Bitcoin mining stocks rose sharply on Wednesday after U.S. winter storms forced some companies to scale back operations, reducing competition for blocks and making mining operations more profitable.

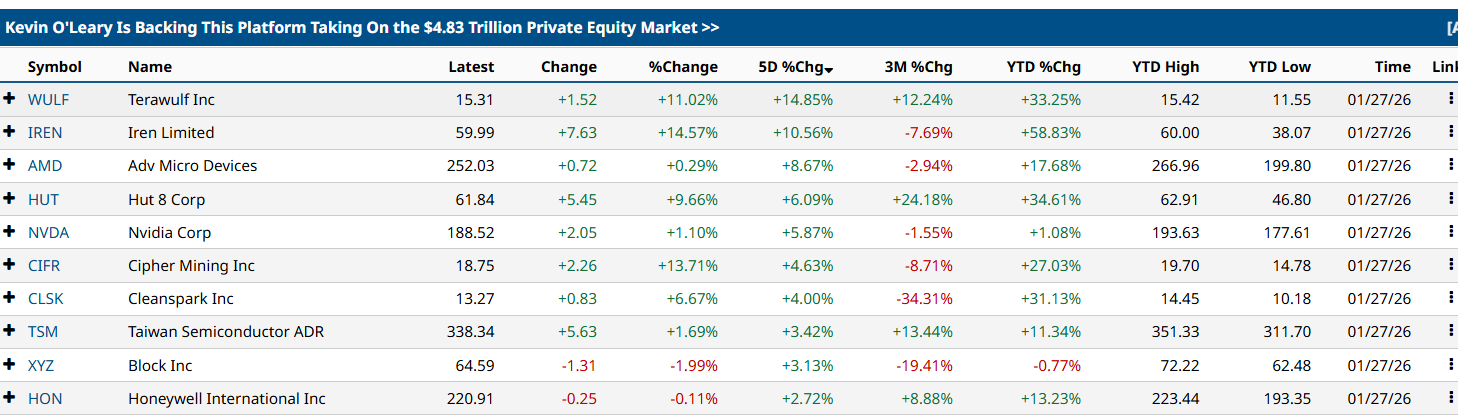

Shares of several major mining companies posted double-digit gains in the past 24 hours. TeraWulf rose about 11%, Iren Limited rose about 14% and Cipher Mining rose about 13%, according to Barchart data.

The rise comes days after the Bitcoin network’s hash rate fell to 663 exahashes per second (EH/s) on Sunday, its lowest in seven months. It has fallen 40% in two days due to the severe winter storm that is hitting the United States.

According to data from Coinwarz, the hashrate recovered to 814 EH/s on Wednesday, but has yet to recover to the 1.1 Zettahash/second (ZH/s) level before the weekend drop.

EH/S Bitcoin hash rate, 1 month chart. Source: Coinwarz

A low hashrate indicates that there are fewer miners online, which reduces competition to mine blocks on the Bitcoin network and increases Bitcoin ($BTC) Mining becomes more profitable for miners who stay online.

Bitcoin mining stock performance. Source: bar graph

Related: Bitcoin rebounds, ETF flows recover as US crypto policy stalls: redefining finance

The Bitcoin Hash Price Index is a benchmark for measuring the profitability of miners through the revenue generated per terahash, and also indicates more favorable mining conditions.

According to HashrateIndex, Bitcoin’s hash price index rose from 0.038 TH/s to $0.040 per second on Wednesday.

Bitcoin Hash Price Index in USD, 1 week chart. Source: Hashrate Index

Related: Cryptocurrencies lose speculative edge as AI and robotics attract capital: Delphi

Bitcoin miners scale back operations amid US winter storm

The improvement highlights how large, well-capitalized mining companies can benefit during temporary network outages, while smaller or inefficient operations may be forced offline.

