Bitcoin’s recent drawdown from all-time highs has been compared to 2022 across crypto Twitter (the similarities are clear), but some technologists argue that the similarities are mostly superficial. TexasWest Capital CEO Christopher Inc. said in a series of posts that while the current move appears to be the completion of a five-wave decline due to a positioning washout, it is not a collapse due to structural factors like the one that dictated the 2022 unwind.

Bitcoin vs. 2022: Similar charts, different stories?

Inks’ main argument is about where the market sits within a larger pattern. “One of the differences with the current drop-off is that $ATH and decline in 2022 $ATH “The point is that we appear to have just completed a five-wave decline. At the time, the same area everyone was referring to had already completed a five-wave decline, or three waves of correction, followed by another breakdown,” he wrote.

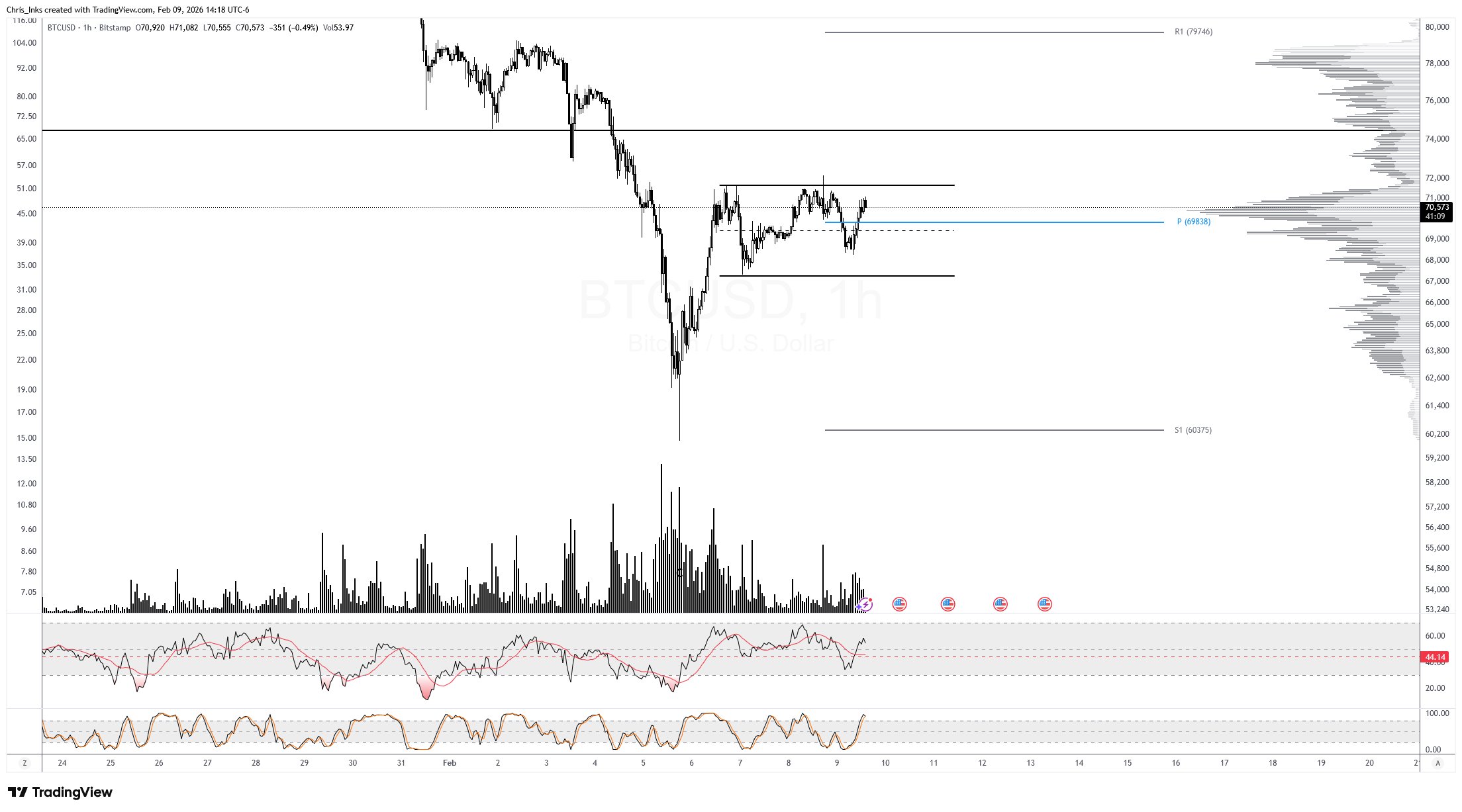

Inkus noted on his weekly BTCUSD chart that after what he described as a sharp recovery in the second half of last week, he sees five waves of decline until early 2026, and then a continued sideways consolidation centered on the “weekly pivot.” What this means is that the sequence is more important than calling a definitive bottom. If the 5-wave leg is completed, the next stage is usually a correction or base building rather than an immediate continuation of the downside.

The ink also separated the catalyst. The 2022 collapse coincided with TerraUSD’s depeg and subsequent market turmoil, with reflexive shocks tightening collateral and eroding liquidity across the venue. In contrast, he characterized last week’s selloff as risk reduction rather than crisis aftermath.

“Another difference between these two periods is that the former coincided with the depeg and breakdown of TerraUSDT, which was the market structural event that triggered the Bitcoin breakout at the time,” Inks wrote. “As we’ve said, last week’s breakdown was degross (reduction of risk-off positions). These are two very different market movements.”

“Does this guarantee that the low is in? Of course not, but when comparing two events you need to compare how they occurred, not just how similar the price movements are,” he added. “That way, if Price does something different than last time, you don’t have to run around in disbelief screaming, ‘Manipulation’ and ‘What’s going on?'”

Inks said Bitcoin was unable to regain its previous weekly close within its range around $75,000, leaving the possibility that the decline was an “apocalyptic shakeout” rather than the start of a deeper trend. But his roadmap was clearly time-based. He wants to see “rebound volume decline” along with sustained lows for “the next couple of weeks,” as well as higher lows on the weekly time frame and “compression below resistance rather than rejection.”

He also linked this move to interest rate positioning. Inks pointed to the 2-year Treasury futures chart, which in his view remains coiled rather than rising in line with the risk-off phase, another data point supporting the idea that last week’s selloff was “pre-resolution positioning rather than post-crisis aftermath.”

Regarding the lower time frame (1-hour chart), Inks asked for patience: “Bitcoin continues to consolidate sideways around the weekly pivot within the indicated range, which is not surprising after Friday’s strong rally. It takes time to build confidence after an event like that. And if you are hoping for a low, you would be better off seeing it instead of continuing straight up without building the foundations to support a rebound.”

At press time, $BTC It traded for $68,639.

Featured image created with DALL.E, chart on TradingView.com