Bitcoin fell below the $70,000 level, a move that reflected increasing selling pressure and increasing market jitters. The breach of this psychological threshold intensified volatility, with short-term participants reacting quickly to the downward momentum. Analysts note that the current environment is defined by internal market structures, particularly the behavior of long-term holders, rather than macro headlines.

Bitcoin price alone rarely defines a market bottom, according to insights shared by On-chain Mind. Instead, key signals tend to come from holder behavior, particularly whether long-term investors are starting to show signs of stress. Historically, these players have been the least responsive cohort, often absorbing volatility rather than amplifying it through quick selling.

However, when long-term holders suffer extensive unrealized losses, the dynamics change. Such situations often coincided with the later stages of a bear market, when confidence waned and a broader capitulation became possible. This step does not guarantee an immediate reversal, but often signals that structural exhaustion is underway.

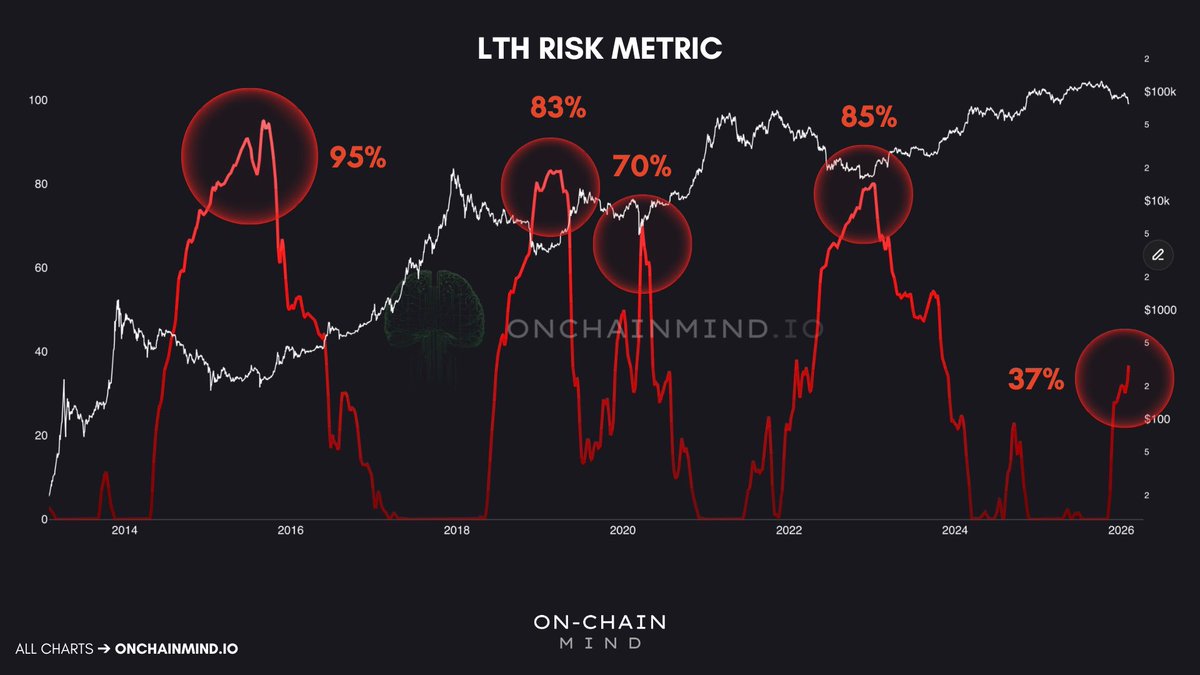

On-chain Mind further emphasizes that long-term holding risk has historically played a critical role in identifying late-stage bear market situations. Previous cycles have seen clear peaks in this indicator. It was about 95% in 2015, about 83% in 2019, about 70% during the Corona crisis, and about 85% during the 2022 recession. These surges typically reflect widespread unrealized losses among long-term investors, indicating severe structural stress across the network.

Historically, when this indicator rises above the 55-60% range, the bottoming process tends to accelerate. At that level, even the most patient person begins to experience significant pressure, often coinciding with the final stage of surrender. This does not necessarily mean that the exact price is lower, but it is often ahead of stabilization and eventual recovery.

However, this indicator is now close to 37%, well below the previous yield threshold. This suggests that while market stress is evident, conditions may not yet reflect the full-blown exhaustion typically associated with the bottom of a sustainable cycle. If the pattern of lower highs continues, a move into the 70% area would mean that even strong hands are under significant pressure. This is historically a prerequisite for more structural and sustained market lows.

Bitcoin’s weekly structure has seen a distinct deterioration in momentum after being rejected in the $120,000-$125,000 area, with the price currently trading near the $69,000 area. The recent decline has taken Bitcoin below its 50-week moving average (blue) and 100-week average (green), levels that have served as dynamic support throughout the previous upward trend. Losses in both signals signal a transition from a corrective pullback to a more structural downtrend phase.

The 200-week moving average (red) remains well below current prices, suggesting that the broader macro trend has not yet entered deep bear market territory. However, the speed of the decline and the expansion of the bearish candle indicate an aggressive distribution rather than an orderly sideways movement. The surge in volume accompanying the recent downward move reinforces the interpretation of forced selling and liquidation activity.

From a technical perspective, the $70,000 area has transitioned from support to resistance following the collapse. Failure to recover this level quickly increases the likelihood of further downside exploration, potentially towards historic demand areas in the sub-$60,000 region. Conversely, stabilization above this area with declining sales could indicate depletion among sellers.

Featured image from ChatGPT, chart from TradingView.com

editing process for focuses on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of the content for readers.