- Ethereum ($ETH) has remained close to $3,000 as financial institutions are accumulating, despite mixed short-term sentiment.

- Strong staking, wallet growth, and ETF inflows are supporting Ethereum’s price floor.

- ERC-8004 has the potential to unlock AI-driven on-chain demand and long-term demand. $ETH value.

Ethereum is entering a pivotal phase as price volatility, institutional flows, and protocol-level innovation begin to converge.

After an unstable start to the year, $ETH has regained the $3,000 level, indicating renewed confidence among both traders and long-term holders.

At the time of writing, Ethereum is trading around $3,010, with a market cap of approximately $364 billion and a 24-hour trading range of $2,899 to $3,028.

This recovery despite $ETH The stock is still trading nearly 40% below its all-time high of around $4,946 in August 2025.

The broader context suggests that Ethereum’s current consolidation may not be about weakness, but preparation.

Market structure shows resilience despite mixed sentiment

Ethereum’s recent drop below $3,000 was short-lived as buyers actively intervened to protect psychological support levels.

On-chain data shows that $ETH are traded in dense cost-based clusters, often reflecting accumulation rather than dispersion.

The number of non-empty Ethereum wallets has reached an all-time high, highlighting continued adoption of the network even during times of price uncertainty.

Demand for staking remains strong, with withdrawal activity remaining relatively calm, while validator entry queues are growing.

This imbalance suggests that more participants are committed. $ETH Securing your network is better than giving up your position.

Organized actions are further reinforcing this trend, with companies and funds reportedly adding more than 1 million funds. $ETH This has affected its balance sheet in recent months.

The Spot Ethereum ETF also returned to net inflows after several days of outflows, driven primarily by strong demand from Fidelity. $ETH product.

