Cryptocurrency markets started the week on the back foot, with Bitcoin, Ethereum and major altcoins plummeting on Monday, hitting multi-month lows.

The decline reflects a decline in investor confidence and a spike in forced liquidations across exchanges. After several days of heightened volatility, the economic downturn showed little sign of abating. As prices fell, traders retreated to the sidelines and losses widened across the market.

Important points

- Selling pressure intensified across major tokens, with both Bitcoin and Ethereum falling to multi-month lows.

- The entire cryptocurrency market lost about 4.4% of its value in the past 24 hours.

- Bitcoin fell below $75,000, widening weekly losses by more than 14%.

- Ethereum fell nearly 10% in a single session, deepening a one-week decline of about 23%.

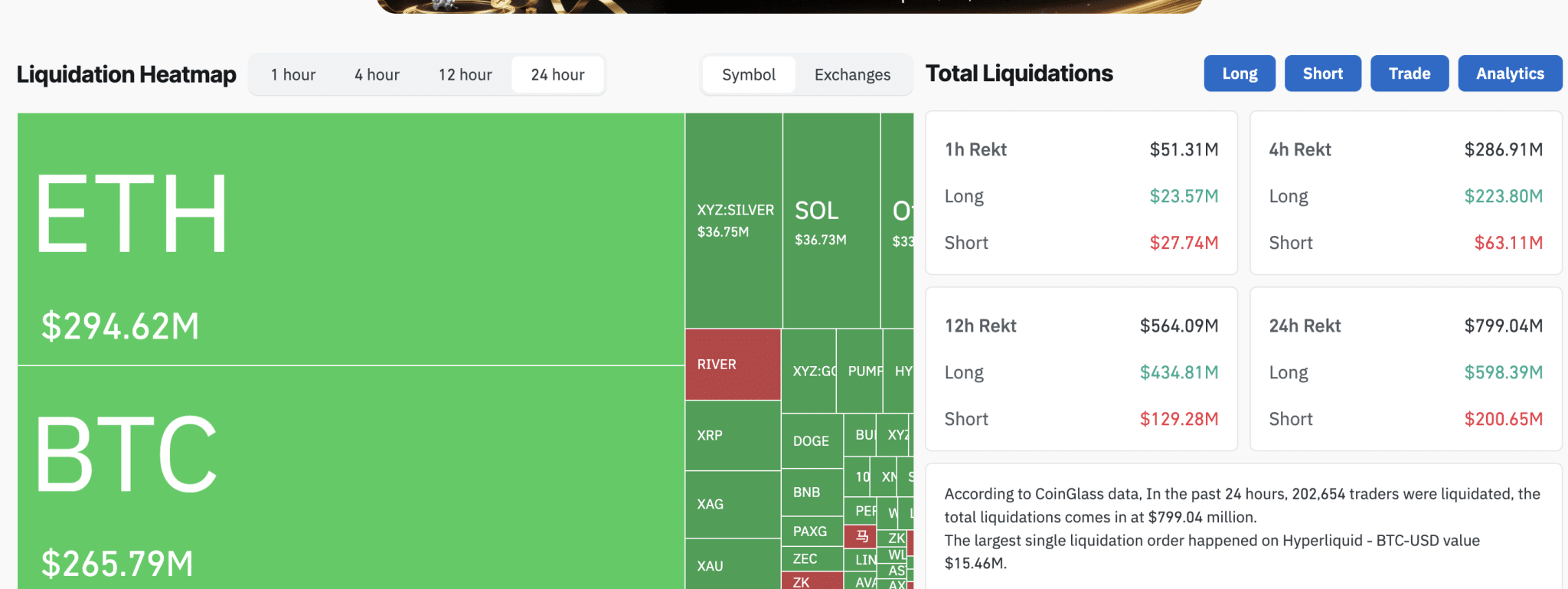

- Approximately $800 million in leveraged cryptocurrency positions have been liquidated in the past day.

- Long positions accounted for more than three-quarters of all liquidations, highlighting the rapid unwinding of bullish bets.

Bitcoin and Ethereum lead the decline

Bitcoin led the decline, falling below the $75,000 mark during the session. The largest cryptocurrency fell 4.7% in the past 24 hours to a nearly nine-month low of about $74,900, according to CoinGecko. BTC is currently down more than 14% over the past week and is about 40% below its October high of $126,080.

Ethereum, on the other hand, recorded even more significant losses. According to data from CoinGecko, ETH fell nearly 10% in one day to around $2,190. As a result, weekly losses have reached nearly 23%, and the second-largest cryptocurrency remains about 55% below its August high, when its price was near $5,000.

The sharp decline in Bitcoin and Ethereum creates an overall negative atmosphere and dampens any attempts at a meaningful recovery for the overall digital asset market.

altcoins fall

The selling pressure quickly spread beyond the major tokens. XRP fell more than 7% to about $1.54, and Solana fell about 6.6% to nearly $98. Dogecoin also fell, dropping more than 4% to trade around $0.10.

The cryptocurrency’s market capitalization has fallen by about 4.4% in the past 24 hours amid widespread losses. The breadth of the decline suggests that investors have reduced their risk exposure overall rather than switching to alternative assets, underscoring the broader market’s retreat from risk.

Clearing accelerates in derivatives market

Due to the economic downturn, traders who used leverage suffered large losses. According to CoinGlass data, approximately $800 million in crypto futures positions were liquidated in the past day, of which long positions accounted for approximately $578 million.

Specifically, Ethereum futures accounted for the largest share of forced liquidations at approximately $278 million, followed by Bitcoin at approximately $254 million. A liquidation of this magnitude shows how quickly bullish positioning can crumble, putting further pressure on an already fragile market.

Cryptocurrency liquidations in the last 24 hours

Macro headwinds weigh on sentiment

The decline in cryptocurrencies unfolded amidst widespread macroeconomic uncertainty. Over the past week, investors have been grappling with U.S. political risks, including concerns about a government shutdown. Indeed, those fears became reality early Saturday morning when the partial shutdown began.

At the same time, there is widespread skepticism about the valuations associated with artificial intelligence investments, with market participants increasingly questioning whether enthusiasm for the space outweighs the underlying fundamentals.

The combination of these factors has strengthened the risk-off environment and spilled over into cryptocurrencies and other speculative assets.

ETF outflows signal a shift to risk-off

Investor caution was also reflected in the flow of funds. Over the past week, nearly $1.5 billion has flown out of U.S. physical Bitcoin exchange-traded funds, while Ethereum-focused ETFs have recorded about $327 million in outflows, according to data from Pharcyde Investors.

Continued withdrawals from crypto ETFs suggest investors are actively reducing their exposure amid rising volatility. ETF flows often reflect broad sentiment, and the latest data points to a defensive turn.

Precious metals offer mixed signals

While cryptocurrencies have struggled, traditional safe-haven assets have been in the spotlight this past week. Gold and silver rose to record highs as risk aversion increased. However, both metals reversed sharply by the end of the week.

Silver in particular suffered a particularly heavy sell-off, plummeting more than 31% during Friday’s U.S. trading session. This sudden reversal highlights how quickly sentiment can change across asset classes during times of heightened uncertainty.

In conclusion, Monday’s decline highlights the fragile state of the crypto market amid leveraged positioning and broader economic headwinds. Volatility remains high and traders remain cautious as they wait to see if prices can find stable footing in the coming days.