The newly relaunched Ethereum DAO was funded through TornadoCash, reiterating Ethereum’s privacy mission. The DAO will set aside $220 million in reserves to fund security research.

The new Ethereum DAO reserves will go through Tornado Cash, which will taint all subsequent transactions. The main goal is to ensure that private transactions are still accepted as the norm, rather than a sign of hacking.

Griff Green, one of the co-founders of the new DAO, announced a planned deposit of $69,420. $ETH Participate in beacon contract. Mr. Green also set stakes through his activities. Griffes vanity address.

.@thedaofund’s 69,420 $ETH Staking is for security. https://t.co/5kEKRmo0V5

— griff.eth – $GIV Maxi (@griffgreen) February 1, 2026

The wallet tagged Deploy DAO funds was initially funded by Tornado Cash and included Etherscan. tag. At this time, regulations regarding the use of funds tainted by Tornado Cash are variable, and exchanges do not necessarily review previous commingling.

However, if you link Ethereum, dao The formal joint statement with Tornado Cash is another statement in support of privacy. Previously, Ethereum supporters proposed creating a private validator pool that could not be linked to depositor addresses.

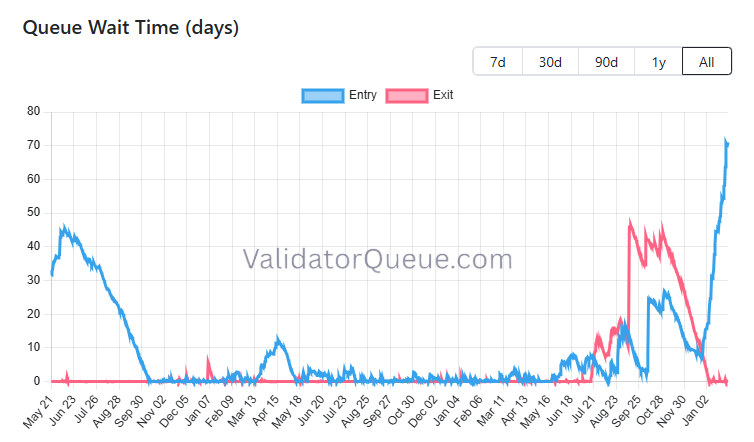

DAO funds need to wait more than 70 days

DAO’s potential passive income may be delayed as funds must first be accepted into the beacon chain contract.

Due to increased demand for deposits, DAO reserves may have to wait more than 70 days.

DAO funds have a waiting period of 70 days or more before generating passive income. |Source: Validator Queue.

Validator queue is kept longer than 4M $ETH All you have to do is wait for deposits to the contract and rarely wait for withdrawals. Wait times have accelerated to an all-time high and are now nearing 71 days.

The DAO holds the funds as potential passive income and is used for grants and research. The DAO will be part of the Ethereum Foundation’s new spending schedule, with the Ethereum Foundation aiming to spend its reserves more conservatively in the coming years.

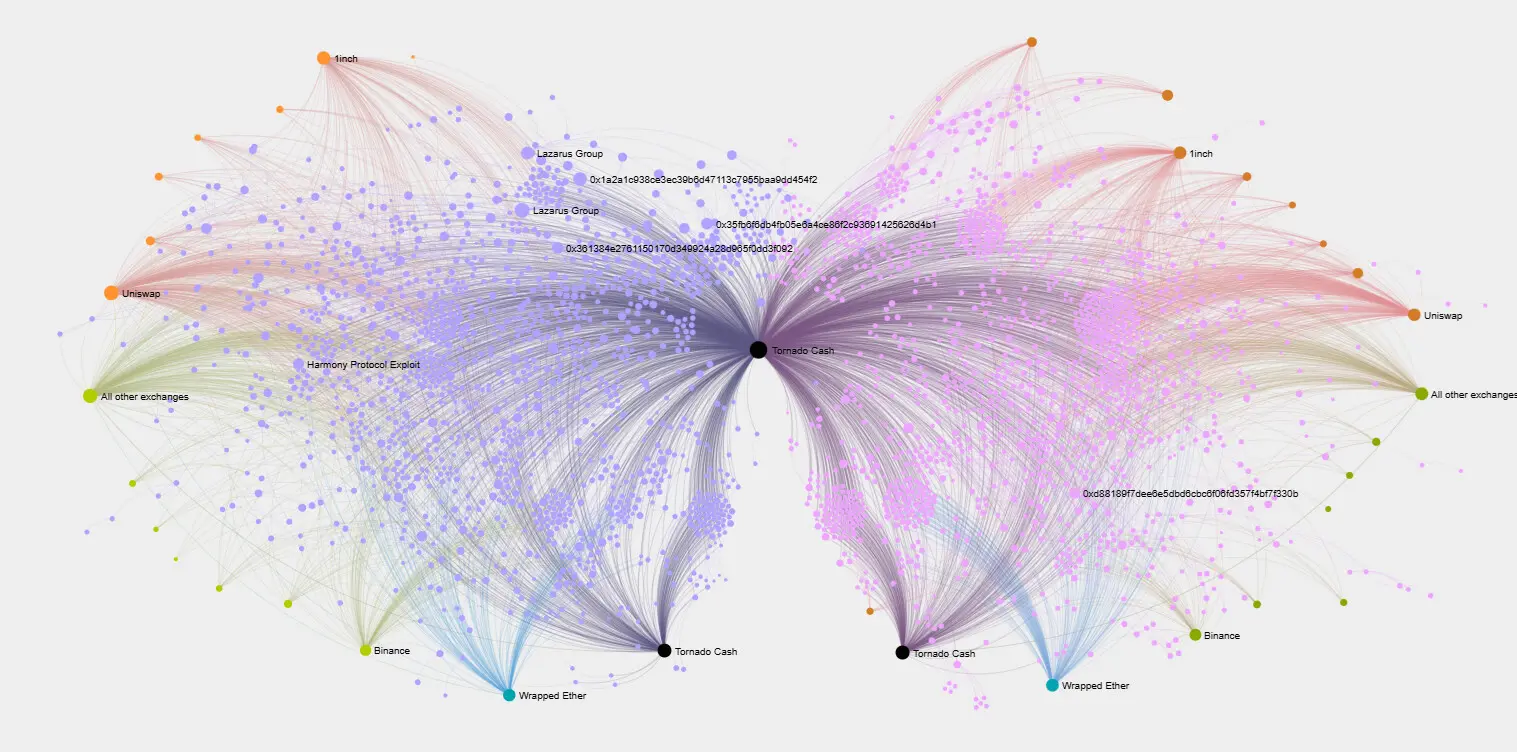

Tornado Cash spreads across Ethereum

Tornado Cash has been flagged for carrying traffic from North Korean exploits and hacks. However, mixers have already spread to large parts of the Ethereum ecosystem through general use and “dusting” from dedicated wallets.

This mixer pulled in traffic from across the crypto ecosystem, including centralized and decentralized exchanges, routers, and apps.

Tornado Cash is becoming an important part of the decentralized Ethereum ecosystem and often receives transfers from top DEXs. |Source: Tornado Network.

Tornado Cash also received peak amount $ETH And stablecoins have reached an all-time high in total value. Mixer contains over 361K $ETHwhile activity has rebounded to levels not seen since 2021.

Over the past year, Tornado Cash has gradually recovered from low baseline activity. Mixers pulled in traffic from decentralized exchanges for an additional layer of privacy. Vitalik Buterin supports veiled trading as a source of security and not exposing whales or prominent traders.