Ethereum is falling towards $2,100 arealined with major liquidity clusters and long-tested support zones. Prices are already under pressure and this level now stands out as a key point that could shape the next direction.

Ethereum faces major liquidity zone near $2,100

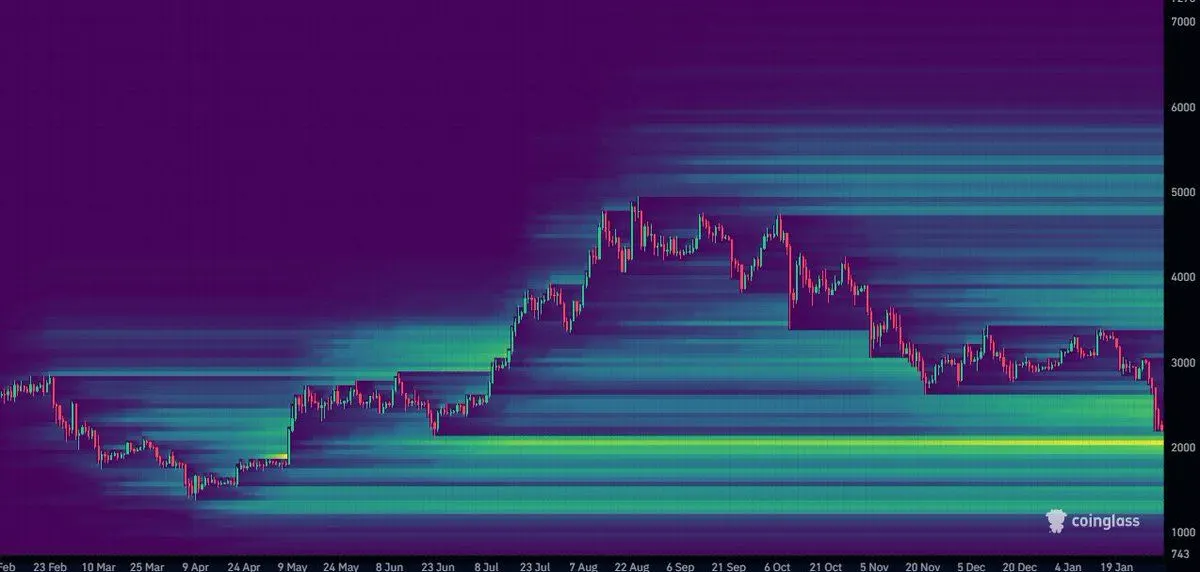

Ethereum is trading lower as chart data shows a large concentration of liquidity around the $2,100 level. A heatmap shared by market analyst Osemka shows dormant liquidity clustered in that zone, suggesting it could act as a major price magnet during the current downturn. Prices have recently fallen from the low $3,000s to the mid-$2,000s, and the lower price range is attracting more attention.

Ethereum liquidity heatmap and price fluctuation. sauce: X (Eight)

The liquidity map shows that buying and selling interest has been steadily increasing around $2,100 for several months. Historically, such clusters tend to attract price as the market moves into testing areas with deeper order flow. As Ethereum continues its decline, that level now stands out as the next major area where trading activity could intensify.

At the same time, overhead liquidity appears thin compared to the lower range, limiting upside traction in the near term. This imbalance explains why the rebound quickly disappeared during recent sessions. Ethereum remains vulnerable to continued downside pressure until the price reaches the $2,100 zone or the liquidity situation changes.

Ethereum tests long-term support zone near $2,100

Ethereum is closing in on a major technical support band between $2,100 and $2,200 after an extended decline from late 2025 highs. The daily chart shows that price has returned to the area that has repeatedly served as a pivot point in past cycles, with sharp reactions in both directions. As ETH trades near $2,326, pressure continues to build around that zone.

Ethereum daily price chart using RSI. sauce: StockCharts / X (Heisenberg)

Momentum indicators highlight the importance of this level. The daily RSI has fallen close to oversold territory, reflecting severe downside depletion rather than acceleration. In the past, similar RSI conditions have preceded sharp countertrend moves near this price range as selling pressure has eased and buyers have stepped in near structural support.

Price history strengthens technical signals. The $2,100-$2,200 range served as a benchmark before the big rally last year, with limited downside during the more severe correction. Once Ethereum stabilizes above this band, its structure favors at least a short-term bounce caused by a mean reversal and short covering. But if it continues to fall below that, the focus will shift to historically low demand zones.