarly busy picture. Total open interest in options has expanded along with price over the past year, rising to multi-month highs even as Ethereum retreats toward $2,000. This combination, a downside spot and sticky derivatives exposure, often sets the stage for sharp directional moves.

Cole continues to dominate positioning. Open interest in options totaled more than 1.8 million, with 57.41% allocated to calls and 42.59% allocated to puts. $ETH On a call. The volume data also reflects that bias, with calls accounting for 53.12% of 24-hour options trading, indicating that traders are still trending higher rather than bracing for a collapse.

The most heavily traded contracts are concentrated around short-term expirations, especially in February and March. There is a large concentration of open interest in the $1,800 to $3,500 strike range, suggesting that traders are hedging broadly while leaving room for volatility.

Maximum pain data made the picture even clearer. On leading options venue Deribit, short-term maximum pain levels hovered around $2,000 to $2,200 for February expirations, but skyrocketed to $2,800 in March and nearly $3,000 in June, uncomfortably close to current levels.

Ethereum options open interest as of Tuesday, February 10, 2026, according to statistics from Coinglass.com.

Binance’s maximum pain curve showed a flatter structure, with pain levels concentrated between $2,200 and $2,600 across the upcoming expiration dates. This range means limited directional mercy for overconfident traders who are too biased in either direction.

On OKX, maximum pain levels remained low in the short term, hovering around $2,100 to $2,400, but spiked toward $3,400 at the end of the year. This curve suggests that traders expect turbulence first, followed by transparency.

Fundamentally, the Ethereum derivatives market appears to be very crowded, arbitrary, and hasty. With spot prices pegged near $2,000 and leverage still set high, this setup leaves little room for complacency.

Frequently asked questions ⏱️

- What is the current price of Ethereum?Ethereum traded at prices between $2,014 and $2,028 per coin on February 10th.

- Are traders bullish or bearish in the options market?Calls are dominating both open interest and volume, indicating a bullish trend.

- Which exchange has the most Ethereum futures open interest?Binance leads with over $5.3 billion $ETH Futures Exposure.

- Where is the maximum pain level concentrated?Depending on the exchange rate, the biggest short-term pain will be closer to $2,000 to $2,400.