Ethereum price continued its downward trend for the fifth day in a row, dropping more than 11% in the past 24 hours amid a massive liquidation of bullish bets and whale selling. As macroeconomic concerns continue to reduce risk appetite, will assets fall below $2,000 next?

summary

- Ethereum’s price fell to an eight-month low of $2,172 on Monday.

- Massive liquidations of bullish bets and whale sales compounded losses.

- Several bearish patterns were confirmed on the daily chart.

According to data from crypto.news, Ethereum ($ETH) Prices fell 11% on Monday morning Asian time to an eight-month low of $2,172, before stabilizing at just above $2,200 at press time. The decline widened losses to more than 25% from Thursday’s high of about $3,000.

Ethereum’s price fell as massive liquidations hit the crypto market, but much of that was due to the major cryptocurrency losing a key support level, wiping out some very bullish bets. Notably, Bitcoin fell below the $80,000 threshold and Ethereum lost support at $2,800 and fell further towards the $2,600 range.

According to data from CoinGlass, more than $757 million in leveraged positions have been liquidated across crypto markets, with the majority coming from extended liquidations. Long Ethereum traders faced the brunt of the pain with $213.59 million liquidated in the past 24 hours and nearly $182.34 million liquidated within the first 12 hours.

Liquidation of long positions tends to create forced selling pressure. A wave of liquidations that began over the weekend, with over $2.4 billion of longs liquidated, continues to frighten traders and keep them out of the market.

You may also like: Will the cryptocurrency market recover as the decline intensifies?

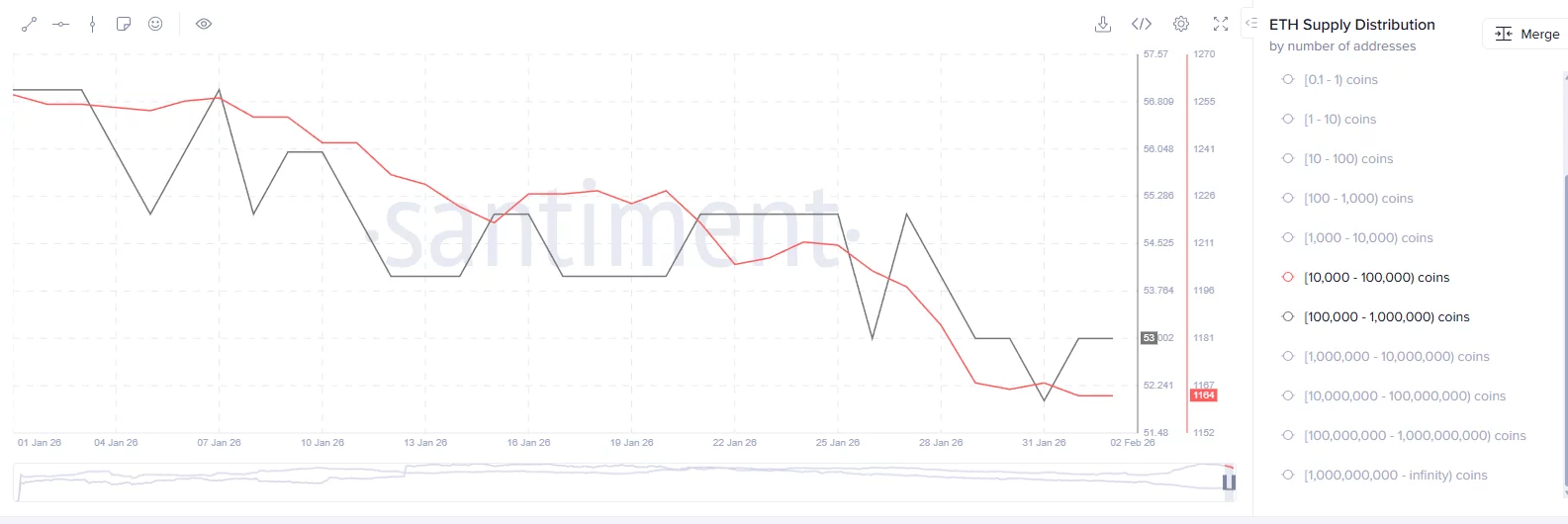

Another major reason why Ethereum is plummeting is selling pressure from whales. In particular, it is home to between 10,000 and 1 million whales. $ETH sold billions of dollars worth $ETH According to Santimento data, in the past week.

$ETH over the past week. “>

$ETH over the past week. “>

Whales have been sold $ETH Past week |Source: Santiment

At the same time, nearly $327 million has been drained from Ethereum ETFs over the past week as institutional investors reduced their exposure.

Such large sell-offs tend to cause retail panic, leading to more forced exits and further losses, at least in the short term.

On the macroeconomic front, market expectations changed after US President Donald Trump nominated Kevin Warsh to be the next Chairman of the Federal Reserve Board. Warsh is widely seen as a hawk by cryptocurrency supporters due to his history of advocating for financial discipline.

Additionally, the partial U.S. government shutdown that began early Saturday morning added to the stigma for investors, creating a data vacuum and stalling regulatory progress.

Ethereum, along with other major crypto assets including Bitcoin (BTC), has plummeted since these developments.

Ethereum price analysis

On the daily chart, Ethereum price has confirmed a breakout from an ascending wedge pattern, a bearish configuration with two ascending and converging lines, which has historically been followed by a sharp trend reversal and a significant price decline.

Ethereum price confirms multiple bearish patterns on daily chart — February 2 | Source: crypto.news

Following the breakout, $ETH Prices then fell below the neckline of the much larger inverted cup-and-handle pattern that formed from mid-2025 onwards. Inverted cups and handles are some of the most bearish patterns in technical analysis and often indicate the continuation of a long-term downward trajectory.

Confirming both of these bearish patterns, it is very likely that Ethereum will continue its downtrend and could lose the psychological support level of $2,000 if the selling pressure continues.

Momentum indicators such as MACD and RSI support the bearish forecast. The MACD line was pointing down while the RSI fell into oversold territory. An oversold RSI typically suggests a reversal may be in the works, but any short-term relief gains could be tempered by prevailing bearish sentiment within the sector.

At the time of writing, the Crypto Fear and Greed Index score is 14, placing the crypto market within the extreme fear level.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorse any products mentioned on this page. Users should conduct their own investigation before taking any action related to the Company.

read more: CME Bitcoin futures open with second-largest gap in history at $6.8 million