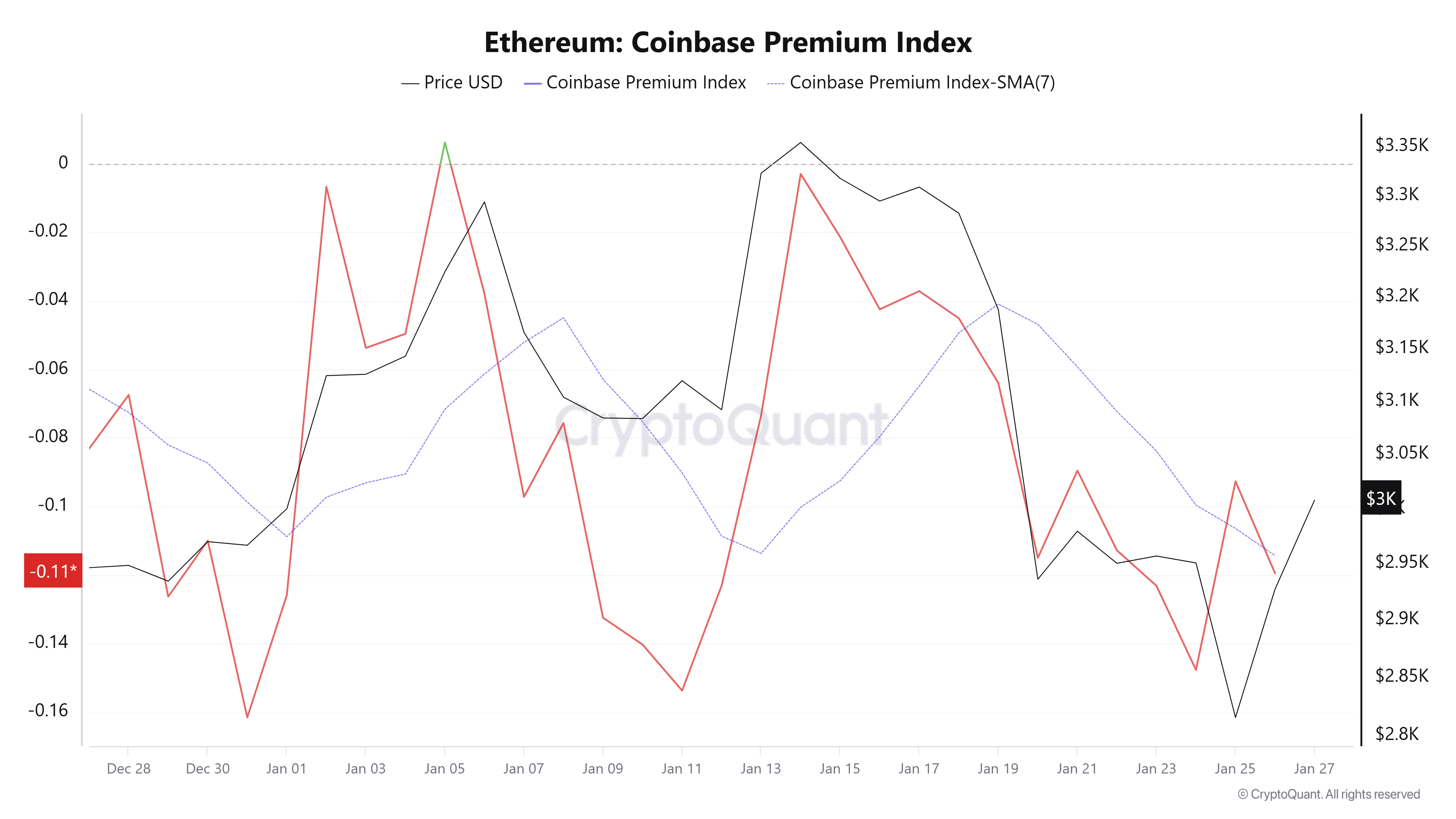

However, selling pressure from US investors remains significant as the Coinbase Premium Index continues to indicate cautious domestic sentiment.

Ethereum Coinbase Premium Index |Source: CryptoQuant

This disconnect between inflows from institutional investors and reluctance from retailers persists. $ETH Rather than causing an immediate breakout, it will be confined to a narrow range.

From a technical perspective, Ethereum faces short-term resistance near the $3,050 to $3,100 zone, which coincides with the 20-day exponential moving average.

A decisive pullout above this region could open the door for a move towards $3,260, but a loss of support at $2,880 would shift the focus to the low demand zone around $2,775.

Ethereum price chart |Source: TradingView

Long-term bullish narrative remains intact

Despite the short-term consolidation, many traders argue that Ethereum’s broader market structure still supports a significantly higher valuation.

Analysts point to Wyckoff-style cumulative models that continue to predict historical cycle patterns and upside scenarios.

In these frameworks, $ETHThe current range of is considered a re-accumulation phase rather than a top formation.

Some traders like Annie and Bitcoin Census claim that a sustained breakout could eventually take it to $10,000. $ETH Return to the table later in the cycle.

This outlook is reinforced by the steady increase in daily transactions, active addresses, and smart contract deployments across the network.

Remarkably, Ethereum has achieved growth in this activity while transaction fees have fallen to multi-year lows, increasing ease of use without sacrificing demand.

Lower fees are often interpreted as a long-term adoption catalyst, especially for applications that rely on high transaction throughput.

These structural improvements strengthen our long-term Ethereum price forecast into 2026.

ERC-8004 rollout adds new basic catalysts

Against this backdrop, Ethereum is preparing for the mainnet deployment of ERC-8004, a new standard designed to support decentralized AI agents.

ERC-8004 will be live on mainnet soon.

By enabling discovery and portable reputation, ERC-8004 enables AI agents to interact across organizations, ensuring trust is transmitted everywhere.

This opens up a global market where AI services can interoperate without gatekeepers. https://t.co/Yrl0rvnSxj

— Ethereum (@ethereum) January 27, 2026

ERC-8004 introduces an on-chain identity, reputation, and validation framework that allows autonomous AI programs to interact trustlessly.

This standard aims to eliminate reliance on centralized intermediaries in AI coordination by enabling portable and verifiable agent evaluation.

This development positions Ethereum as a fundamental payments and trust layer for the emerging AI-native economy.

The timing of this development is notable as it coincides with a growing interest in autonomous agents in both cryptocurrencies and traditional technology.

If implemented, ERC-8004 could power new categories of on-chain activity, from automated services to agent-to-agent commerce.

For such use cases, blockspace, staking, and $ETH As such, it is the core economic asset of the network.