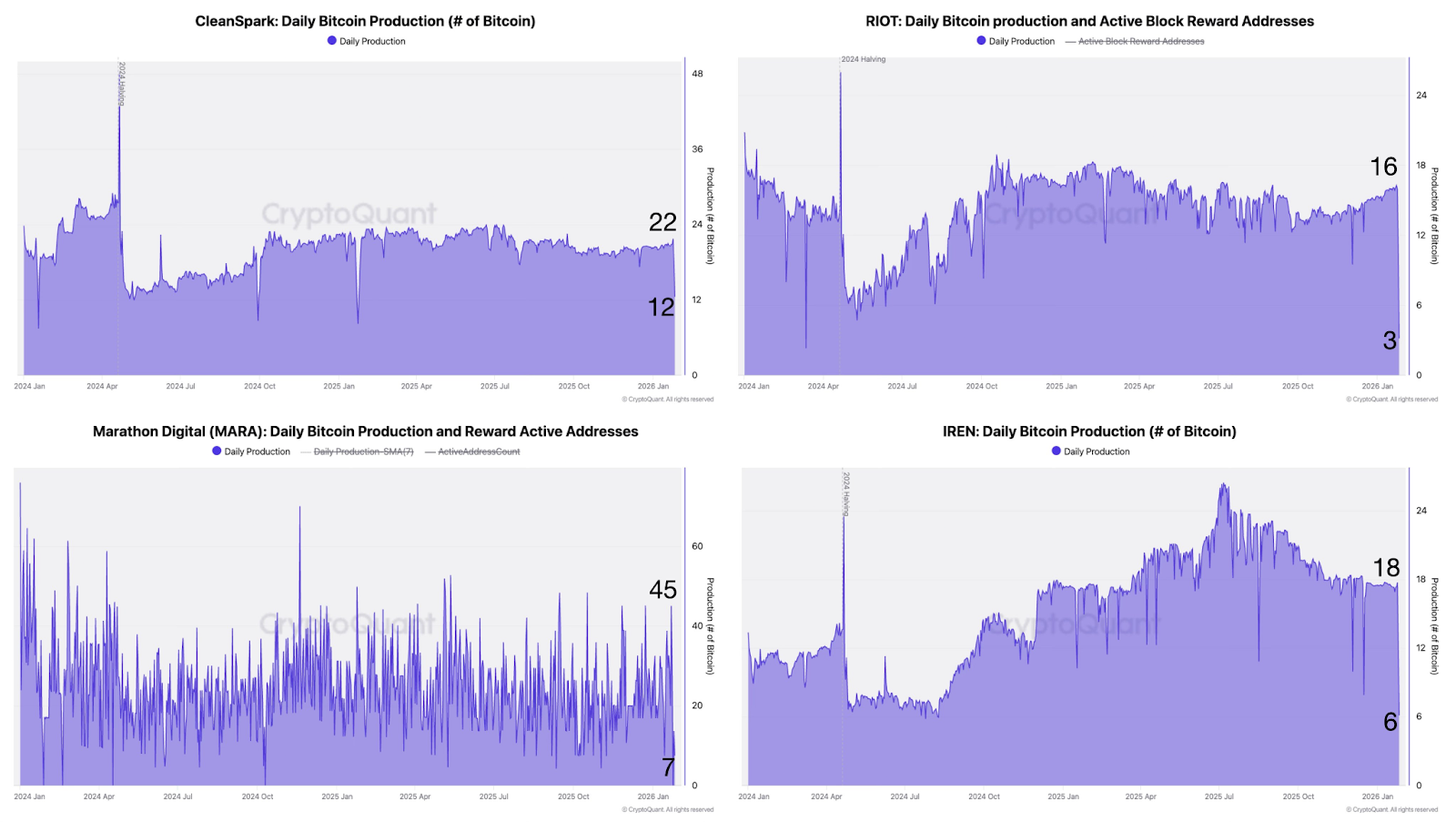

Julio Moreno, head of research at data platform CryptoQuant, said the U.S. winter storm forced multiple Bitcoin mining companies to scale back operations to support the power grid.

This includes daily Bitcoin production decreasing from 22. $BTC up to 12 $BTC For CleanSpark, 16 $BTC up to 3 $BTC Riot Platform reduction, down from 45 $BTC up to 7 $BTC Marathon Digital Holdings decreases from 18 companies $BTC up to 6 $BTC It is mined daily by Iren, Moreno wrote in a Monday X post.

Daily Bitcoin production from CleanSpark, Riot, Marathon Digital, and Iren. Source: Julio Moreno

Meanwhile, according to Bitcoin mining ecosystem Brains, the unusual winter weather in the US “has had an impact on weakening mining operations”, which is another reason for the sharp decline in the global hashrate.

“Winter punishes poor preparation and hasty decisions,” Brains wrote in an X post on Tuesday, warning miners that most equipment damage occurs when mining machines are restarted in subzero temperatures or when facilities lack proper ventilation or temperature control.

magazine: Bitcoin mining industry “will be extinct within two years” — Bit Digital CEO