This Friday, February 6, 2026, the crypto market is starting to boom. ethereum price Succeeded in regaining psychologically important parts $2,000 mark. After a week of intense selling pressure, $ETH As prices plummeted to their lowest since May 2025, buyers finally stepped in to try to stem the bleeding.

However, while the green candlestick on the hourly chart brings temporary relief, technical indicators suggest that the danger is not over yet for the second-largest cryptocurrency.

Ethereum Coin Analysis: $2,000 Battlefield

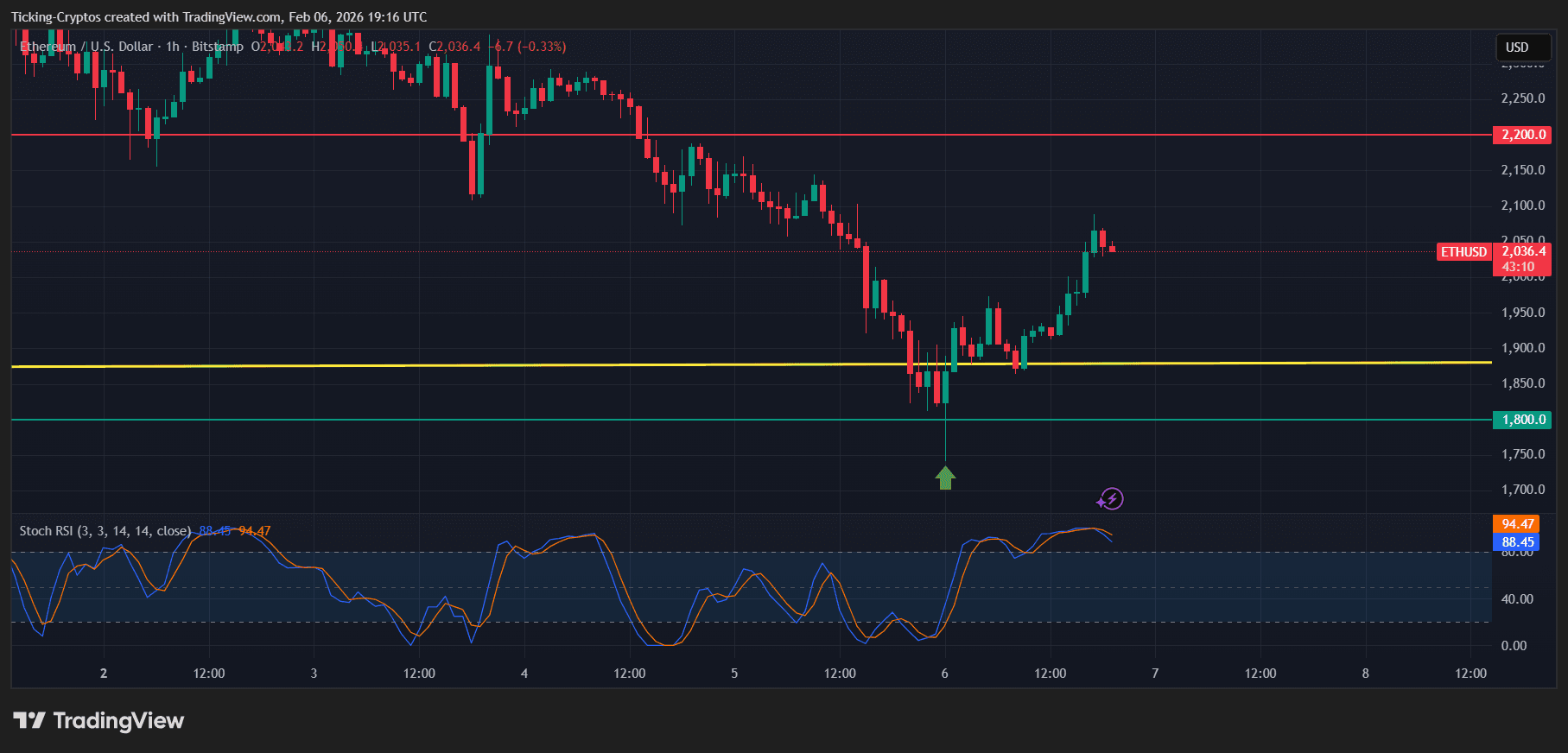

Looking at the present $ETH/USD On the 1-hour chart, Ethereum showed a notable recovery from the $1,850 support zone (highlighted by the yellow trendline). The rebound was marked by a bullish divergence. Stock RSIhas now surged into overbought territory above 90.

Although near-term momentum is trending upward, Ethereum is currently hovering around the area. $2,036facing a group of resistance forces. The rejection from the $2,200 red resistance line earlier this week is a fresh memory for traders, and the current move could be interpreted as a “dead cat pullback” before a deeper correction.

$ETH/USD 1H – TradingView

Trading notes: The Stoch RSI is currently overextended. Crossovers to the downside at these levels often precede local tops.

Ethereum Price Prediction: Lower Targets Still Valid

Despite the rally above $2,000, the broader market structure remains bearish. Recent liquidations exceed $400,000 $ETH As some analysts have reported, bulls are having a hard time filling the market liquidity gap with major investment vehicles.

If Ethereum fails to consolidate above $2,050 and convert the previous resistance into support, it could see a rapid decline towards the downside objective below.

- $1,810: The primary support level that held the floor during the initial impact.

- $1,600: Major historic liquidity zones.

- $1,450: The ultimate “macro bottom” target if Bitcoin fails to sustain its recovery at $70,000.

Investors should remain cautious as the Crypto Fear and Greed Index remains in “extreme fear” territory and is often a harbinger of further volatility.

Market outlook and strategy

For those considering entering the market, comparing different platforms is essential during times of high volatility. You can check our exchange comparison to find the best liquidity provider. Additionally, considering the recent currency outflows, we highly recommend protecting your assets with a hardware wallet.

The next 48 hours will be critical for Ethereum. A daily close above $2,100 could invalidate the immediate bearish thesis, but a break below the yellow line at $1,880 is likely to trigger a rapid move towards the $1,600 area.