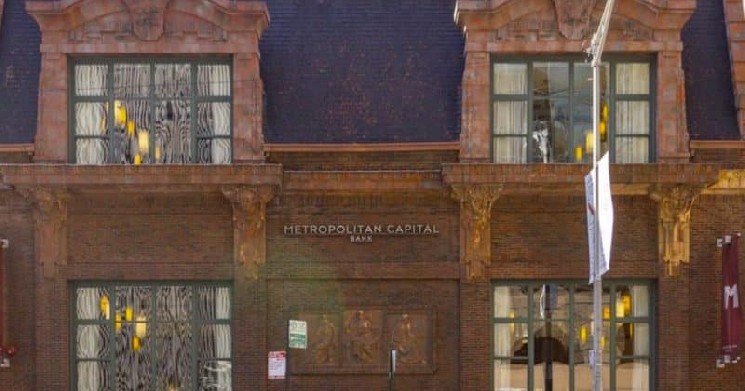

Metropolitan Capital Bank & Trust, a Chicago-based single-branch lender, became the first U.S. bank to fail this year after regulators shut it down Friday and appointed the FDIC as receiver, according to the Federal Deposit Insurance Corporation (FDIC).

First Independence Bank will assume substantially all of the deposits of failed Metropolitan Capital Bank & Trust, acquiring approximately $251 million in assets. The former Metropolitan Capital branch will reopen as a First Independence Bank store on February 2nd.

Customers automatically maintain FDIC coverage and have immediate access to funds via check, debit card, or ATM while continuing to make regular loan payments. The FDIC expects the failure to result in a loss of approximately $19.7 million to the Deposit Insurance Fund.

The closure follows a period of minimal bank failures, with two small banks failing in 2025.