Ethereum Giant BitMine Immersion Technologies and Top Bitcoin They are in charge of financial strategy and have seen stock prices fall amid renewed investor concerns, with both of their chosen assets falling sharply on Thursday.

As of market close on Thursday, Bitmine, which trades on the Nasdaq under the ticker BMNR, was down nearly 10%, trading at $26.70. BMNR fell to $26.02 on the day, matching its closing price of $26.02 on November 2, 2025.

At the beginning of the week, Tom Lee’s Bitmine acquired $116 million worth of assets, making it the biggest purchase ever in 2026. $ETH. Since the beginning of this year, the company has made three additional acquisitions worth $108 million, $76 million, and $100 million. Ethereum Treasury currently holds assets worth approximately $11.9 billion. $ETHAccording to a tracker maintained by price aggregator CoinGecko, it represents 3.5% of the total supply.

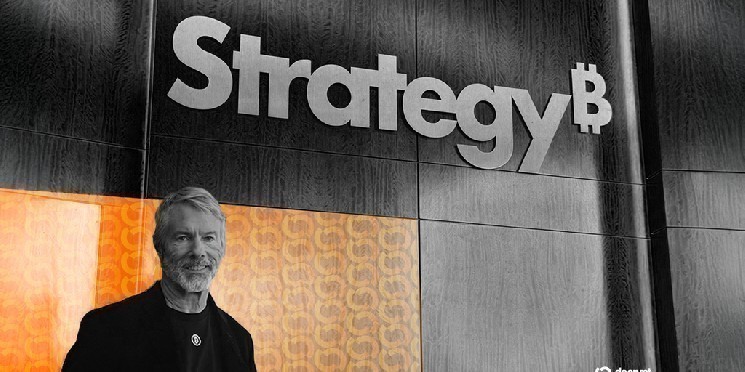

Meanwhile, Strategy’s stock price similarly fell, reaching levels not seen in more than a year. At the close of trading, MSTR was also down nearly 10%, trading at $143.19. Thursday’s low of $139.36 marked the lowest price registered on MSTR since September 2024, according to Yahoo Finance data.

The company, co-founded by chairman and outspoken Bitcoin bull Michael Saylor, also added money to the Treasury on Monday. MSTR announced last week that it had spent $267 million on Bitcoin. 712,647 $BTC Assets held at the Treasury are valued at approximately $60 billion at current prices.

Thursday’s declines in both stock and cryptocurrency markets came amid signs of potential turmoil. The U.S. Senate on Thursday afternoon blocked a continuing resolution that would have averted a partial government shutdown. Lawmakers have until Saturday to reach a deal. This also coincided with the sharp drop in Microsoft’s stock price, which heightened deep-rooted concerns about an AI bubble.

Bitcoin fell more than 5% on the day and was recently trading at $84,416 after partially recovering from the day’s low of $83,407. It remains above its recent low in late November, when it briefly fell below $83,000. $BTC The billionaire released his entire $1.3 billion stash onto the market. Meanwhile, Ethereum has fallen to $2,816, trading 6.6% lower than yesterday, according to CoinGecko.

This volatile price movement has irritated users of Myriad, a prediction market platform owned by Myriad. decryption Parent company Dastan is raising the possibility that Ethereum will reach $2,500 before falling back to $4,000. On Thursday, users who predicted the token would sink further increased that probability from 65% to more than 75%.